Vietnam’s animal feed industry has made remarkable strides, becoming a sought-after commodity by many nations thanks to technological advancements and improved quality.

According to preliminary statistics from the General Department of Customs, in the first seven months of 2024, Vietnam exported nearly 584.18 million USD worth of animal feed and raw materials, a decrease of 10.5% compared to the same period in 2023.

In July 2024 alone, exports of animal feed and raw materials reached over 90.65 million USD, a 4.7% increase from the previous month but a 30% decrease from July 2023.

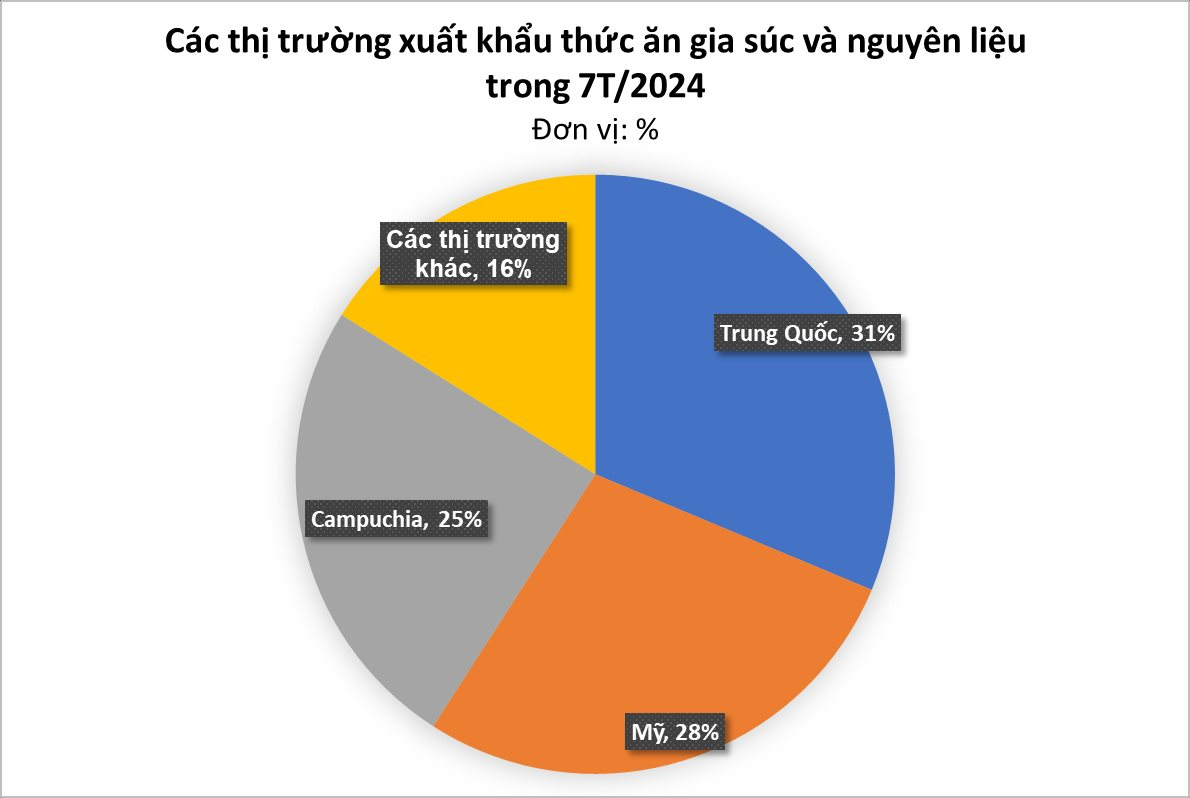

China is the largest market for Vietnam’s animal feed and raw material exports, accounting for 40.9% of the country’s total exports in this sector.

In the first seven months of 2024, exports to China reached nearly 239.15 million USD, a 23.5% decrease compared to the same period in 2023. In July 2024, exports to this market reached 38.22 million USD, a 4.5% increase from June but a 46.6% decrease from July of the previous year.

The United States was the second largest market, with exports totaling over 74.87 million USD, an increase of 80.2%, accounting for 12.8%. Exports of animal feed and raw materials to the Southeast Asian market reached over 175.76 million USD, a decrease of 18.1% compared to the first seven months of 2023, accounting for 30% of Vietnam’s total exports in this sector.

