The VN-Index remained in positive territory for most of the trading session, but the market experienced frequent bouts of volatility, even dipping below the reference level at times. Eventually, it closed slightly higher.

Banking stocks sent out positive signals after the State Bank allowed credit room “relaxation.” Specifically, from August 28, credit institutions with a credit growth rate of 80% of the State Bank’s target for this year will be able to proactively adjust their outstanding loans based on their ranking scores.

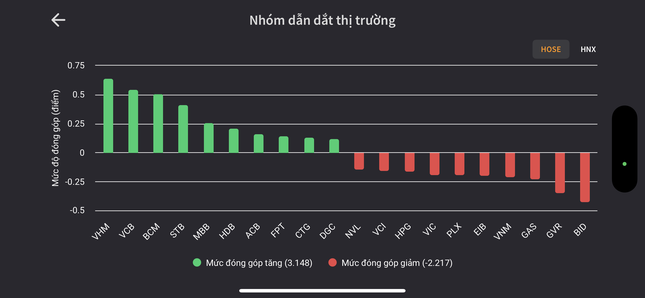

The VN-Index’s upward movement relied heavily on a few large-cap stocks.

The return of the “king” stocks supported the index, with VCB leading the gains, followed by STB, MBB, VPB, and BID. STB saw the biggest increase of 3%, while the rest rose by around 1%.

Two banks, MSB and OCB, will close for dividend eligibility today and tomorrow. MSB will pay a 30% stock dividend, while OCB will pay a 20% cash dividend.

The VN-Index’s ascent was largely driven by a handful of large-cap stocks, while the midcap segment continued to exert pressure. The HoSE saw more than 250 declining stocks, with red dominating the screen. Liquidity also took a hit,

with cautious sentiment among investors leading to a standoff between buyers and sellers.

Influential sectors like real estate and securities failed to find common ground, but the overall sentiment was slightly more optimistic. For instance, DIG of DIC Corp. only closed 0.8% lower. Investors regained their composure after yesterday’s sell-off triggered by the Government Inspectorate’s conclusion on the equitization and state capital divestment at DIC Corp.

At the close, the VN-Index rose 0.03 points to 1,281.47. The HNX-Index lost 0.35 points (0.15%) to 237.88, and the UPCoM-Index fell 0.28 points (0.3%) to 93.85.

Liquidity dried up, with HoSE’s trading value dropping to VND14 trillion. Foreign investors net sold over VND117 billion.