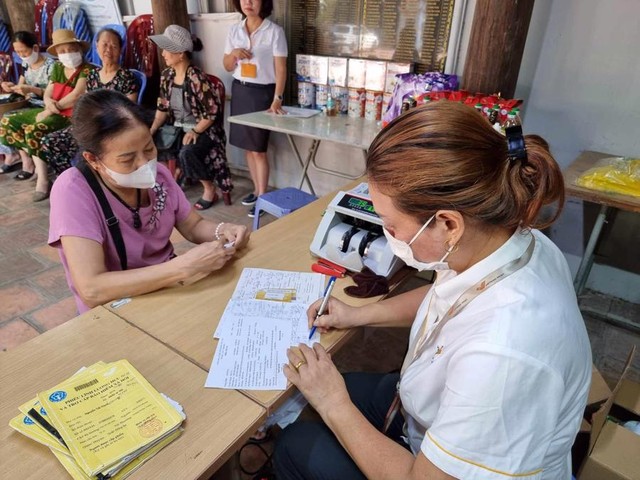

Mrs. Nguyen Thi Hao, 74 years old, residing in Thu Duc City, Ho Chi Minh City, eagerly awaits her pension every month. Her pension schedule starts at the beginning of the month, but she eagerly anticipates it even at the end of the month. Having retired in the early 2000s, Mrs. Hao now receives a pension of over VND 4.9 million per month after several increases.

As her husband worked as a freelance laborer and does not receive a pension, her pension is the main source of income for the couple. With her pension of almost VND 5 million, Mrs. Hao has to set aside a significant amount for weddings, death anniversaries, and visiting the sick. The remaining amount is used for the monthly expenses of the couple.

In the past 10 years (2013-2023), the government has adjusted pensions seven times, with an average increase of more than 8.43% each time, higher than the increase in the consumer price index in the same period.

According to the Ministry of Labor, Invalids, and Social Affairs, under the Social Insurance Law, social insurance benefits are calculated based on contribution levels and contribution periods. Monthly pension amounts depend on the employee’s monthly salary, which serves as the basis for social insurance contributions, and the length of time the employee has contributed. Therefore, the higher the salary and the longer the contribution period, the higher the pension will be.

Article 57 of the 2014 Social Insurance Law stipulates that pension adjustments are based on consumer price index increases and economic growth, in alignment with the state budget and the Social Insurance Fund.

On June 30, 2024, the government issued Decree No. 73/2024/ND-CP, adjusting pensions, social insurance allowances, and monthly allowances. Accordingly, from July 1, 2024, there will be a 15% increase in pensions, social insurance allowances, and monthly allowances compared to the previous month. This adjustment demonstrates the government’s commitment to improving the lives of pensioners and social insurance beneficiaries.

Moving forward, the Ministry of Labor, Invalids, and Social Affairs will continue to coordinate with relevant ministries and sectors to research and advise the government on adjusting pensions and monthly social insurance allowances in accordance with the Social Insurance Law and Resolution No. 28-NQ/TW.

To improve pensions for those with low incomes, the 2024 Social Insurance Law, which will take effect on July 1 of next year, has introduced a provision for a reasonable pension increase for those with low pensions who retired before 1995. This policy aims to narrow the pension gap between retirees from different periods.

Salary Adjustments and Social Insurance Payments for 2024

The average salary and monthly income subject to social insurance paid will be the basis for calculating pensions, one-time retirement benefits, one-time social insurance, and one-time disability benefits…

How many years do workers have to contribute to voluntary social insurance to receive a pension in 2024?

According to Article 3 of the 2014 Social Insurance Law, voluntary social insurance is a type of insurance organized by the State. Participants in voluntary social insurance have the right to choose the level and method of insurance payment that is suitable for themselves.

Many Retirement Reforms for Retirees with Merit

Starting from 1st July 2024, with the reform of salary for civil servants and officials, a series of policies concerning pensions and benefits for meritorious people are expected to change. The Vietnam Social Security (VSS) has recently proposed an 8% increase, while the Ministry of Labor, Invalids and Social Affairs (MOLISA) argues for a minimum of 15% raise.