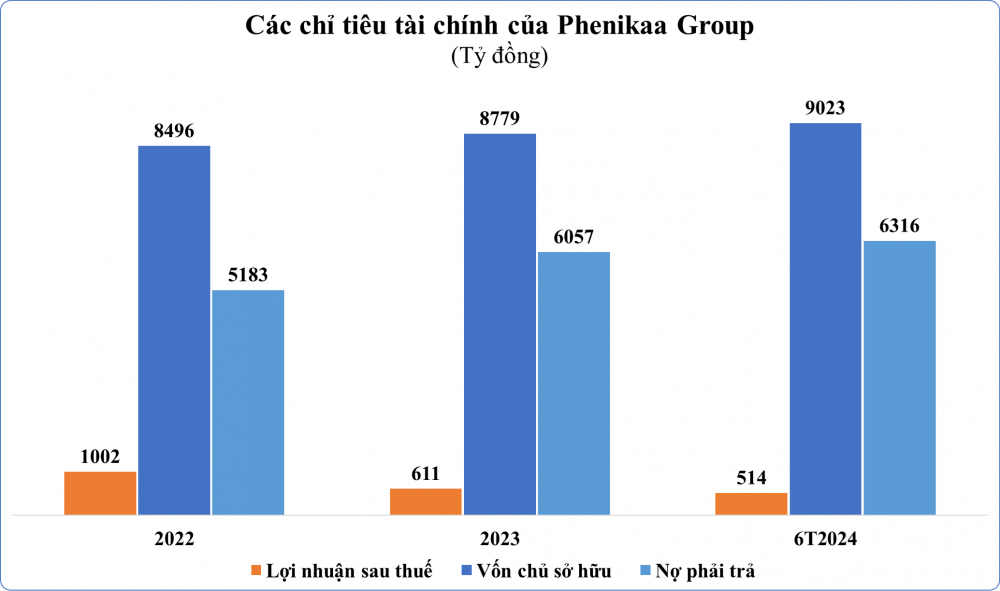

Phenikaa Group, a prominent Vietnamese conglomerate, has released its financial report for the first half of 2024, boasting impressive results. The group’s consolidated after-tax profit reached nearly VND 514 billion, a significant increase of 31.5% compared to the same period in 2023. The after-tax profit ratio to equity (ROE) also improved, rising to 5.78% from 4.54% year-over-year.

This positive trajectory marks a rebound from the previous year’s performance, as Phenikaa Group’s after-tax profit had declined by 39% in 2023 compared to 2022, resulting in a drop in the ROE from 12.06% in 2022 to 7.08% in 2023.

As of June 2024, the company’s equity stood at VND 9,023 billion, reflecting a modest 3.3% increase compared to the same period last year.

The debt-to-equity ratio also witnessed a slight increase from 0.6 to 0.7. Notably, the group’s bond debt exceeded VND 900 billion, representing 0.1 times the equity.

The bond debt incurred by Phenikaa Group originated entirely in 2023, following the issuance of two bond lots, PKACH2330001 and PKACH233002, on December 14, 2023, with a total face value of VND 900 billion. These bonds share a seven-year maturity, with respective interest rates of 6.2% and 5.87% per annum.

Vicostone, a key enterprise within the Phenikaa Group ecosystem founded by entrepreneur Ho Xuan Nang, reported strong results for the first half of the year. The company recorded a gross revenue of VND 2,248 billion and an after-tax profit of VND 456 billion, representing year-over-year increases of 3.5% and 9.9%, respectively.

Established in October 2010, Phenikaa Group is currently headquartered in Trung Hoa Ward, Cau Giay District, Hanoi. The company commenced operations with a chartered capital of VND 100 billion, with its founding shareholders being Nghiem Thi Ngoc Diep (99%), Pham Hung (0.5%), and Pham Thi Thu Hang (0.5%).

In February 2017, Phenikaa increased its chartered capital to VND 1,600 billion, and in December of the same year, it was further raised to VND 2,100 billion. The company’s capital continued to grow, reaching VND 3,000 billion in August 2019, and has remained at that level ever since. Ho Xuan Nang currently serves as the Chairman of the Board of Directors and legal representative of Phenikaa Group.

Over the years, the conglomerate has expanded its ecosystem to include over 30 member units operating in key sectors such as technology, industry, and scientific research. Vicostone, in particular, has been instrumental in establishing Ho Xuan Nang’s reputation and propelling him into the ranks of Vietnam’s stock market tycoons.

As of June 2024, Phenikaa Group held over 134.6 million VCS shares, equivalent to 84.15% of Vicostone’s charter capital. Additionally, Ho Xuan Nang directly owned 5.98 million VCS shares, representing a 3.74% stake.

Beyond Vicostone, Ho Xuan Nang’s business interests extend to various other enterprises, including Phenikaa University, Phenikaa Education Investment Joint Stock Company, Phenikaa Certification and Testing Joint Stock Company, and Phenikaa Electronics Joint Stock Company, among others.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.