The Vietnamese e-wallet market is an intensely competitive arena, with major players such as MoMo, ZaloPay, Viettel Pay, Payoo, and VinID (soon to be rebranded as OneU) vying for dominance. These e-wallets offer more than just payment solutions; they have evolved into comprehensive digital ecosystems, providing a range of convenient services to their users. The following is an overview of the popular e-wallets in Vietnam and their emerging trends in response to market dynamics.

After the “money-burning” race, what should Vietnamese e-wallets do to Innovate, retain, and attract users? (Photo: Internet)

The “money-burning” race to attract users is coming to an end as e-wallets like MoMo, ZaloPay, and others incur annual losses of hundreds of billions due to promotional costs. Instead, these e-wallets are shifting their focus to building more comprehensive ecosystems, integrating a diverse range of services from finance to consumer spending. Advanced technologies such as AI and blockchain are being leveraged to enhance user experiences and ensure secure transactions. Additionally, the rapid adoption of QR codes as a convenient and fast payment method presents a significant challenge to e-wallets. The introduction of VietQR and the ability to make seamless payments without pre-loading money into the wallet have contributed to the dominance of QR codes in the cashless payment market.

VinID (soon to be OneU)

VinID, soon to be rebranded as OneU, has embarked on a transformation from a reward and payment e-wallet to a multifunctional “super app.” This shift enables OneU to maximize the vast ecosystem of Vingroup and its partners, covering everything from shopping and hotel bookings to medical appointments, tuition fee payments, and even real estate transactions (OneHousing). Users no longer need to install multiple apps as they can manage all their transaction needs, including shopping, healthcare, education, and real estate, on a single platform.

Additionally, with financial features like insurance, investments, and expense management, OneU provides users with easy access to financial services directly from their phones. By leveraging advanced technologies such as artificial intelligence (AI), OneU aims to deliver personalized and optimized experiences, helping to shape smarter consumption and payment habits among Vietnamese users.

