SMDS’s Annual General Meeting for 2024 is scheduled to take place on September 19, 2024, at the Sunshine Center building in Nam Tu Liem district, Hanoi. In fact, SMDS had previously requested an extension to hold the conference in June but has now postponed it until September.

Continuing the Downward Trend

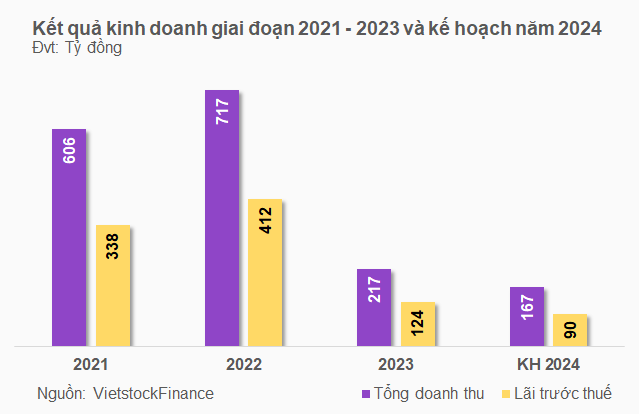

According to the conference materials, SMDS set its 2024 business plan with a total revenue target of nearly VND 167 billion and a pre-tax profit of VND 90 billion, down 23% and 27%, respectively, compared to the 2023 performance.

In the proposal, the Board of Directors also suggested receiving authorization from the AGM to proactively adjust accounting profits before tax, increasing or decreasing by a maximum of 10% compared to the above plan. This flexibility is intended to navigate potential market changes, external factors, and objective conditions that may impact the company’s business and the deployment of its products and services.

Looking ahead to 2024, the SMDS Board of Directors anticipates persistent challenges for the global and Vietnamese economies. Consequently, the Vietnamese stock market has yet to enter a cycle of improvement and growth.

Additionally, the fierce competition among securities companies in terms of equity capital, transaction fees, and margin lending rates shows no signs of abating, posing a significant challenge for SMDS.

The SMDS Board of Directors proposed several solutions to execute the 2024 plan, notably continuing to maintain and improve the proprietary trading activities that generate the company’s main revenue stream. They also aim to initially expand brokerage operations, provide margin/advance services, and offer corporate financial advisory services.

Furthermore, SMDS intends to enhance its governance capabilities and leverage information technology as a core strength in delivering products and services to its customers.

If this plan comes to fruition, SMDS will experience consecutive years of decline in both revenue and profits. In the previous year, 2023, the company’s financial performance was mainly impacted by a shift in its business direction, discontinuing the brokerage of private placement bonds.

During the first half of 2024, SMDS’s business performance was also lackluster compared to the same period last year, with total revenue of over VND 86 billion, a decrease of 28%; pre-tax profit of nearly VND 51 billion, down 27%; and net profit of almost VND 41 billion, a reduction of 27%.

SMDS attributed this decline to decreases in revenue from its two most significant activities: bond services and proprietary trading.

The revenue from bond services plummeted by 56% due to lower service fees compared to the previous year. Since the second quarter of 2023, the company has reduced service fees for issuers, and the number of outstanding bonds, which serve as the basis for calculating bond service fees, has decreased as some bond packages have matured.

In terms of proprietary trading, revenue declined by 17% due to lower profit-making transactions in bonds compared to the previous year, coupled with a drop in stock market prices, resulting in a reduction in the unrealized gain.

Cost pressures are also evident, with total operating and management expenses amounting to nearly VND 37 billion, a 26% decrease, which is lower than the decline in revenue. From the end of 2022 to the middle of 2023, SMDS adjusted its business plan, scaled down its operations, reduced personnel, and implemented cost-cutting measures to maintain its business. However, from the second half of 2023 to the first quarter of 2024, a shift in the company’s business strategy led to an increase in expenses.

No Dividend Payout for 2023

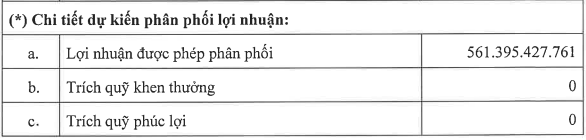

Given the recent unfavorable business performance, the SMDS Board of Directors proposed not paying dividends for 2023 and also not allocating funds to the reward and welfare fund.

Source: SMDS 2024 Annual General Meeting Documents

|

SMDS also plans to consider electing additional members to its Board of Directors for the 2024-2029 term and approving the selection of an independent audit firm for 2024.

Chứng khoán KS đổi tên, bổ nhiệm Chủ tịch mới

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.