Retailers Rake in Massive Profits

One of the largest foreign-invested multi-sector retailers in Vietnam, Central Retail’s financial results for the first six months of 2024 in the Vietnamese market recorded a revenue of 132.4 billion bath, equivalent to approximately 96,900 billion VND, a 5% increase compared to the same period. Pre-tax profit was 5.3 billion baht, equivalent to nearly 4,000 billion VND.

Currently, Central Retail owns a vast retail system with Central Food Hall, Tops Market, Go!, Mini Go!, Nguyen Kim, and Lan Chi mart…

The retail market has been very vibrant recently (Photo: Can Dung)

Another foreign retail system that is performing well in Vietnam is AEON. According to the recently published financial report for the first quarter (March 1 – May 31), Japanese retailer AEON recorded operating revenue in the Vietnamese market of more than 4 billion yen, equivalent to more than 640 billion VND, up 13.8% over the same period last year. Thus, on average, this Japanese retailer earns about 7 billion VND per day in Vietnam.

Aeon currently has 6 shopping centers opened in Vietnam, including Tan Phu Celadon and Binh Tan in Ho Chi Minh City, Ha Dong and Long Bien in Hanoi, Hai Phong Le Chan in Hai Phong, and Binh Duong Canary in Binh Duong, with a total rental area of 411,000 m2.

In the second half of 2024, AEON is expected to operate a shopping center in Hue with a total floor area of 86,000 m2. With a total investment of approximately US$169.67 million.

In addition, in the coming time, there will also be more shopping centers named AEON in Dong Nai and Can Tho City.

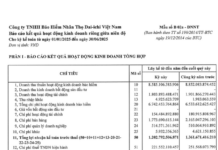

Taking over WinCommerce in 2019 from Vingroup, Masan received skepticism about when it would turn a profit. Founded in 2014, VinCommerce (the predecessor of WinCommerce) was one of the largest store chains in the country, continuously growing in revenue but never reaching the breakeven point. “How to effectively manage a loss-making business?” was a challenging question for Masan.

But after 5 years, the answer is out. The Q2/2024 financial report shows that the WinCommerce chain, including WinMart, WinMart+, and WiN stores, recorded a net profit for the first time. After more than 10 years in the market, effective strategies have helped the largest consumer retail chain in Vietnam become profitable.

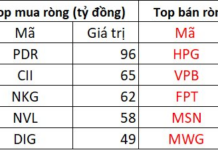

Another unique retail chain is The Gioi Di Dong – a “giant” in the electronics retail industry. In the first seven months of 2024, Mobile World Investment Corporation (stock code MWG) grew by 15% over the same period last year, completing 61% of its full-year business plan.

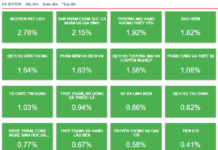

According to the 7-month business results of 2024 announced by Mobile World Investment Corporation, the Dien May Xanh, Bach Hoa Xanh, and The Gioi Di Dong retail chains contributed the main revenue. Specifically, Dien May Xanh contributed the most with 46.2% of total revenue. Bach Hoa Xanh chain ranked second with 30.1%, The Gioi Di Dong contributed 20.9%, and other business segments contributed 2.8%.

Bach Hoa Xanh also performed well in the past time, with a cumulative revenue of 19,400 billion VND in the first six months of the year, up 42% over the same period. In June alone, this retail chain earned 3,600 billion VND in revenue, up nearly 5% from the previous month, with an increase in both main product lines of fresh food and FMCGs. Notably, in June, Bach Hoa Xanh set a record average revenue of 2.1 billion VND/store/month.

Many New Stores to Open Soon

According to the General Statistics Office, in the first seven months of 2024, the total retail sales of goods and service revenue was estimated at VND 3,625.7 trillion, up 8.7% over the same period last year (in 2023, it increased by 10.6%). If excluding the price factor, it increased by 5.2% (in 2023, it increased by 9.8%).

The positive signal in the retail market encourages enterprises to expand new retail distribution channels. Recently, the Saigon Trading Group – One Member Limited Company (SATRA) said it is rushing to complete the final steps to put the SATRA Trade Center on Vo Van Kiet Street (Centre Mall Vo Van Kiet) into operation soon. According to SATRA, this is the third trade center and also the largest one of the enterprise after Centre Mall Pham Hung and Centre Mall Cu Chi.

Regarding this project, Ms. Pham Thi Van, Deputy General Director of SATRA, said that the SATRA Trade Center on Vo Van Kiet Street has a construction floor area of nearly 30,000 m2, with six floors and one basement. It is the largest trade center project in the SATRA retail chain. This is a shopping mall complex with perfect utilities for families, such as Satramart supermarket, restaurants, movie theaters, children’s playgrounds, education centers, vaccination centers, and shopping stores…

At the end of July, Vincom officially inaugurated two new trade centers: Vincom Mega Mall Grand Park in Ho Chi Minh City and Vincom Plaza Bac Giang in Bac Giang city.

Previously, Vincom also launched Vincom Dien Bien Phu and Vincom Ha Giang. With the consecutive opening of four new trade centers within 30 days, Vincom Retail has raised the total scale of the entire system to 87 trade centers in 47 provinces and cities, affirming its leading position in the market by offering unique shopping, dining, and entertainment experiences to its customers.

According to Savills Vietnam, in each market, such as Ho Chi Minh City and Hanoi, there are about 1.5 million m2 of leasable retail space, maintaining an occupancy rate of over 90% for many years, indicating that large-scale trade centers remain attractive.

Savills Vietnam informs that investing in large-scale trade centers is attracting the interest and resources of many domestic and foreign investors. For domestic investors, the most significant advantage is their understanding of consumers and their existing land fund. Conversely, foreign investors also have their strengths and strategies, such as Aeon and Central Retail, which are long-standing and reputable retail investors in the region. When entering the Vietnamese market, they maintain their strengths.

Talking to the Vietnam Industry and Trade Newspaper, economic expert Vu Vinh Phu said that regardless of the form, retail businesses need quality products and good after-sales service. Experience from large retailers shows that they invest heavily in customer care services and integrate many utilities such as dining, entertainment, and movies with shopping. This is why these retail channels remain resilient and successfully conquer Vietnamese consumers.

“Breaking News: Nguyen Duc Tai Delights The Gioi Di Dong Shareholders as Market Capitalization Surpasses VND 100,000 Billion Mark: July Revenue Surges, and 2025 Outlook Remains Positive”

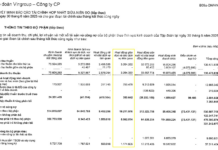

Reviewing the first half of the year, The Gioi Di Dong (Mobile World) – one of the leading retailers in Vietnam – reported impressive financial results with revenue reaching VND 65,621 billion and after-tax profit reaching VND 2,075 billion, up 16% and a staggering 5,200% year-on-year, respectively.

The Rental Landscape: The Slow Revival and the Uncertain Throne

In a challenging economic climate, the rental property market is experiencing a contrasting shift: street-front retail and commercial spaces are painting a picture of divergence.