In August, most banks released their semi-annual financial reports for 2024, revealing interesting figures about the incomes of their executives and employees.

The financial industry boasts relatively high incomes compared to other sectors. (Photo: Đ.V)

Techcombank takes the lead in employee compensation, with an average monthly salary of 53 million VND, an increase of 9 million VND compared to 2023.

Vietcombank, the champion in profitability, ranks second in employee compensation. On average, each Vietcombank employee earns nearly 38 million VND per month.

TPBank and HDBank occupy the third and fourth positions, respectively. TPBank offers an average monthly salary of nearly 37.8 million VND, while HDBank provides almost 37.4 million VND.

The next four banks all maintain average employee salaries above 33 million VND per month. Specifically, Vietinbank ranks fifth with an average salary of 33.95 million VND, followed by BIDV in sixth place, offering over 33.8 million VND.

Sacombank secures the seventh position with an average monthly salary of 33.2 million VND. MSB ranks eighth, providing its employees with an average income of 31.6 million VND per month.

The remaining two spots in the top ten go to VIB and NCB. VIB takes ninth place with an average salary of 31.2 million VND, while NCB rounds out the top ten with an average monthly income of nearly 29.5 million VND.

Other banks, including SeABank, VPBank, KienlongBank, PGBank, Eximbank, NamABank, and OCB, follow suit with average employee salaries ranging from 22.6 to 29.5 million VND per month. Notably, OCB’s average employee income stands at a modest 22.65 million VND compared to its peers.

Executives pocket nearly 820 million VND per month

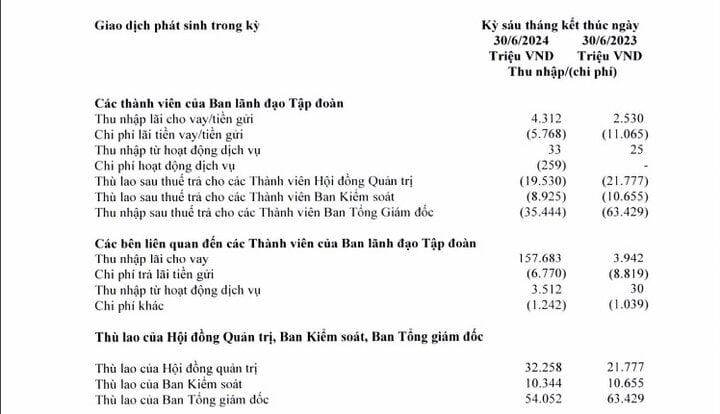

According to Sacombank’s recent semi-annual financial report, the bank disbursed over 96.6 billion VND to its Board of Directors, Executive Board, and Supervisory Board. Specifically, the bank allocated more than 32.2 billion VND to the Board of Directors, over 54 billion VND to the Executive Board, and more than 10.3 billion VND to the Supervisory Board.

As of June 30, Sacombank’s Board of Directors comprised seven members. This equates to an average monthly income of approximately 766 million VND for each board member.

Bank executives enjoy high incomes. (Photo: Dai Viet)

The Executive Board consists of 11 members, resulting in an average monthly income of about 818 million VND per member. The Supervisory Board, comprising four individuals, earns an average monthly income of approximately 429 million VND each.

Sacombank’s 2023 audited financial statements also revealed that the bank is among the highest payers for its Chairman of the Board of Directors. Mr. Duong Cong Minh, the Chairman, received 8.6 billion VND per year (roughly 716 million VND per month).

At VPBank, the recently released mid-term reviewed financial report shows that Mr. Ngo Chi Dung, Chairman of the Board of Directors, earned 1.68 billion VND in the first six months, translating to an average monthly income of approximately 280 million VND. The Vice Chairpersons received 1.56 billion VND, equivalent to about 260 million VND per month. Board members earned around 100 million VND monthly.

The Executive Board of VPBank was compensated with 27.6 billion VND. With a team of nine individuals, this equates to an average monthly income of roughly 255 million VND per person. The three members of the Supervisory Board received a total of 2.5 billion VND, resulting in an average monthly income of approximately 138 million VND for each member.

Eximbank’s Board of Directors, Executive Board, and Supervisory Board received a combined remuneration of over 30.4 billion VND. With a total of 17 individuals in these roles, the average monthly income for Eximbank’s executives stands at nearly 300 million VND.

At other banks, the average monthly incomes of executives vary from 100 to 820 million VND, depending on their positions. Typically, members of the Board of Directors and the Executive Board enjoy higher incomes compared to those in the Supervisory Board.

Why Not Adjust the Average Wage for Pension Calculation in the Amended Social Insurance Law?

“Calculating the average salary for social insurance contributions is pivotal in determining pension formulas, directly impacting the benefits of participants and the equilibrium of the social insurance fund. This intricate process involves a meticulous consideration of various factors to ensure equitable outcomes for all stakeholders involved.”