Rose Valley Urban Area Project Perspective.

According to the Hanoi Stock Exchange, Dragon Village Joint Stock Company has just announced its financial statements for the first six months of 2024.

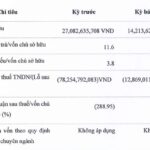

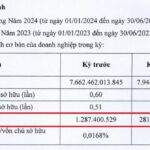

As of June 30, 2024, the company’s equity stood at nearly VND 1,000 billion, only 25% of the figure from the previous year, which was nearly VND 4,030 billion.

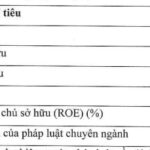

For the first half of 2024, Dragon Village reported a net profit of over VND 68.8 billion, nearly 3.9 times higher than the same period last year. As a result, the return on equity (ROE) also increased from 0.44% to 7.13%.

The debt-to-equity ratio was 6.73, corresponding to a debt of VND 6,720 billion at the end of the second quarter of 2024. Of this, bond debt stood at VND 2,800 billion.

The bond debt comprises five lots of bonds, from DVLCH2124001 to DVLCH2124005. In the first half of 2024, the company paid VND 194 billion in interest on these five bond lots.

It is known that the above five bond lots of Dragon Village were issued in 2021 and 2022, with interest rates ranging from 10.5% to 11%.

According to Decision No. 1310/2023/QD-HDQT dated October 13, 2023, of Dragon Village, the company approved the change in the maturity term in the issuance plan of the DVLCH2124005 bond lot.

Specifically, the bond term was changed from 36 months to 60 months. As a result, the maturity date of this bond lot was extended by two years, from January 11, 2025, to January 11, 2027.

Also, on October 13, 2023, Dragon Village issued Decision No. 1310-1/2023/QD-HDQT, approving the change in the term of four bond lots from 36 months to 60 months. After the change, these bond lots will mature in September, October, and November 2026.

Regarding Dragon Village, the company was established in May 2014 under the name Phu An Khang Real Estate Joint Stock Company. According to a registration change in February 2015, Phu An Khang had a capital of VND 6 billion, comprising three shareholders: Pham Thi Van Ha (40%), Nguyen Thi Hau (30%), and Pham Thuy Hong (30%).

In April 2016, the company’s capital increased significantly to VND 440 billion. At this time, the ratio of the three founding shareholders decreased, with Ms. Pham Thi Van Ha holding 15.727%, Ms. Nguyen Thi Hau 17.045%, and Ms. Pham Thuy Hong 0.409%. The remaining 66.8% belonged to other undisclosed shareholders.

In August 2016, Mr. Nguyen Ngoc Thang took on the role of General Director and legal representative of the company. However, in May 2017, this position was assumed by Mr. Nguyen Dang Duy Hai (born in 1973).

Not long after, the company changed its name from Phu An Khang Real Estate to Dragon Village Real Estate Joint Stock Company.

In July 2022, Mr. Nguyen Khanh Trung (born in 1971) replaced Mr. Hai as the General Director and legal representative of the company.

As of the end of 2023, the company’s charter capital was VND 1,200 billion.

Dragon Village is known to be a major shareholder of Vinh Son Joint Stock Company, the investor of the Rose Valley Urban Area Project. This project has a scale of 75.71 hectares and is located in Tien Phong commune, Quang Minh town, Me Linh district, and Nam Hong commune, Dong Anh district, Hanoi.

The expected total investment capital of the project, pending approval by the Board of Directors of Vinh Son, is VND 11,873 billion (estimated in 2019). The implementation progress is expected to span from 2019 to 2029 and is divided into five phases.

The Real Estate Company in District 7 Reports a Surge in Half-Yearly Profits, a Whopping 100 Times More Than Last Year’s Annual Figures.

In a surprising turn of events, amidst a subdued real estate market, a real estate company in District 7, Ho Chi Minh City, has recorded extraordinary financial results. The company’s performance for the first half of the year far exceeded expectations, with profits soaring to over 100 times their full-year 2023 earnings. This remarkable achievement has caught the attention of industry experts and stakeholders alike, leaving many wondering about the strategies employed by this company to achieve such remarkable success during a period of market stagnation.