Tan Tao Industrial Promotion and Investment JSC (coded ITA on the stock exchange) has requested the State Securities Commission and the Ho Chi Minh City Stock Exchange (HoSE) to postpone the publication of its 2023 audited financial statements, 2023 annual financial statements, and 2024 semi-annual reviewed financial statements.

On June 24, ITA provided a response to the State Securities Commission’s letter number 3619/UBCK-GSĐC dated June 7, explaining and providing evidence of force majeure circumstances. However, the company is yet to receive a reply from the State Securities Commission. Meanwhile, HoSE has issued Decision No. 414/QD-SGDHCM dated July 9, placing ITA shares under trading restrictions from July 16 onwards.

In all its communications with the State Securities Commission and HoSE, Tan Tao has consistently maintained that it has provided detailed explanations regarding the force majeure circumstances it has been facing for several months. Despite their best efforts to contact, collaborate with, and persuade all auditing firms (30 auditing firms approved to audit public interest entities in the securities sector in 2023), they have been rejected by all of them.

According to Tan Tao, the main reason for these rejections is the suspension of four auditors by the State Securities Commission. These auditors had conducted the audits of Tan Tao’s financial statements for the years 2021 and 2022, as well as the semi-annual reviewed financial statements for 2023.

“Tan Tao is still striving to persuade auditing firms to perform the 2023 audited financial statements and 2024 semi-annual reviewed financial statements. Whether we can find an auditing firm or not depends on the actions taken by the State Securities Commission and HoSE to protect the rights and interests of shareholders and investors,” the company stated.

Tan Tao was once a prominent industrial real estate developer in Vietnam. Founded in 1993, the company was chaired by Ms. Dang Thi Hoang Yen, who was born in 1959 and graduated from the University of Economics in Ho Chi Minh City. Ms. Yen was a well-known businesswoman and ranked among the top 10 richest people in the Vietnamese stock market for three consecutive years from 2008 to 2010.

However, in 2012, Tan Tao faced significant challenges due to economic factors, causing the ITA share price to drop to one-tenth of its value at the time of its listing in 2006. Since then, Ms. Yen has been notably absent from the company’s annual general meetings, citing different reasons each time.

After an eight-year absence, Ms. Yen unexpectedly reappeared at the 2020 annual general meeting of Tan Tao via an online format. Following this, she became more actively involved in the company and later changed her name to Maya Dangelas.

