Dung Quất Refinery Upgrade and Expansion Plan

The Dung Quat Refinery, located in the Dung Quat Economic Zone, is Vietnam’s first oil refinery. This project is situated in Binh Thuan and Binh Tri communes, Binh Son district, Quang Ngai province. Binh Son Refining and Petrochemical Joint Stock Company (BSR) is assigned to receive, manage, and operate the Dung Quat Refinery.

However, after nearly 15 years of operation, the quality of BSR’s products only meets Euro II and III emission standards, which is lower than the government’s proposed roadmap for environmental protection. Therefore, upgrading the refinery is necessary. With this project, BSR can enhance the quality of its products and diversify its crude oil sources.

Panorama of Dung Quat Refinery.

Last March, BSR announced information about the Decision to approve the adjustment of the Dung Quat Refinery Upgrade and Expansion Project.

Accordingly, the Dung Quat Refinery will be invested to increase its processing capacity from 148,000 barrels/day to 171,000 barrels/day, with products meeting Euro V standards and environmental standards according to the mandatory roadmap of the Government. It will also enhance the flexibility to choose crude oil, ensuring a long-term and efficient supply of crude oil for the refinery.

“We believe that this project will be a growth driver for BSR in the long term, given the context of increasing demand for petroleum products in Vietnam, while the Nghi Son Refinery often encounters technical problems,” said MB Securities Company (MBS).

The total investment for the project is VND 36,397 billion (equivalent to USD 1.489 billion). The implementation time for this upgrade and expansion is 37 months from the date of signing the EPC contract, and the goal is to put the Project into operation in 2028.

How does BSR arrange capital?

In the enterprise analysis report by ACB Securities Company (ACBS), it is known that due to the difficulty in accessing capital for the project, BSR will consider and adjust the increase in the rate of ownership capital suitable to the actual capital balance to ensure the rate of ownership capital for the project from 40 – 60%.

Accordingly, BSR is reporting to the Vietnam Oil and Gas Group to consider and submit to the competent authority for approval of the plan to increase BSR’s charter capital from 31 to 50 thousand billion (paying dividends in shares) in Official Letter No. 009/BSR-NDD dated February 01, 2024. The loan capital (expected to be about 40%-60%) will be arranged from ECA loan sources, domestic and international commercial loans, green bonds, and other suitable and feasible sources.

BSR’s total Owners’ Equity at the end of Q2/2024 was VND 56,800 billion, including VND 31,000 billion of Charter Capital. The current scale of Owners’ Equity ensures that BSR can use all investment and development funds and profits to increase charter capital as planned through dividend payment in shares.

“However, we do not rule out the possibility that BSR may raise capital by private issuance and reduce PVN’s ownership rate from the current 92% to a level that still ensures a controlling rate (>65%)”, ACBS said.

