The U.S. Dollar Index (DXY) rose by 1.05 points over the week to 101.73. This increase was driven by the latest initial jobless claims report from the U.S. Department of Labor, which indicated a decrease in the number of Americans filing for unemployment benefits.

Specifically, initial jobless claims for the week ending August 24 stood at 231,000, slightly lower than the expected 232,000 and down from the previous week’s revised level of 233,000. This positive development eased concerns about an economic recession, subsequently reducing expectations of a Federal Reserve interest rate cut.

Fed officials have recently indicated that they are paying closer attention to the labor market as inflationary pressures have started to ease. Chairman Powell stated last week that monetary policymakers “do not want to see a further cooling of the labor market.”

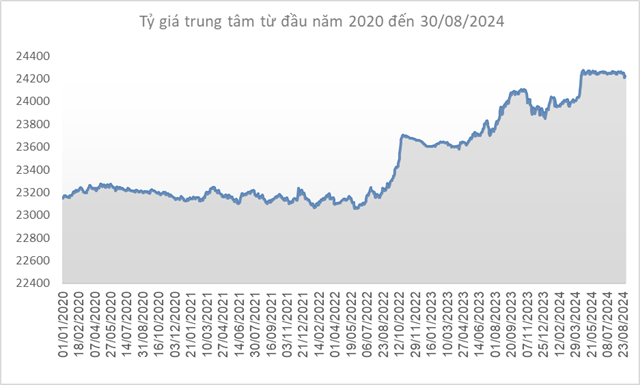

Source: SBV

|

Domestically, the Vietnamese Dong-USD mid-point exchange rate decreased by 29 VND/USD compared to the previous week (August 23), settling at 24,221 VND/USD on August 30, 2024.

The State Bank of Vietnam (SBV) kept the immediate buying rate unchanged at 23,400 VND/USD. Additionally, the selling rate remained at 25,450 VND/USD since April 19. This is the intervention selling price at which the SBV offers USD to commercial banks with negative foreign currency positions to bring their positions back to zero.

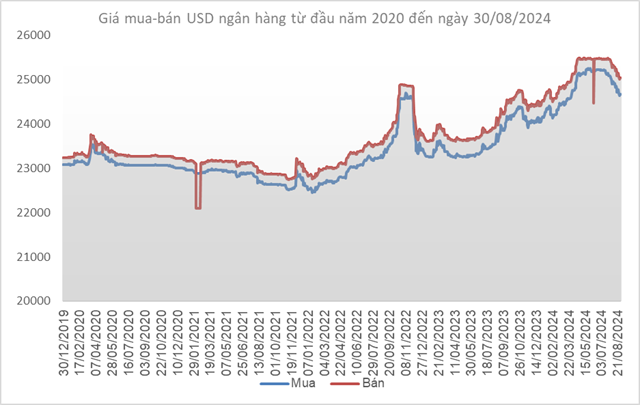

Source: VCB

|

Vietcombank’s posted exchange rate was 24,660-25,030 VND/USD (buy-sell), a decrease of 120 VND/USD on both sides. This marks the fifth consecutive week of declining USD bank rates, with a total decrease of 431 VND/USD on both sides.

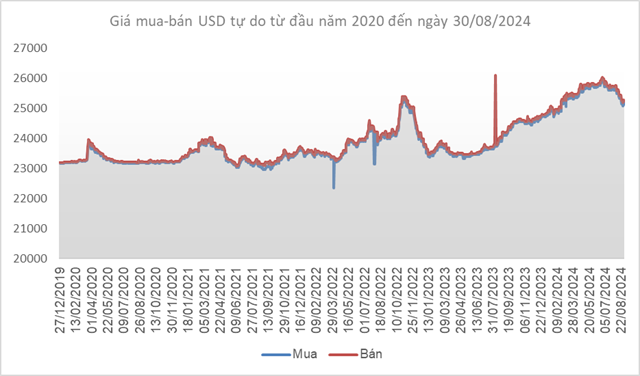

Source: VietstockFinance

|

In contrast, the USD/VND exchange rate in the free market increased by 70 VND/USD on the buying side and 20 VND/USD on the selling side, reaching 25,220-25,270 VND/USD (buy-sell). This ends a five-week streak of declines for the free-market USD rate.

Khang Di

The Heiress and Senior Executive of Phat Dat Want to Sell Millions of PDR Shares

PDR stock is currently down 14% since the beginning of 2024. A concerning decline, but a potential opportunity for savvy investors to enter a promising market. With a strategic approach, this stock could offer a unique entry point and a chance to diversify. A well-timed investment could see a significant rebound, offering a profitable future for those willing to take a calculated risk.