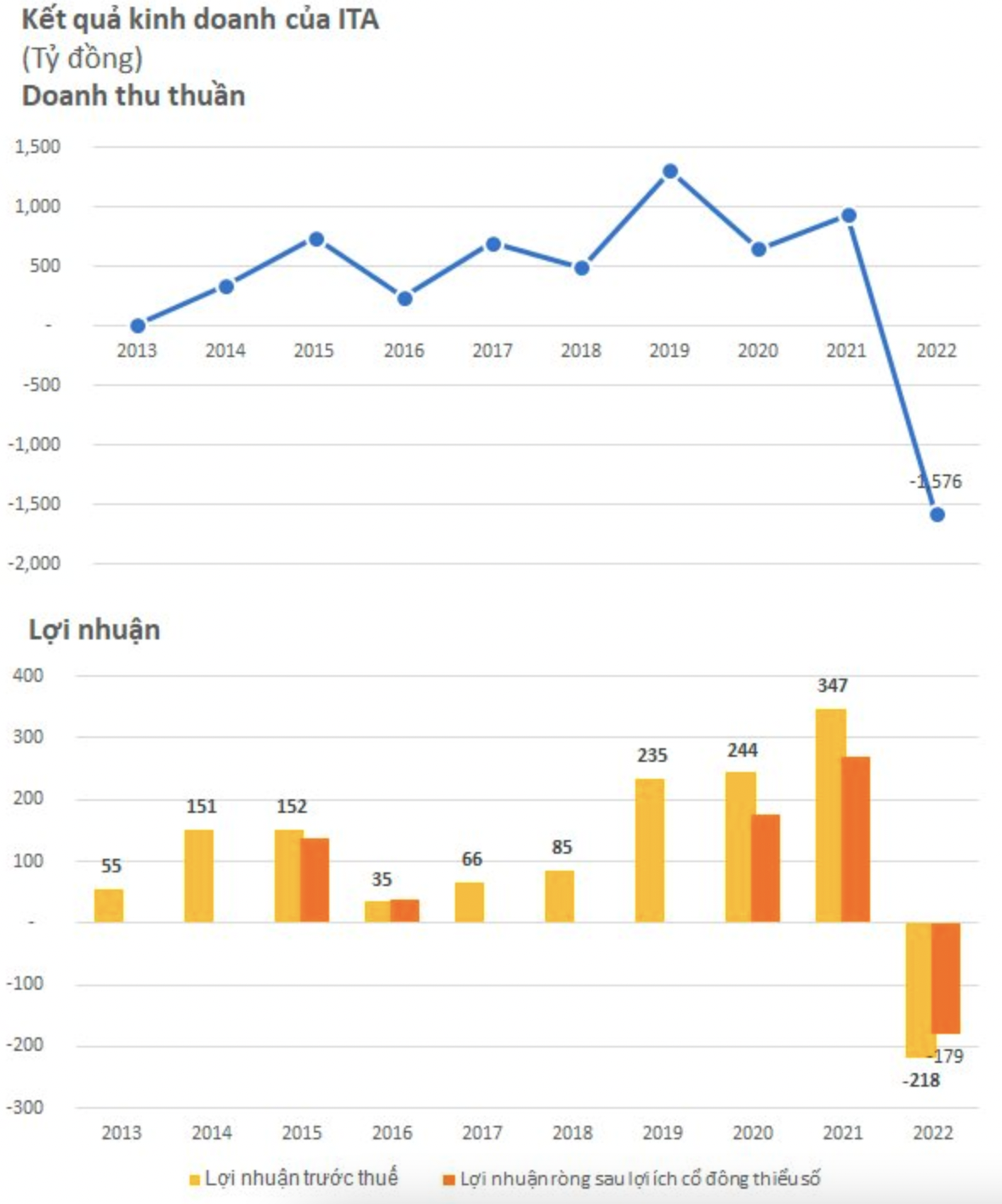

2021 also marked the year when the chairman declared Tan Tao’s return to its golden age, with a primary focus on boosting business in the United States. Nevertheless, according to the 2022 audited financial statements, Tan Tao incurred a substantial loss of over VND 260 billion.

Attributing the sharp decline in performance, Tan Tao explained that it was mainly due to decreased revenue from land with developed infrastructure and the compulsory retrieval of Kien Luong land from Tan Tao Energy Development JSC due to force majeure events. Consequently, the company had to terminate the long-term land lease agreement for the Kien Luong Power Center, resulting in a reduction of over VND 2,142 billion in revenue. Specifically:

– According to the Prime Minister’s Decision No. 428/QD-TTg dated March 18, 2016, on the approval of adjustments to the national power development plan for the period of 2011-2022 with a vision towards 2030, the “Kien Luong 1 project was removed and not included in the list of power projects to be operated from 2016 to 2030.”

– On June 13, 2016, the General Directorate of Energy under the Ministry of Industry and Trade notified that the “Kien Luong 1 project is not included in the list of projects to be operated before 2030. Therefore, the General Directorate of Energy does not have a basis for further implementation.”

– As the Kien Luong 1 project was removed by the Prime Minister from the list of projects to be operated before 2030, Tan Tao Energy Development JSC (TEDC) and Tan Tao had no basis for implementing the project, constituting a case of force majeure as per the contract.

For the full year 2022, Tan Tao recorded a record negative revenue of over VND 1,576 billion (with reductions in revenue of over VND 2,150 billion). The company incurred a net loss of more than VND 179 billion and a pre-tax loss of VND 218 billion.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.