Mirroring the surge in trading volume, average liquidity spiked to 22,000 shares per day, including a trading volume of over 44,000 shares on August 29th, seven times the annual average.

Source: VietstockFinance

|

| Share price movement of KSD in the past year |

In a document sent to the State Securities Commission and the Hanoi Stock Exchange (HNX), DNA Investment explained the surge in a formulaic manner: “Share price increases depend on the supply and demand of the stock market and the tastes and demands of investors.”

Previously, HNX had included KSD in the list of stocks ineligible for margin trading from August 13th due to the company’s semi-annual audited financial statements for 2024, which reported a negative retained earnings and negative undistributed post-tax profit as of June 30, 2024.

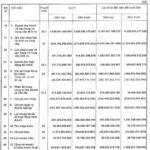

After the audit, the company posted a semi-annual loss of more than VND 2 billion, an increase compared to the loss of nearly VND 1.2 billion in the first six months of 2023. The company attributed the loss to the impact of the economic downturn, which led to a decline in revenue and subsequently affected profitability.

In 2024, KSD set a target of VND 70 billion in revenue and a net profit of VND 2 billion, an increase of 34% and 13 times the performance in 2023, respectively. However, after the first six months, the company achieved only over 29% of the revenue target and incurred a loss.

|

KSD’s semi-annual business results over the past 10 years |

As of the second quarter of 2024, KSD’s total assets amounted to over VND 122 billion, including nearly VND 27 billion in bank deposits and VND 7 billion in cash. On the liabilities side, the company had over VND 3 billion in payables, with financial borrowings standing at just VND 647 million, a decrease of over VND 7 billion compared to the beginning of the year. The company recorded accumulated losses of nearly VND 1.3 billion as of June 30, 2024.

DNA Investment, formerly known as Dong Nam A Limited Company, was established in 2003. Its initial business focused on assembling air conditioners, and it later transitioned to manufacturing and exporting hangers for clothing. The company is headquartered in Chau Son Industrial Park, Phu Ly City, Ha Nam Province. As of June 30, 2024, the company employed 27 people.

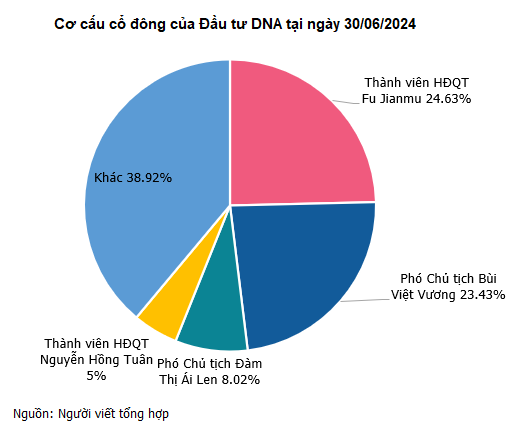

The company has undergone three rounds of charter capital increases since its establishment. Starting with a capital of VND 15 billion, it reached VND 120 billion in 2012, an eightfold increase. As of the second quarter of 2024, KSD’s major shareholders included Mr. Fu Jianmu, a member of the Board of Directors, holding 24.63% of capital; Mr. Bui Viet Vuong, Vice Chairman of the Board of Directors and General Director, holding 23.43%; Ms. Dam Thi Ai Len, Chairman of the Board of Directors, holding 8.02%; and Mr. Nguyen Hong Tuan, a member of the Board of Directors, holding 5%.

Notably, in early August 2024, KSD received a resignation letter from Mr. Nguyen Hong Tuan, a member of the Board of Directors, citing personal reasons.

Meanwhile, Vice Chairman Bui Viet Vuong registered to purchase 185,000 KSD shares from August 22nd to September 20th, aiming to increase his ownership to 25% (equivalent to 3 million shares) and become the company’s largest shareholder.

Surging Profits from Associated Joint Venture, Nam Long (NLG) Reports After-Tax Profit of over 800 billion VND in 2023

According to NLG, the primary revenue for the entire year came from the sale of houses and apartments, from two major projects Izumi and Southgate. Additionally, in the third quarter, NLG also had the Mizuki project, which was a significant handover project.