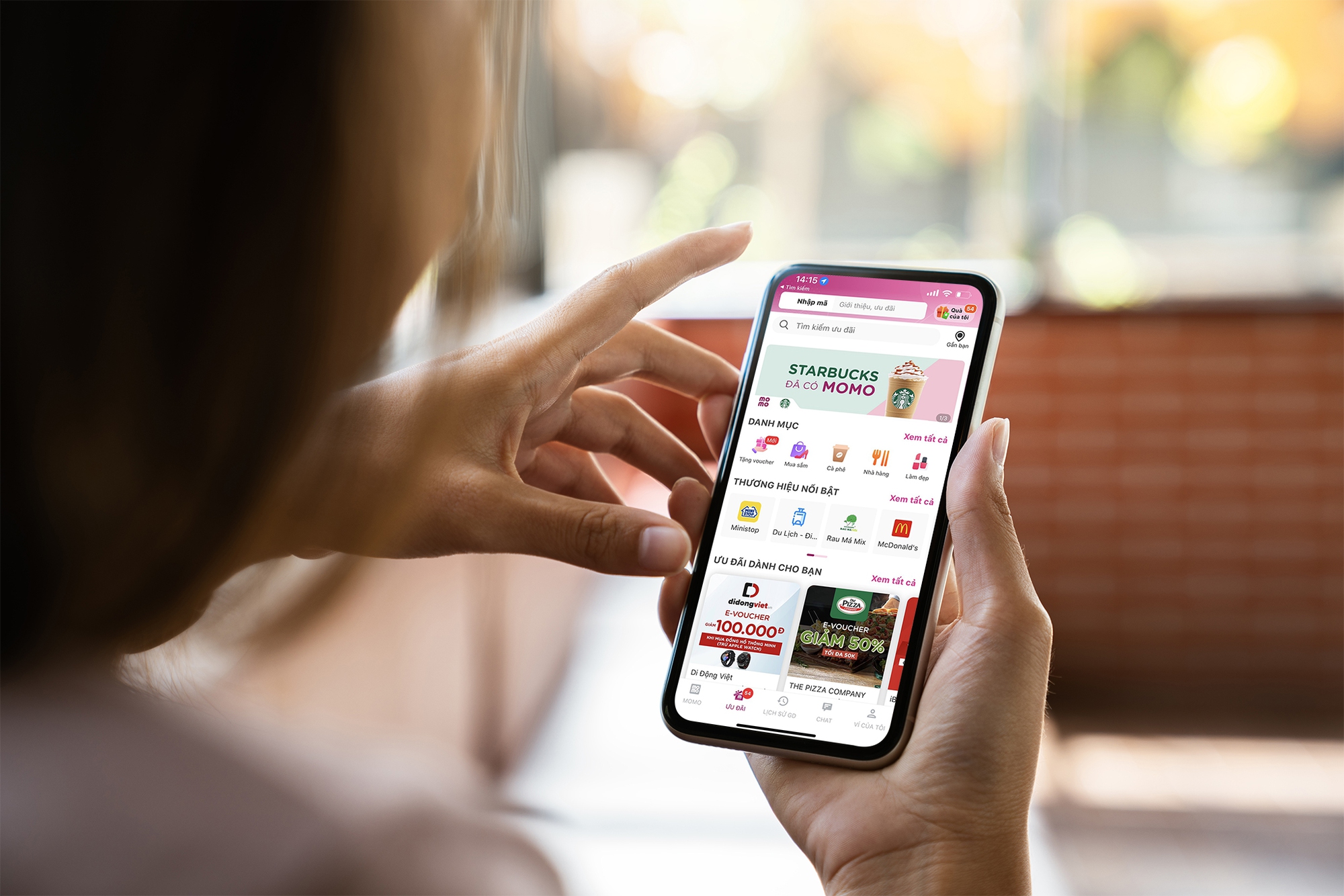

MoMo

MoMo is Vietnam’s largest e-wallet, commanding a market share of 68%. To maintain this leading position, MoMo has invested heavily in promotional programs and user benefits.

Currently, MoMo is continuously upgrading its strategy, focusing on expanding its ecosystem of financial services such as insurance, savings, and investments. By integrating new technologies like AI and blockchain, MoMo aims to provide users with personalized experiences and enhanced security. This evolution positions MoMo not just as a simple e-wallet but as a comprehensive personal financial management platform.

Zalopay

Zalopay demonstrated its strong commitment to the Vietnamese electronic payment market by positioning itself as a comprehensive financial platform during its new identity launch in July. Specifically, in addition to conveniences such as money transfer, payment, and online shopping, Zalopay has actively collaborated with strategic partners to develop personal financial services directly on the application.

Zalopay also took a pioneering step by introducing the Multi-purpose QR Code, simplifying the payment experience for both customers and businesses. Additionally, Zalopay made a bold move by allowing users to make payments through bank transfers for the conveniences offered on the Zalopay application. This not only increases utility for users but also aligns with Zalopay’s strategy to promote and drive the trend of QR code payments, which has gained significant traction in recent years.

Viettel Pay

Viettel Pay is an e-wallet owned by the Military-Telecom Industry Group (Viettel), leveraging its advantage of a nationwide telecommunications network. Viettel Pay serves not only bill payments and online shopping but also provides financial services such as interbank transfers, consumer loans, and investments.

One of Viettel Pay’s strengths is its ability to function even in areas with weak internet connections, allowing it to reach users in remote and rural areas, thus expanding its customer base.

Payoo

Payoo sets itself apart from other e-wallets by focusing heavily on public service payments such as electricity, water, internet, cable TV, and other fees. With a widespread acceptance network, Payoo provides convenient payment services to both consumers and businesses.

In line with emerging trends, Payoo has also started integrating financial services such as insurance and investments to compete with other major players in the e-wallet market.

The Vietnamese e-wallet market is entering a phase of intense competition, requiring new development strategies to maintain and expand market share. E-wallets like VinID (OneU), MoMo, ZaloPay, Viettel Pay, and Payoo have been working diligently to build more comprehensive ecosystems to attract and retain users. By integrating diverse services and leveraging advanced technologies, these e-wallets aim to become not just payment solutions but also smart financial and consumer management platforms for Vietnamese users.

Better Choice Awards honor and celebrate “Innovative Breakthroughs” in products, services, and achievements that bring practical benefits to consumers, creating a difference by not seeking the “best choice in the segment,” but instead focusing on the actual needs of users to help them find the most suitable brands and products.

Better Choice Awards 2024 is now open for nomination submissions from July 25 across six categories: Technology, Automotive, Consumer, Finance – Banking, Fashion, and Transportation Services: Car Choice Awards, Smart Choice Awards, and Innovative Choice Awards. Submit your nominations now at https://betterchoice.vn/.

For any queries during the nomination preparation process, please contact: [email protected] (Ms. Vi Hạnh)

Begging for Money Online

By scanning a bank’s QR code along with the message “everyone gives, everyone receives, the more, the merrier,” some people have jokingly turned themselves into a form of online beggars, sparking controversy in the online community recently. During the Lunar New Year holiday, these various forms of online begging for money have become even more diverse.

The Crypto Conundrum: Unraveling the Mystery of Vietnam’s Government Decree 52

The government has recently issued Decree No. 52/2024 on non-cash payments (effective from July 1), replacing Decree No. 101/2012 (as amended and supplemented). Notably, the new decree introduces additional provisions on virtual currencies, providing a clear definition and elucidating the nature of this emerging form of currency.

Combating ‘Loan Sharks’ with ‘White Knights’

“With the noble goal of ‘leaving no one behind’, we must strive to empower the underprivileged by providing them access to ‘white credit’. It is our duty to ensure that those who are less fortunate have the same opportunities as everyone else. By offering them a chance to obtain this ‘white credit’, we are giving them a tool to build a better future for themselves and their loved ones.”