According to VietstockFinance, the total deferred income (Customer prepayments + Unrecognized revenue) of 115 real estate enterprises listed on the HOSE, HNX, and UPCoM exchanges as of June 30, 2024, amounted to over VND 133.6 thousand billion, a 6% increase compared to the beginning of the year.

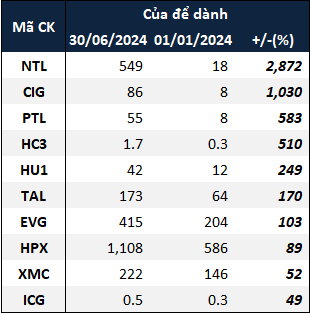

The most impressive increase was recorded by Urban Development and Investment Corporation (HOSE: NTL), with a deferred income value of VND 549 billion at the end of June, compared to only VND 18 billion at the beginning of the year, equivalent to a nearly 30-fold increase. The significant rise in NTL was due to the short-term unrecognized revenue of over VND 538 billion that occurred in the second quarter, which was not present at the beginning of the year.

In the first six months of the year, NTL reflected in its financial statements the revenue from the sale of products for which payment had been fully received for the Bãi Muối 23ha project in Quang Ninh Province, resulting in a 7.3-fold increase in net revenue compared to the same period last year, amounting to over VND 878 billion. Financial revenue also increased by 456 times, reaching nearly VND 12 billion.

Although not as high as NTL, the deferred income of COMA 18 Joint Stock Company (HOSE: CIG) is also considered a significant change, with a more than 11-fold increase from the beginning of the year, amounting to VND 86 billion, all from customer prepayments.

|

Top 10 enterprises with the highest increase in deferred income in the first six months of 2024 (in VND billion)

Source: VietstockFinance

|

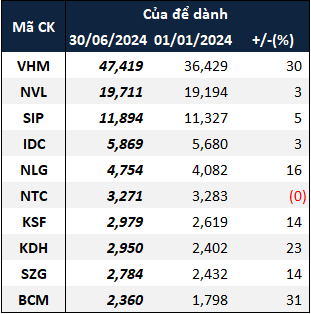

In absolute terms, Vinhomes Joint Stock Company (HOSE: VHM) and No Va Real Estate Investment Group (HOSE: NVL) remained the two enterprises with the highest deferred income in the industry, with amounts of over VND 47.4 thousand billion and VND 19.7 thousand billion, respectively, representing increases of 30% and 3% compared to the beginning of the year.

It is known that in the first six months of the year, VHM completed a large-lot transaction for the Vinhomes Royal Island project and continued to hand over existing projects.

The “giant” in the industrial real estate sector, the Industrial Investment and Development Corporation (HOSE: BCM), also recorded a 31% increase in deferred income, ranking 10th in the industry with nearly VND 2.4 thousand billion. This increase was partly due to the rise in internal land transfer profits to be refunded (long-term unrecognized revenue), which increased by 99% from over VND 475 billion at the beginning of the year to over VND 946 billion at the end of June.

|

Top 10 enterprises with the highest deferred income as of June 30, 2024 (in VND billion)

Source: VietstockFinance

|

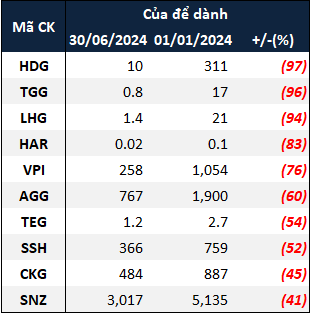

On the other hand, many residential real estate enterprises, such as Ha Do Group (HOSE: HDG), Van Phu – INVEST Investment Joint Stock Company (HOSE: VPI), and An Gia Investment and Development Joint Stock Company (HOSE: AGG), unexpectedly reported double-digit decreases in deferred income in the first six months of the year.

The most notable was HDG, whose deferred income fell to just under VND 10 billion, a 97% decrease. Meanwhile, the enterprise’s cash balance and the value of trading securities (including bonds and certificates of deposit) increased dramatically, by 2.2 times and 58%, to nearly VND 546 billion and over VND 609 billion, respectively.

At VPI, the decrease in deferred income was mainly due to the absence of a VND 700 billion advance payment for the purchase of a subsidiary’s capital, which was recorded at the beginning of the year. Moreover, the amount of prepayment from customers for the Terra Bac Giang project decreased by more than 10%, to over VND 236 billion. In contrast, the Terra An Hung project saw an increase of nearly 79%, to over VND 1 billion.

AGG reported a 69% decrease in prepayments from individual customers for apartment purchases, from over VND 1,500 billion to VND 469 billion. Prepayments from related parties also decreased by 19%, to VND 297 billion.

|

Top 10 enterprises with the largest decrease in deferred income in the first six months of 2024 (in VND billion)

Source: VietstockFinance

|

Which real estate enterprise has the most cash on hand?

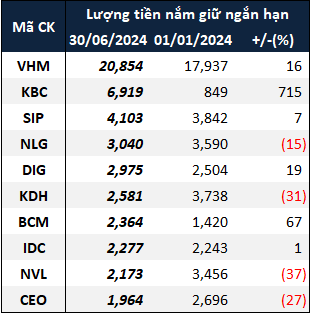

In addition to deferred income, the amount of short-term cash holdings is also an important resource that enables enterprises in the industry to accelerate project development as the real estate market recovers strongly.

VHM continues to lead the industry with nearly VND 20.9 thousand billion in cash, a 16% increase. The most notable enterprise is Kinh Bac City Development Holding Corporation (HOSE: KBC), with a cash balance of over VND 6,900 billion, 8.3 times higher than at the beginning of the year, accounting for 17% of total assets. Another industrial real estate enterprise, BCM, recorded a 67% increase in cash deposits, reaching nearly VND 2.4 thousand billion.

|

Top 10 enterprises with the highest cash balance as of June 30, 2024 (in VND billion)

Source: VietstockFinance

|

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”