The Vietnamese stock market traded rather sluggishly ahead of the September 2 holiday as investors remained cautious ahead of the long holiday. As a result, liquidity remained low across the board. The VN-Index edged up 2.4 points to close at 1,283.87. Trading value on HoSE reached a meager VND13,522 billion.

Meanwhile, foreign investors turned net buyers, injecting a net VND58 billion into Vietnamese stocks, a positive reversal from previous strong net selling. Specifically:

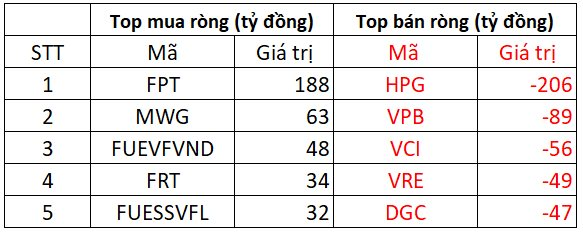

On HOSE, foreign investors net bought VND62 billion

FPT was the most purchased stock by foreign investors, with a net value of VND188 billion. This was followed by MWG and FUEVFVND, which were accumulated VND63 billion and VND48 billion, respectively. FRT and FUESSVFL were also net bought in the range of VND32-34 billion.

On the other side, HPG faced the strongest net selling pressure from foreign investors, with more than VND206 billion. VPB and VCI were also offloaded, with net selling values of VND89 billion and VND56 billion, respectively. VRE and DGC were also among the top sold stocks, with nearly VND50 billion net sold each.

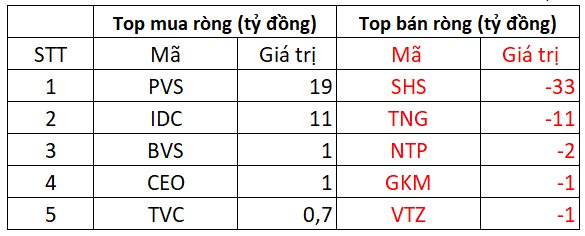

On HNX, foreign investors net sold VND18 billion

PVS was the most net bought stock on HNX, with a net value of VND19 billion. IDC followed suit with a net purchase of VND11 billion. Foreign investors also net bought nearly VND1 billion each of BVS, CEO, and TVC.

On the opposite side, SHS faced the strongest net selling pressure, with a net selling value of nearly VND33 billion. TNG was also net sold for VND11 billion. NTP, GKM, and VTZ were among the top sold stocks, with a few billion VND net sold each.

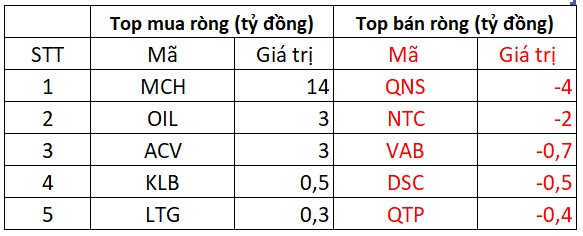

On UPCOM, foreign investors net bought VND14 billion

In terms of net bought value, MCH led with VND14 billion. OIL and ACV were also net bought, with VND3 billion each.

Conversely, QNS was net sold by foreign investors for nearly VND4 billion. NTC, VAB, DSC, and QTP were also among the top net sold stocks.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”