The VN-Index ended the week’s final trading session on a positive note, inching up by 2.40 points to 1,283 points as it headed into a four-day holiday break. However, there was a distinct divergence within the large-cap Vn30 group, which rose 4.85 points, while mid-cap stocks fell by 0.31 points. As a result, most sectors managed to stay in positive territory, despite modest gains, with only 202 stocks advancing against 180 decliners.

Banks posted a modest gain of 0.19%, with VCB up 0.22%, TCB climbing 1.52%, and CTG ticking up 0.14%, while BID slipped 0.81%. A similar pattern played out in the real estate sector, which edged up 0.06%, even as Vin stocks VRE, VHM, and VIC closed unchanged. On the other hand, industrial real estate stocks like CBM, SNZ, and SJS saw a healthy bounce.

Most other sectors also ended in positive territory, including materials, food and beverage, telecom services, and energy. Top performers that buoyed the market included TCB, FPT, HVN, VCB, and MWG, while BID led the decliners, with the rest seeing negligible moves.

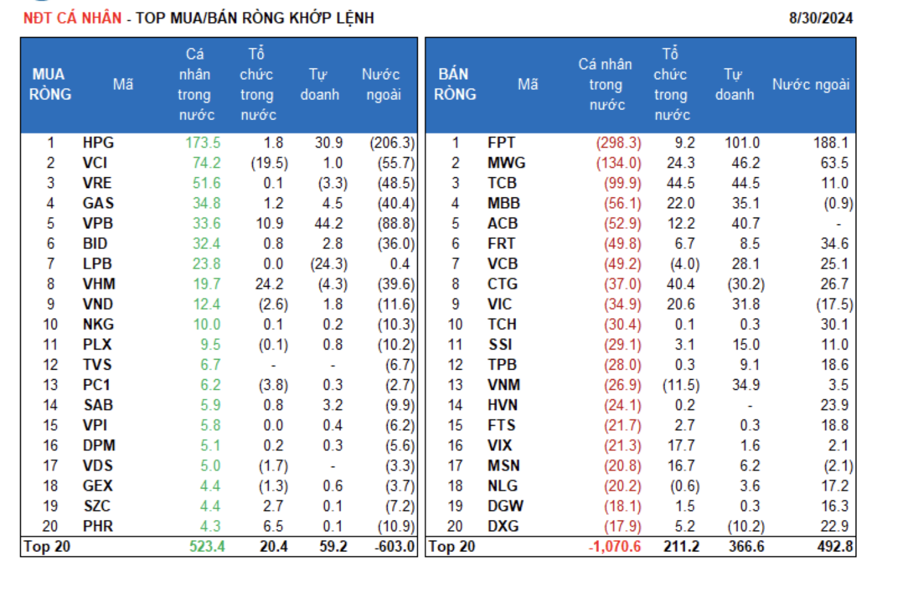

Ahead of the holiday, liquidity across the three exchanges dipped to VND15,200 billion, with foreign investors recording a modest net buy position of VND61.3 billion. Specifically, in matched transactions, they were net buyers to the tune of VND24.4 billion.

Foreign investors focused their net buying on the IT and Retail sectors. Top stocks in their net buy list included FPT, MWG, FUEVFVND, FRT, TCH, CTG, VCB, HVN, DXG, and HCM.

On the other side, they net-sold Basic Resources stocks. HPG, VPB, VCI, VRE, DGC, VHM, BID, HDB, and VIC were among the top stocks in their net sell list.

Retail investors net-sold VND1,491.8 billion, with a net sell position of VND856.0 billion in matched transactions. In these transactions, they net bought in 6 out of 18 sectors, primarily Basic Resources. Their top net buys included HPG, VCI, VRE, GAS, VPB, BID, LPB, VHM, and VND.

In terms of net sells, they offloaded stocks in 12 out of 18 sectors, mainly in the Banking and IT sectors. Top stocks in their net sell list included FPT, MWG, TCB, MBB, ACB, FRT, CTG, VIC, and TCH.

Proprietary traders net bought VND1,066.5 billion, with a net buy position of VND519.4 billion in matched transactions.

In these transactions, they net bought in 14 out of 18 sectors, with Banking and IT stocks leading the way. Top net buys included FPT, MWG, TCB, VPB, ACB, MBB, VNM, HDB, VIC, and HPG.

Financial Services stocks were the top net sells. FUEVFVND, CTG, LPB, PDR, DXG, HCM, NVL, VHM, VRE, and GVR were among the top stocks in their net sell list.

Local institutions net bought VND360.1 billion, with a net buy position of VND312.2 billion in matched transactions.

In these transactions, they net sold in 4 out of 18 sectors, with Financial Services stocks seeing the largest net sell position. Top net sells included VCI, VNM, FUESSVFL, DIG, FUEVFVND, SHB, VCB, PC1, HCM, and VND.

On the buying side, they focused on Banking stocks. DGC, TCB, CTG, MWG, VHM, MBB, VIC, VIX, and MSN were among their top net buys.

Block trades today totaled VND1,632 billion, up 11.6% from the previous session, contributing 10.8% to the overall value.

Noteworthy block trades included EIB and PC1, with local institutions on the buy side and domestic individuals on the sell side.

Additionally, there were block trades between domestic individuals in HDB, MWG, KOS, HVN, and MSN.

In terms of money flow allocation, there was an increase in Real Estate, Chemicals, Steel, Food, Retail, IT, Textiles, and Aviation, while a decrease was seen in Banking, Securities, Agricultural & Seafood, and Electricity. Specifically, in matched transactions, money flow allocation increased in mid-cap VNMID and small-cap VNSML stocks while decreasing in large-cap VN30 stocks.