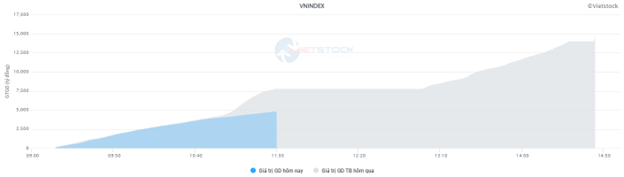

The VN-Index saw a trading volume of just over 197 million units in the morning session, equivalent to a value of more than 4.8 trillion VND, a decrease of nearly 40% from yesterday morning. The HNX-Index recorded a trading volume of over 19 million units, with a value of more than 387 billion VND.

Source: VietstockFinance

|

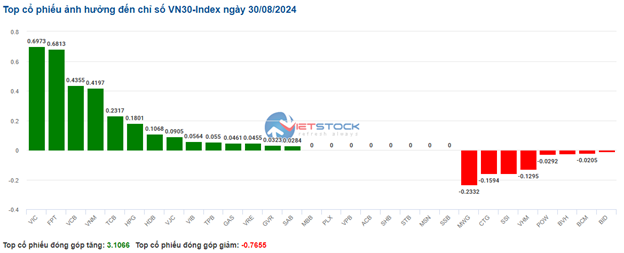

In terms of impact, VCB bore the brunt, contributing almost 1 point to the VN-Index increase. This was followed by VIC, FPT, and VNM, which also traded positively, adding more than 1.2 points to the overall index. On the other hand, CTG, VHM, and BCM were the most negatively impacting stocks, but their influence was not significant.

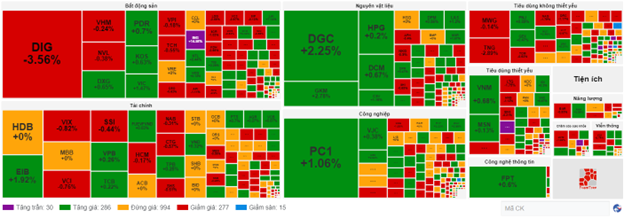

Sector performance continued to be mixed, with mild fluctuations. The information technology sector, led by FPT (+0.75%) and CMT (+1.43%), temporarily topped the market, rising by 0.69%. Following closely was the consumer staples sector, which increased by 0.58%, largely due to gains in VNM (+0.95%), MCH (+1.48%), SAB (+1.39%), SBT (+0.8%), and others. However, many stocks within this sector remained in the red, including QNS, KDC, VCF, HAG, HNG, DBC, ANV, and VLC.

On the flip side, the energy sector lagged, ranking last with a decline of 0.33%. This was mainly due to pressure from large-cap stocks in the industry, such as BSR (-0.42%), PVS (-0.25%), and PVD (-0.18%). The non-essential consumer goods and telecommunications services sectors were the other two groups facing selling pressure, experiencing slight declines of over 0.1%.

10:40 am: The market continues to fluctuate

The buying side remained weak, causing the major indices to move in opposite directions and hover around the reference level. As of 10:30 am, the VN-Index rose 2.71 points, trading around the 1,284-point level. Meanwhile, the HNX-Index dropped 0.82 points, trading around 237 points.

A clear differentiation was evident within the VN30 basket, but the green side slightly prevailed, with 14 out of 30 stocks posting gains. Notably, VIC pushed the index up by 0.69 points, FPT by 0.68 points, VCB by 0.43 points, and VNM by 0.41 points. Conversely, only a few stocks like MWG, CTG, SSI, and VHM faced selling pressure, but the declines were not significant.

Source: VietstockFinance

|

Leading the gains was the healthcare sector, with a modest increase of 0.76%. Standouts included TNH, up 4.97%; DHG, up 0.75%; DHT, up 0.29%; and NDC, up 14.97%… Conversely, significant selling pressure was observed in some stocks like DCL, down 0.19%; DVM, down 1.92%; and FIT, down 1.16%… These stocks are currently hindering the sector’s performance.

Additionally, the materials sector was among the top five industries supporting the index, with green dominance. Buying interest was mainly focused on GKM, up 2.78%; DCM, up 0.8%; CSV, up 1.42%; and DPM, up 0.72%… Notably, DGC witnessed a positive breakout right at the market open, surging by 2.52%.

From a technical perspective, DGC stock surged in the morning session of August 30, 2024, accompanied by rising trading volume surpassing the 20-day average, indicating optimistic investor sentiment. Moreover, the stock’s price continued to trade above the Middle Bollinger Band in recent sessions after successfully testing the SMA 200-day support, suggesting a potential recovery after the correction. Furthermore, the MACD indicator maintained an upward trajectory after generating a buy signal. This reinforces the recovery scenario, with further confirmation expected as the indicator climbs above the zero level in the upcoming period.

Source: https://stockchart.vietstock.vn/

|

On the contrary, the energy sector exhibited mixed performance, but selling pressure prevailed, making it the worst-performing sector in the market with a decline of 0.49%. Specifically, BSR fell by 0.42%, PVB by 0.34%, and TMB by 0.42%… Most other stocks in the sector, such as PVS, PVD, PVC, and CST, remained unchanged.

Compared to the opening, the market continued to fluctuate, with the buying side holding a slight advantage. There were 286 advancing stocks and 277 declining stocks.

Source: VietstockFinance

|

Market Open: Modest Gains at the Start

At the start of the session on August 30, as of 9:30 am, the VN-Index turned green, reaching 1,286.03 points. Meanwhile, the HNX-Index posted a slight increase, maintaining the 238.01-point level.

Green dominance was slightly more evident in the VN30 basket, with 5 declining stocks, 22 advancing stocks, and 3 unchanged stocks. Notably, VCB, TCB, and VIB were the top losers, while CTG, SSI, and BCM were the top gainers.

The healthcare sector was one of the most prominent industries at the start of the morning session. Stocks that traded positively from the beginning included NDC, which hit the daily limit (+14.97%), DHT (+0.72%), AMV (+3.33%), TNH (+0.65%), and PBC (+1.35%), among others.

Additionally, the utilities sector made a positive contribution to the market performance this morning. Notable performers within this sector included GAS (+0.48%), STW, which hit the daily limit (+14.76%), QTP (+0.68%), BWE (+0.68%), and BWS (+2.42%), among others.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.