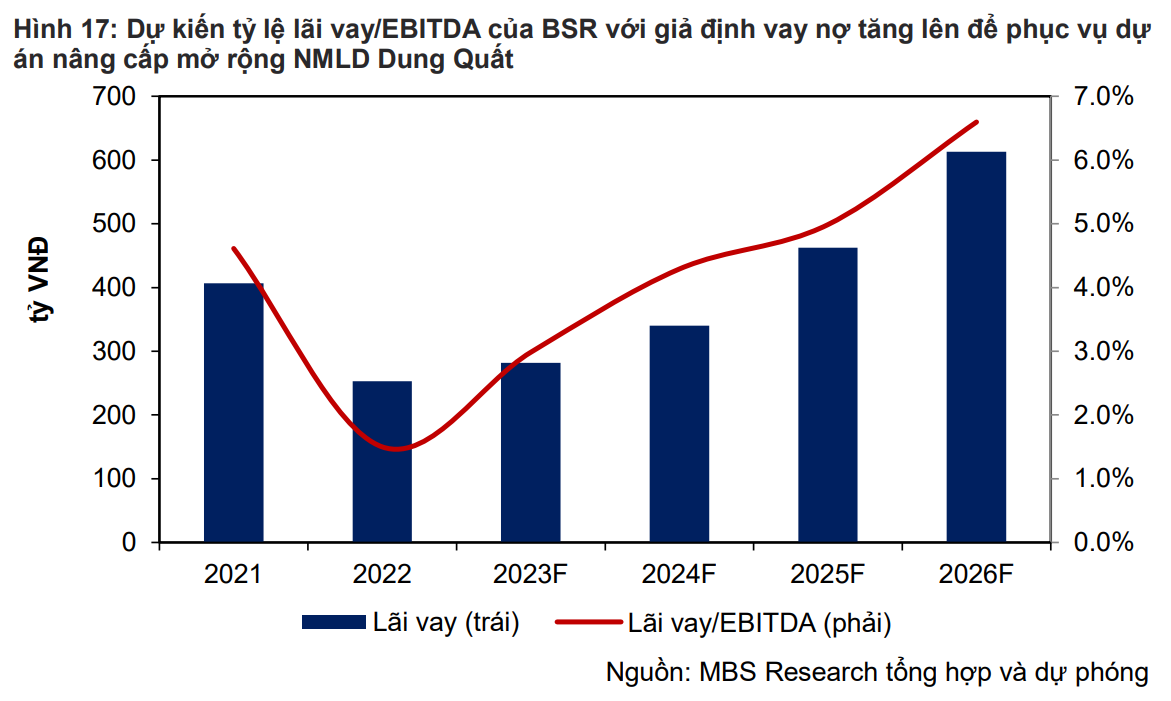

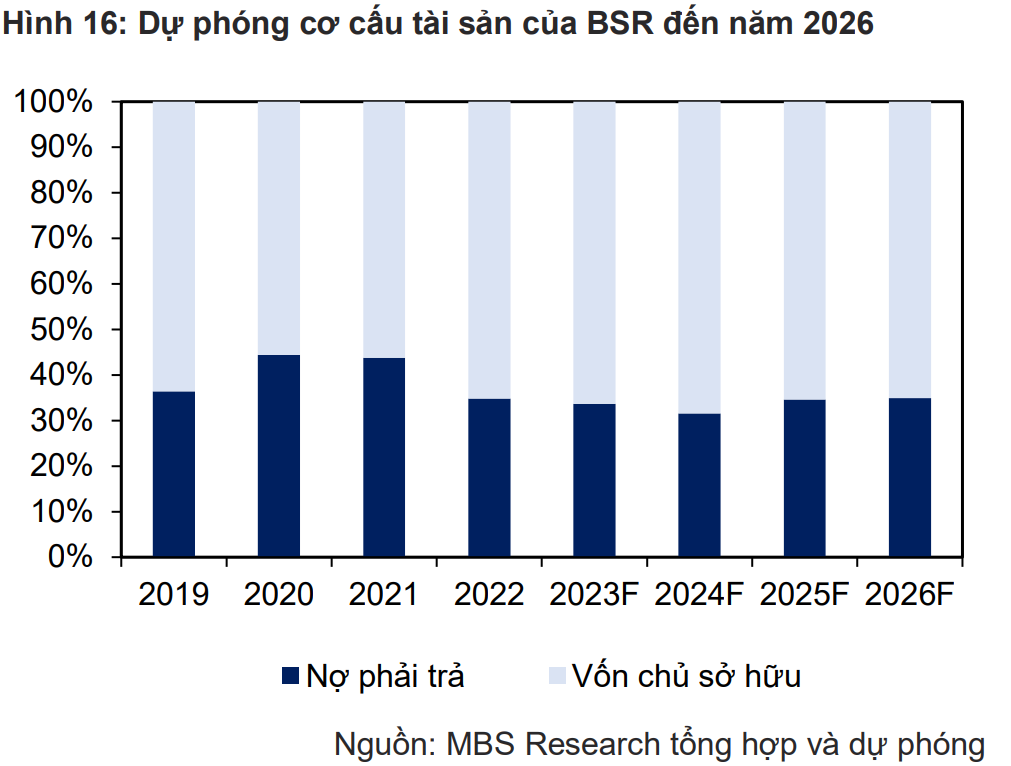

Meanwhile, according to MBS’s assessment, it is expected that BSR will spend more than VND 6,000 billion annually on this project from 2024, and the cost will peak in the period of 2025 – 2026. Although projected borrowing increases gradually in the period of 2024 – 2026, causing interest expenses to increase, MBS believes that the ratio of Total Liabilities/Total Assets of BSR will continue to be maintained at below 40% due to high retained earnings.

In MBS’s scenario, the NCMR project of the refinery will be completed in 2028, and the entire value of the construction in progress item will be transferred to fixed assets at this time.

Regarding the project’s prospects, MBS said: “We expect that after completing the upgrade and expansion of the refinery, BSR will improve its oil refining revenue and increase profits by providing oil refining products that meet Euro 5 emission standards for the domestic market.”

“Currently, the Nelson Complexity Index (NCI) of BSR is at 6.27, which is relatively low compared to other refineries in the region. After the project is completed in early 2028, Dung Quat’s NCI is expected to increase to over 8.0 thanks to more flexibility in crude oil processing and optimization of the product portfolio.”

Regarding business activities, in the first six months of the year, BSR recorded a revenue of VND 55,117 billion (down 18.6%) and a net profit of VND 1,925 billion (down 35.2%). The decrease in output and crack spread were the main reasons for the company’s decline in business performance.

ACBS projects BRS’s business results in 2024 with a revenue of VND 125,540 billion (down 14.8%) and a net profit of VND 5,608 billion (down 34.1%). By 2025, the company’s revenue is expected to reach VND 134,284 billion (up 7%), with a net profit of VND 6,913 billion (up 23.3%), and a gross profit margin of 5%, an increase/decrease of 0.5% compared to 2024 due to no refinery maintenance.

“State Audit: Some of the Mining and Mineral Group’s Investments ‘Conceal Risks’”

The State Audit Office has revealed that the Vietnam National Coal, Mineral Industries Holding Corporation has a number of long-term financial investments that are currently underperforming and pose a financial risk.