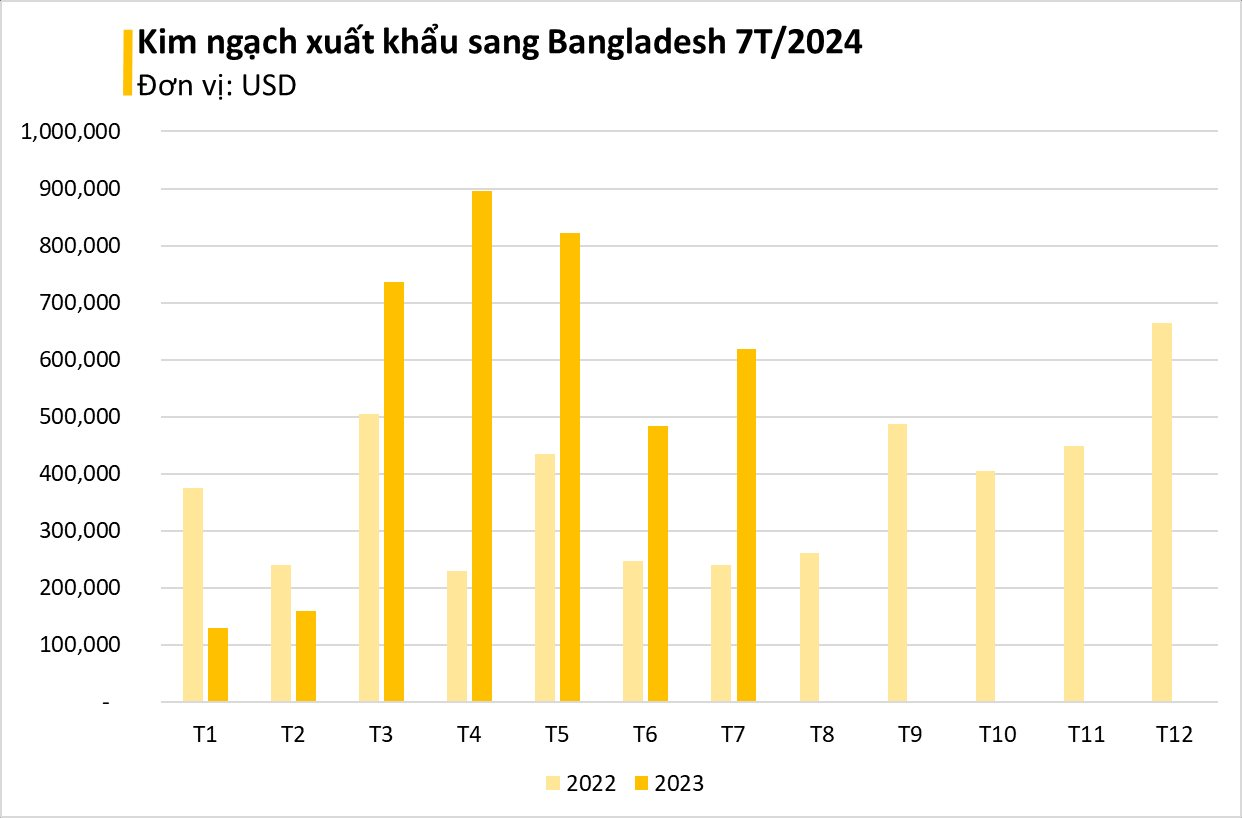

Notably, exports to Bangladesh have been surging in recent months. Although Vietnam’s exports to this country reached only 3.9 million USD in the first seven months of the year, it marked a significant increase of 72.93% compared to 2023. In July alone, exports surged by 160% year-on-year.

According to a report by the Foreign Agricultural Service (FAS) of the US Department of Agriculture, despite economic challenges and high feed prices, the demand for animal feed in Bangladesh is expected to rise as large commercial poultry farms expand their operations. Consequently, businesses in Bangladesh have turned to Vietnam to secure their supply.

Bilateral trade between the two countries has witnessed robust growth in recent years, increasing from 93 million USD in 2009 to 927 million USD in 2023. In terms of agricultural products, Vietnam exports rice, rubber, rubber products, animal feed, and raw materials to Bangladesh.

Over the past two decades, Vietnam has made remarkable improvements in the technology and quality of its animal feed, fully meeting the requirements of demanding import markets.

According to the Alltech Global Feed Survey 2023, Vietnam’s production reached 26.72 million tons, ranking 8th in the world. Vietnam is also among the top 10 countries in the world for animal and aquatic feed production.

Currently, there are 269 industrial mixed feed mills in the country, with a total designed capacity of 43.2 million tons. Of these, 90 mills are owned by FDI enterprises (accounting for 33.5% in quantity and 51.3% in designed capacity) and 179 mills by domestic enterprises (accounting for 66.5% in quantity and 48.7% in designed capacity).

The strong potential for development in recent years has attracted many businesses to enter the Vietnamese animal feed market, including prominent foreign-invested enterprises that have expanded their production.

Notable names include Cargill Group (USA), CP Group (Charoen Pokphand Group – Thailand), De Heus (Netherlands), Haid (China), BRF (Brazil), Mavin (France), Japfa (Singapore), and CJ (South Korea), among others.

The presence of these global giants in the Vietnamese animal feed market has fostered intense competition between domestic and foreign-invested enterprises.

Reducing Taxes on Certain Feedstock Items

In response to a petition from voters in Ben Tre, the Ministry of Finance stated that, in addition to solutions on tax, fee and charge extension, reduction, and deferral, the Ministry of Finance has submitted to the Government a Decree on reducing preferential import tax rates for certain essential items used in the production of animal feed, such as wheat and corn, in order to continue supporting the domestic livestock industry.