|

Financial Targets of Greenfeed in the First Half of 2024

Source: HNX

|

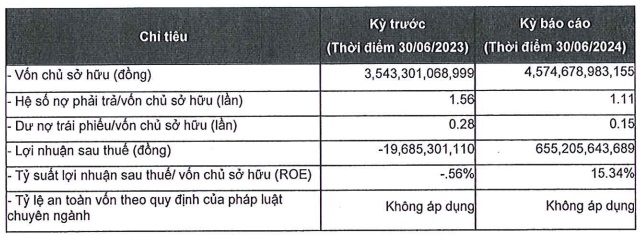

Specifically, GreenFeed reported a post-tax profit of over VND 655 billion in the first half of 2024, an impressive increase compared to the loss of nearly VND 20 billion in the same period last year.

Equity increased by more than VND 1,000 billion, from VND 3,500 billion to VND 4,600 billion as of the end of June 2024. ROE reached 15.34%.

The debt-to-equity ratio decreased from 1.56 to 1.11, equivalent to a total debt of nearly VND 5,080 billion. Of this, bond debt amounted to VND 700 billion. The bond debt ratio decreased from 0.28 to 0.15.

Currently, Greenfeed has one lot of bonds with the code GFVCH2128001 with a total value of VND 1,000 billion. This lot has a tenor of 84 months, issued on November 3, 2021, and will mature on June 15, 2028. Vietcombank Securities Company (VCBS) acts as the advisor, registrar, issuer, and transfer manager for this bond lot.

The interest rate applied to this bond lot is 6.53% per annum, with interest payments made every 6 months. The company is currently meeting its interest payment obligations for this bond lot.

These are non-convertible bonds, without warrants, that are asset-backed and payment-guaranteed. The bondholder is the International Finance Corporation – IFC (IFC). The assets used as collateral are 100% of the charter capital of GreenFeed Farm Co., Ltd. and LinkFarm Co., Ltd. (both owned by Greenfeed) along with all related or generated rights and income.

On June 17, 2024, Greenfeed repurchased VND 300 billion worth of bonds and completed its interest payment obligations for the first half of 2024.

Greenfeed owns the G Kitchen chain of clean meat stores

|

After record low interest rate until 2023, Mobile World (MWG) forecasts a 14-fold profit increase in 2024 but still falls short of the peak period

After a comprehensive restructuring that began in Q4/2023, The Gioi Di Dong believes that the company has the potential to further strengthen its revenue and improve profitability targets.