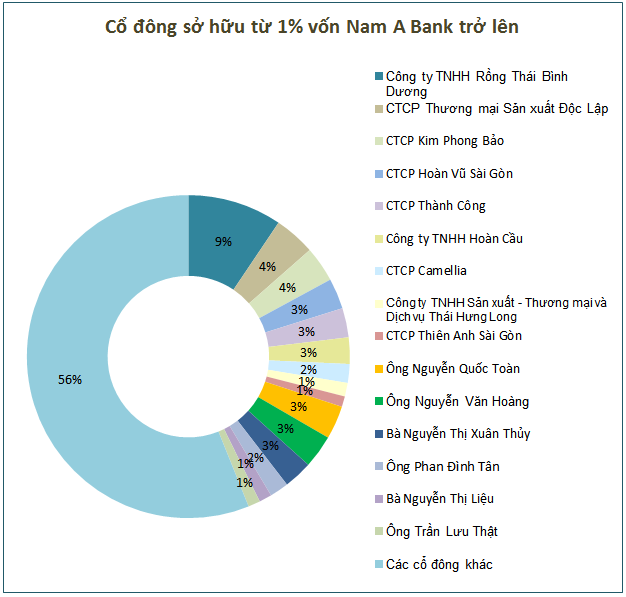

Source: Nam A Bank (Based on information provided by shareholders as of August 21, 2024)

|

When the Chairman is a “Hired Hand”

The list of shareholders owning 1% or more of Nam A Bank’s charter capital (announced on August 22, 2024) reveals that the top executives of this bank do not hold any shares in their personal capacity.

In addition, the bank’s semi-annual governance report for the first half of 2024 shows that the Chairman of the Board of Directors, Tran Ngo Phuc Vu, does not hold any NAB shares. In his family, only his younger brother, Tran Ngo Phuc Khoa, holds 29,441 NAB shares, or 0.003% of the bank’s charter capital.

Two other key leaders are Tran Ngoc Tam, Vice Chairman of the Board of Directors, who holds nearly 3.4 million shares or 0.32% of the capital, and Tran Khai Hoan, Board member and Acting General Director, who owns more than 2.95 million shares, equivalent to 0.279% ownership.

Typically, the Chairman of the Board is the owner of the business with the largest shareholding. However, in the case of banks, ownership can be quite different.

While the Chairman often serves as the legal representative, they are not necessarily the largest shareholder. Current laws only stipulate that the Chairman is elected by the Board of Directors, without requiring them to be the largest shareholder. As a result, the owners of banks in Vietnam are diverse, and many “real owners” do not appear as the highest-ranking leaders in the bank.

Who is the Real “Boss” of Nam A Bank?

According to the bank’s disclosure, as of August 21, 2024, the largest institutional shareholder of Nam A Bank is Pacific Dragon Company Limited, holding over 9.4% of the capital, equivalent to more than 99.8 million shares.

In addition, there is the presence of Nguyen Quoc Toan, the eldest son of the late businesswoman Tran Thi Huong (commonly known as Tu Huong), who holds more than 3.33% (35.3 million shares); Nguyen Van Hoang with over 3.32% (over 35.1 million shares), and Nguyen Thi Xuan Thuy, Mr. Toan’s sister, with 2.9% (30.4 million shares).

The background of Pacific Dragon Company Limited reveals connections between the company and Mr. Nguyen Quoc Toan and Mr. Nguyen Van Hoang.

Pacific Dragon Company Limited was established in October 1999 with an initial charter capital of VND 90 billion. The late businesswoman’s son and daughter, Nguyen Quoc Toan and Nguyen Thi Xuan Ngoc, held almost 100% of the capital. Specifically, Mr. Toan contributed VND 89.7 billion (99.7% of capital), and Ms. Ngoc contributed VND 250 million.

In late 2012, Mr. Toan’s wife, runner-up Duong Truong Thien Ly, owned 99.94% of the company’s shares. In 2013, Ms. Dao Thi Dieu acquired all of Ms. Thien Ly’s shares and held them until June 2016.

Thus, around early 2015, when Pacific Dragon was announced to hold 14.26% of Nam A Bank’s charter capital, the company was already a legal entity independent of Mr. Toan’s family.

