On August 30, 2024, Vingroup officially inaugurated the construction of the National Exhibition and Convention Center project in Dong Anh district, Hanoi. With a total scale of 90 hectares, it is expected to be a “new wonder” of the capital and is among the top 10 largest exhibition centers in the world.

The National Exhibition and Convention Center is a key national project in the field of trade and services, replacing the old Exhibition Center in Giang Vo. Vingroup believes that this convention center will boost a vibrant Expo economy, similar to the models of Dubai Expo (United Arab Emirates), Frankfurt (Germany), and Fiera Milano (Italy), among others.

The project is located at the northeastern gateway to Hanoi, with a total area of 90 hectares, making it one of the top 10 largest exhibition centers in the world in terms of both overall and exhibition area.

The indoor exhibition building is the centerpiece of the complex, designed in the image of Kim Quy (Golden Turtle) – one of the four sacred animals in Oriental culture, associated with the legend of Kim Quy protecting the ancient land of Co Loa, Dong Anh.

Conceptual sketch of the project.

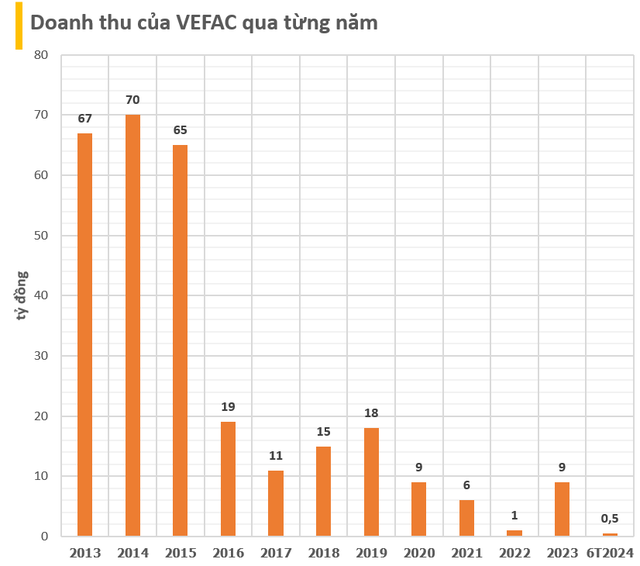

The direct investor of this project is Vietnam Exhibition and Fair Center JSC (VEFAC) – a subsidiary of Vingroup, in which Vingroup holds more than 83% of the capital. In addition to being the investor of the National Exhibition and Convention Center in Co Loa, the company is also developing a new urban area project in Xuan Canh, Dong Hoi, and Mai Lam (Vinhomes Co Loa) with a total investment of approximately VND 35,000 billion.

As of June 30, VEFAC recorded construction in progress of nearly VND 830 billion for the National Exhibition and Convention Center in Co Loa.

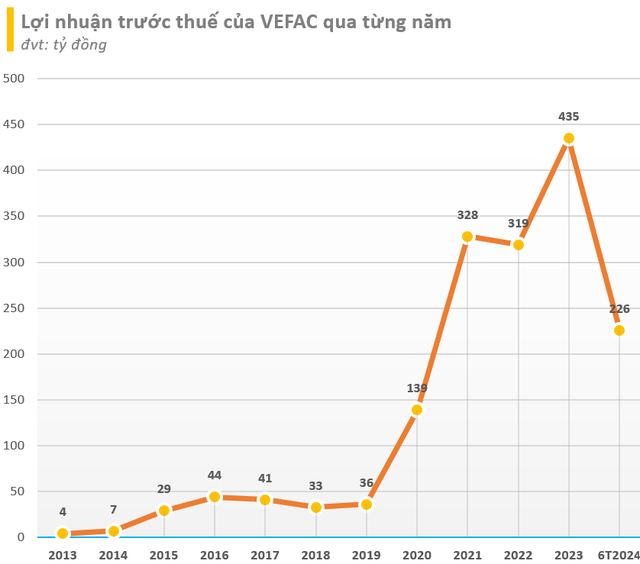

In terms of financial performance, VEFAC reported profits of hundreds of billions of VND each quarter. According to the reviewed financial statements for Q2 2024, the company achieved a pre-tax profit of VND 226 billion.

Financial Statements – VEF

Financial Highlights – VEF

VEFAC’s market price has also left a strong impression with its soaring performance since the beginning of the year. Specifically, the share price increased by 112% to VND 234,000/share at the end of the trading session on August 29. However, liquidity remained modest with only a few thousand matched orders per session.

VEF Share Price Performance

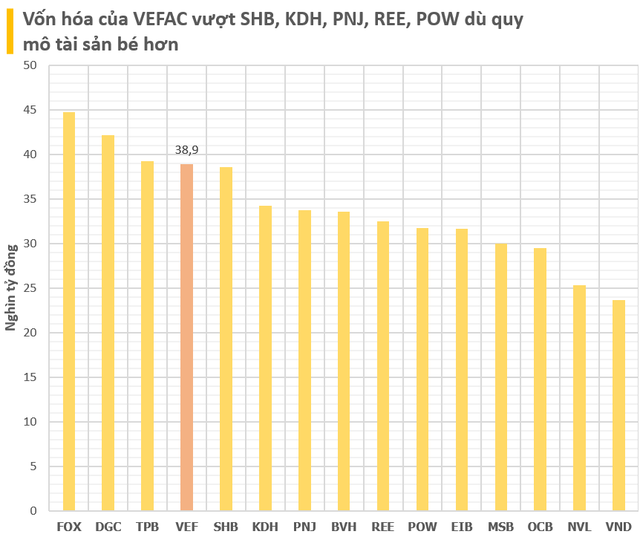

With the current share price, VEFAC’s market capitalization has reached nearly VND 39,000 billion (approximately USD 1.5 billion), an increase of more than VND 20,000 billion compared to the beginning of the year. The company’s market capitalization has now almost caught up with that of TPBank and FPT Telecom, and has even surpassed well-known names on the exchange such as Bao Viet Holdings, PNJ, OCB, PV Power, REE, and Khang Dien.

This came as a surprise to many, considering the scale of the company. As of Q2 2024, VEFAC’s total assets were just over VND 10,000 billion, much smaller than the aforementioned companies.

Total Assets Comparison

‘From Carp to Dragon’: VinFast’s Journey of Ascendance on the Global Financial Map

The listing of VinFast on the Nasdaq stock exchange in the United States, with a market capitalization exceeding 23 billion USD, has garnered attention from global investors. This has become an inspiration for Vietnamese businesses who dare to dream and take action.