Hanoi police have charged seven individuals with manipulating the stock market by trading CMS shares of CMH Vietnam Group JSC.

According to the allegations, Tran Binh Minh and Nguyen Hoang Thi were the ringleaders. The group also included accomplices such as Phung Tien Thanh, Ha Duc Dat, Tran Ngoc Son, Tran Ba Tuan, and Le Xuan Cao.

Minh allegedly employed a scheme of buying CMS shares at low prices, driving up their value, and then selling them for profit. Thi and the other five individuals used chat groups on Zalo and Telegram to discuss stocks and make recommendations, including on CMS, to influence investors’ decisions and impact stock prices.

Between May 2023 and October 2023, when CMS shares peaked, the group made profits of over VND 10 billion, with Minh alone earning VND 5.5 billion, according to the State Securities Commission.

Tran Binh Minh: Founder of investment and real estate channels with over 1 million followers, self-proclaimed “master” with 18 years of experience

Image: The self-proclaimed “master” sharing on his YouTube channel.

Notably, Minh had previously organized investment courses and proclaimed himself a “master.” Specifically, Tran Binh Minh, born in 1982, is a resident of Thuong Dinh ward, Thanh Xuan district, Hanoi. He is an active member of the stock and real estate investment community, frequently posting videos on two YouTube channels with a combined following of over 1 million.

For instance, one of his channels, focusing on finance, has over 100,000 subscribers. Established in June 2018, it has uploaded 122 videos with a total of over 4.1 million views as of August 30, 2024.

On YouTube, Minh also consistently uploads videos (on a separate channel created in June 2019) with over 924,000 followers, dedicated to finance and real estate. Here, he introduces himself as the channel’s founder, sharing attractive investment opportunities and experiences with anyone aspiring to succeed in business and achieve financial freedom. He also claims to have 18 years of practical experience, gained through hard work, dedication, and even tears, as shared candidly on his channel.

In addition to these two channels, the KTC community founded by Minh is also present on other social media platforms like Facebook and Network X, and it previously had its own website. However, as of August 30, the website was inaccessible.

Along with the term KTC, according to the criminal investigation agency, Minh established the “Internal KTC Brothers” chat group to disseminate specific content for each person to post on various groups.

As trust in “master” Minh and the KTC community grew, they organized offline events and site visits to different localities. These gatherings were then shared on social media channels, attracting more and more members.

