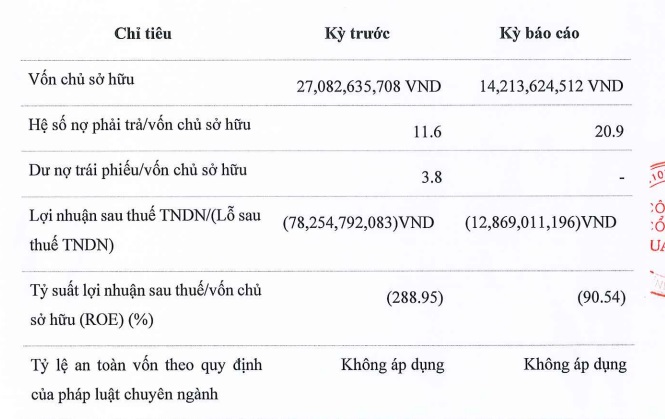

According to the periodic financial report sent to the Hanoi Stock Exchange (HNX), Joint Stock Company Vua Nem experienced a loss of nearly 13 billion VND in the first six months of 2024. However, this loss is only one-sixth of the loss incurred in the same period the previous year (over 78 billion VND).

|

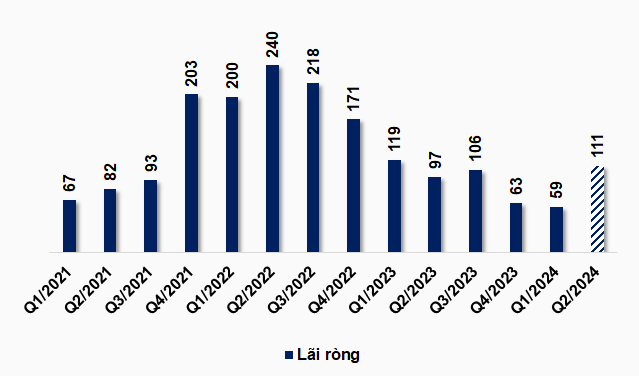

Financial indicators of Vua Nem in the first half of 2024

Source: HNX

|

As of the end of June 2024, owner’s equity decreased significantly from 27 billion VND to over 14.2 billion VND. The debt-to-equity ratio increased sharply from 11.6 times to 20.9 times, corresponding to a total debt of about 300 billion VND.

On a positive note, the bond debt-to-equity ratio decreased from 3.8 times to 0, indicating that the company has cleared its bond debt.

At the beginning of 2024, Vua Nem had one lot of bonds with the code VUNCH2224001 still in circulation. This lot consisted of 1,500 bonds with a par value of 100 million VND each, totaling 150 billion VND in fundraising. The bonds had a term of 2 years and matured on May 26, 2024. Information shows that the company completed the early repurchase of bonds in early May this year.

In late 2023, Vua Nem repurchased 45 billion VND worth of bonds from this lot. In the first half of 2024, the company repurchased the entire lot of bonds ahead of schedule and also completed the interest payment obligation for this lot.

The Vua Nem brand was established in 2007 by Mr. Hoang Tuan Anh and Nguyen Vu Nghi from the Dem.vn e-commerce project. The legal entity, Joint Stock Company Vua Nem, was established in August 2017. In 2018, the company welcomed a strategic investor, Mekong Enterprise Fund III. The two brands, Dem.vn and Vuanem.vn, were also consolidated into one brand, Vua Nem, with a new e-commerce website.

Currently, the company has 153 stores nationwide, with a charter capital of nearly 280 billion VND. The legal representative is Mr. Hoang Tuan Anh.

The Pork Entrepreneur: G Kitchen’s Profitable First Half

The financial report submitted to the Hanoi Stock Exchange (HNX) reveals that Greenfeed Vietnam JSC has had a prosperous first half of the year, with profits in the hundreds of billions of dong.