After Ms. Dieu divested, the new owners of Pacific Dragon included Ms. Truong Vu Hoa Mi (holding 50%, equivalent to VND 400 billion) and Mr. Nguyen Van Hoang, who increased his ownership from 0.06% (VND 480 million) to 50% of the capital (VND 400 billion).

In August 2018, the new owners of Pacific Dragon were Mr. Duong Tien Dung, holding 80%, and Ms. Nguyen Thi Kim Phuong, holding 20%. In November 2018, Mr. Nguyen Van Hoang returned as a 50% owner of Pacific Dragon (VND 400 billion), and Ms. Kim Phuong increased her ownership to 50%.

From April 2019, Ms. Phuong and Mr. Hoang no longer held ownership in Pacific Dragon, and they were replaced by Ms. Vo Thi Hiep and Mr. Nguyen Binh Duy, each holding 50% of the capital.

After no longer holding ownership, Mr. Nguyen Van Hoang was appointed as the legal representative and General Director of Pacific Dragon from July 2021 to May 2024. Since then, Mr. Ha Hoc Duy has held this position, replacing Mr. Hoang.

Mr. Nguyen Van Hoang used to be a member of the Board of Directors and General Director of Hoan Vu Sai Gon JSC, the organizer of the Miss Universe Vietnam pageant. Nam A Bank has always been a major sponsor of this beauty contest.

Independent Production and Trading Joint Stock Company is the second-largest shareholder of NAB, with a stake of 4.096% (over 43.3 million shares). In June this year, Independent issued VND 200 billion in bonds, using 25 million NAB shares owned by Kim Phong Bao JSC as collateral.

Kim Phong Bao JSC, according to NAB’s shareholder structure, holds 3.558% of NAB’s capital (over 36.6 million shares), the third-highest proportion.

Hoan Vu Sai Gon JSC is the fourth-largest institutional shareholder of NAB, with a stake of 3.067% (nearly 32.5 million shares). The company has a charter capital of VND 650 billion, and Mr. Tran Ngoc Nhat is currently the General Director and legal representative. Previously, this position was held by Mr. Nguyen Van Hoang and Mr. Tran Viet Bao Hoang.

Hoan Cau Company Limited is the legacy of the late businesswoman Tu Huong and her husband, Mr. Nguyen Chan, established in 1993. After some changes, the ownership structure and the position of Chairman of the Board of Directors were transferred to several individuals, including Ms. Tu Huong, Mr. Nguyen Quoc Cuong, and Mr. Phan Dinh Tan. The position of General Director was also held by Mr. Phan Dinh Tan, Mr. Nguyen Quoc Cuong, and Ms. Nguyen Thi Xuan Thuy (daughter of Ms. Tu Huong and Mr. Chan).

Currently, Hoan Cau is chaired by Mr. Phan Dinh Tan, who is also the General Director. The company has a charter capital of VND 1,170 billion, with Mr. Tan holding 99% and Ms. Nguyen Ton Nu Nhu Hoang holding 1%.

Mr. Tan personally holds over 20 million NAB shares, equivalent to 1.891% of the capital. He also served as Chairman of the NAB Board of Directors, replacing Mr. Toan, in 2015.

Thus, the ownership percentage of Mr. Toan and related parties (Pacific Dragon, Mr. Nguyen Vu Hoang, Ms. Nguyen Thi Xuan Thuy, Hoan Vu Sai Gon, Hoan Cau, and Mr. Phan Dinh Tan) currently accounts for nearly 27% of Nam A Bank’s charter capital.

Mr. Nguyen Quoc Toan, former Chairman of Nam A Bank

|

Mr. Nguyen Quoc Toan was elected Chairman of the Board of Directors of Nam A Bank in 2014 but unexpectedly left the position a year later, only to return in 2016.

In June 2019, Mr. Toan officially announced his resignation as Chairman of Nam A Bank and authorized the Vice Chairman to handle matters at the bank while he focused on resolving some issues related to family disputes. Thus, after more than five years since that announcement, Mr. Toan has officially left the bank’s leadership.

Despite no longer holding executive powers, Mr. Nguyen Quoc Toan and related parties still hold a large number of Nam A Bank shares.

The company used 25 million NAB shares to issue VND 200 billion in bonds

Pomina Steel (POM) addresses delayed financial report submission, pledges to meet deadline to avoid delisting

Pomina has implemented measures to address the delay in completing the audit report and is committed to preventing any risks from occurring in meeting the deadline for submitting the 2023 audit report.