CMS Chairman had previously warned about the abnormal surge in stock prices

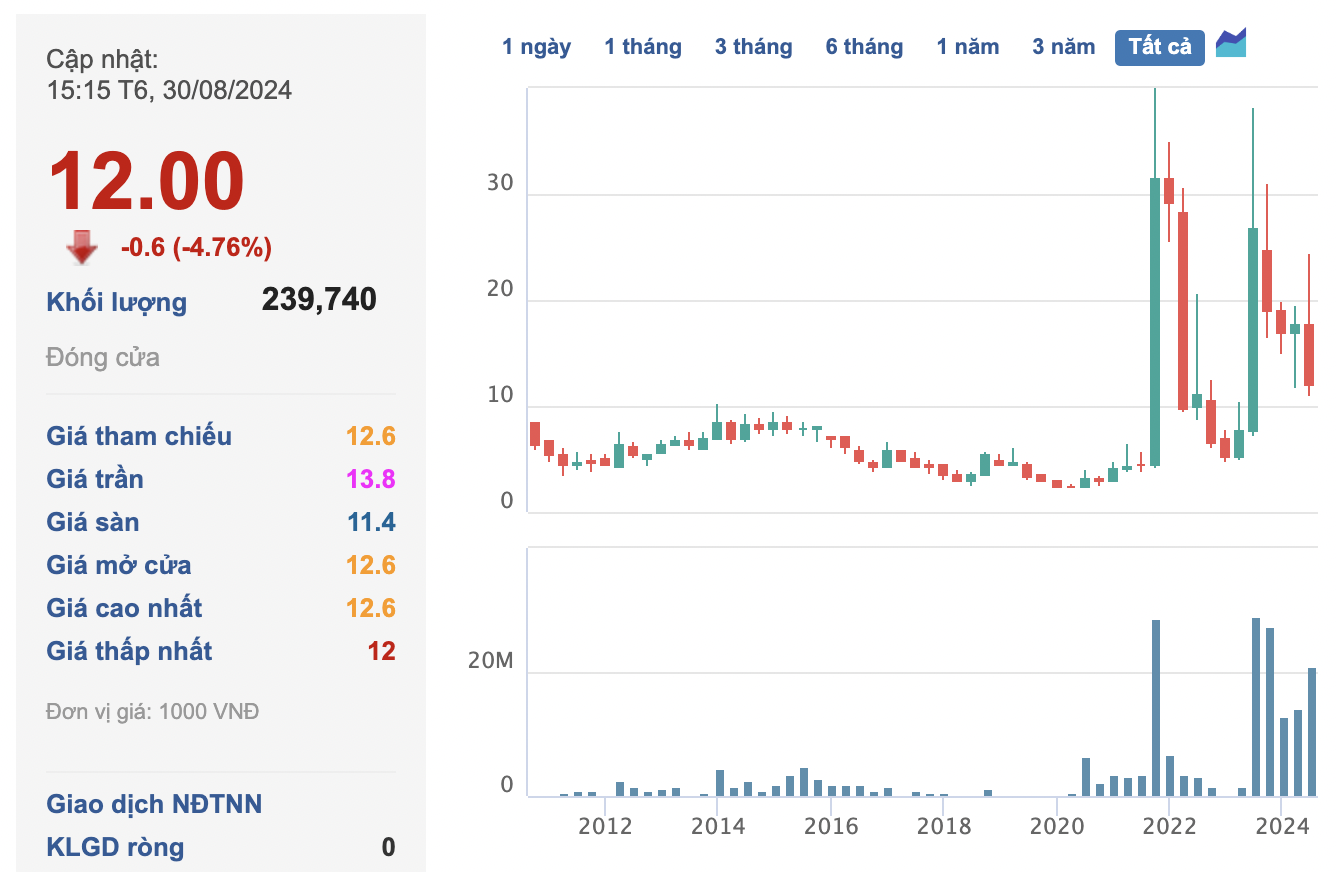

Returning to the topic of CMS, the stock unexpectedly surged in mid-2023. Notably, between August 29 and September 8, 2023, CMS rose 66% in just one week, with prices soaring from VND 12,000/share to VND 19,900/share and liquidity reaching millions of shares per session.

In late September 2023, CMS shares again surged dramatically to VND 30,000/share, representing a 500% increase from the bottom.

During the period when CMS shares hit consecutive ceiling prices (August 31 to September 8, 2023), CMH Vietnam Group issued an explanation stating that stock price fluctuations entirely depend on market supply and demand, as well as investor preferences and needs.

The company affirmed that its business operations were normal, with no significant changes or influences on trading prices.

“Regarding CMS, if I were a small investor with limited funds, I wouldn’t buy at this time. As I mentioned earlier, CMS’s business operations are normal, without any significant changes, but the stock price movement seems abnormal”, the company’s chairman once warned.

Image: The company’s chairman once warned about the abnormal surge in stock prices.

However, this was not the first time the stock had surged dramatically in a short period. CMS previously attracted market attention with a price increase from VND 5,100/share to VND 37,500/share between October 27 and December 8, 2021, representing a more than sevenfold rise in less than two months.

During this period, several company leaders and insiders registered to sell millions of CMS shares. Conversely, Nguyen Duc Huong, the former chairman of a bank, bought 3.7 million CMS shares, matching the number sold by Phuc, increasing his ownership to 24.9% of the charter capital.

According to data from the Hanoi Stock Exchange (HNX), on December 10 and 13, 2021, the market also recorded the transfer of 3.7 million CMS shares through matching transactions, with a total value of VND 113.1 billion.

After becoming a major shareholder, Huong was elected to the CMS Board of Directors at an extraordinary general meeting on December 22, 2021, upon Phuc’s nomination. However, in the subsequent private placement, Huong did not participate, causing his ownership to drop to 16.83%, although he remained CMS’s largest shareholder.

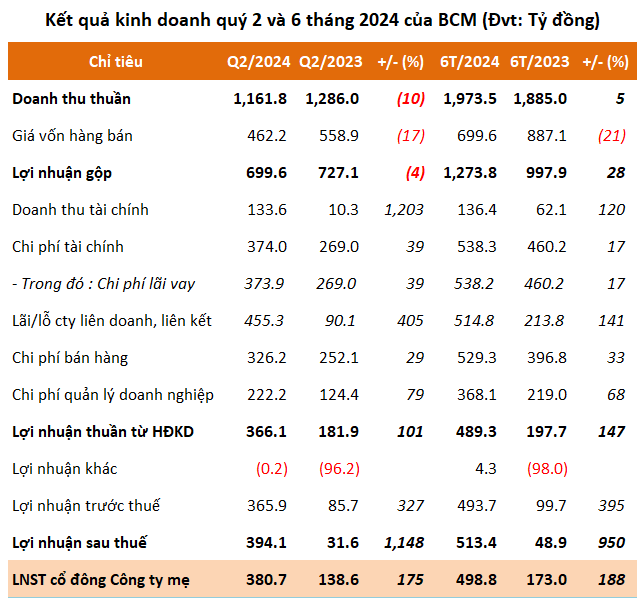

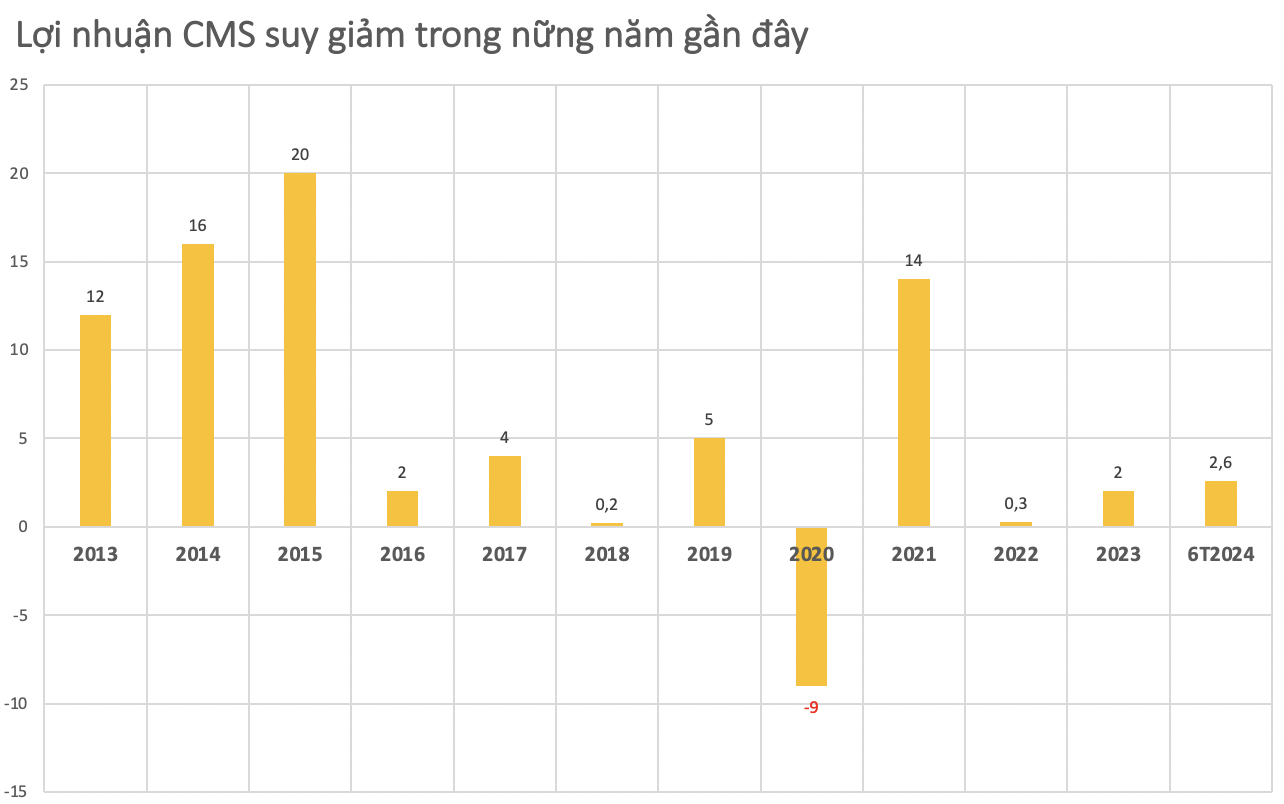

CMS’s profits have declined significantly since 2016, falling from tens of billions to just a few billion dong

Regarding CMS, the company was previously known as Cavico Manpower Supply JSC, established by founding shareholders, including Cavico Bridge and Tunnel Construction JSC, other companies in the Cavico system, and individual shareholders, with initial charter capital of VND 6 billion.

In 2014, CMS transformed its business model, increasing its charter capital from VND 50 billion to VND 80 billion and shifting from an international labor contracting model to an international construction contracting model by signing and implementing the Xepian Xenamnoy hydropower project contract in Laos with SK E&C of South Korea.

Currently, the company’s charter capital stands at VND 254.5 billion. CMS has been listed on the HNX since 2010. Contrasting with the “explosion” in stock prices, the company’s performance in recent years has consistently declined.

While CMS achieved growth in the 2010-2015 period, with revenues in the hundreds of billions and profits in the tens of billions, its profits have plummeted since 2016, ranging from just hundreds of millions to a few billion dong.

In the first half of 2024, CMS recorded revenues of VND 62 billion, triple that of the previous year, mainly due to increased construction revenues. After deducting expenses, the company’s net profit was VND 2.6 billion.

Image: CMS’s financial performance from 2013 to 6/2024 (VND billion)

As of June 30, 2024, the company’s total assets exceeded VND 430 billion, with short-term receivables of VND 218 billion and inventory of over VND 125 billion accounting for the largest proportions. CMS’s liabilities stood at VND 152.5 billion.

Securities Authorities Charge Seven in Scheme to Manipulate CMS Stock

To manipulate the price of CMS stock, the group led by Tran Binh Minh employed multiple securities accounts to buy and sell the CMS stock. They aimed to create a false sense of liquidity and volume, enticing unsuspecting investors to join the scheme. This orchestrated effort allowed the group to control the stock’s price movement, creating an illusion of stability and potential growth.

Charging Seven Individuals for Manipulation of CMS Stock Code

The Hanoi Police Investigation Agency has initiated legal proceedings and charged seven individuals with market manipulation in relation to the CMS stock of CMH Vietnam Group Joint Stock Company (HNX: CMS).