The latest US jobs report figures continued to roil global stock markets, impacting domestic investor sentiment. The index plummeted sharply at the end of the session, losing 7.59 points to settle at 1,268. The breadth was negative, with 285 declining stocks outweighing 118 gainers.

Similar to the previous day, except for the real estate sector, which was mainly propped up by the VinGroup, most other sectors were in the red. Real estate rose 0.7%, led by VHM with a 2.94% gain and VIC, up 2.39%. In contrast, most other stocks in the sector declined.

Commercial real estate stocks DIG, PDR, NLG, and CEO fell 2.14%, 2.46%, 2.14%, and 1.81%, respectively. Large and mid-cap sectors such as Banks, Securities, Construction Materials, Transport, Telecom, and Information Technology also witnessed declines, with the latter two sectors dropping 0.5% and 1.8%, respectively. Stocks weighing on the index included VCB, FPT, GVR, MBB, MSN, and MWG…

These large-cap stocks dragged the market down by 5.05 points. Conversely, VHM and VIC acted as pillars, lifting the market by over 2 points. Market liquidity across the three exchanges rose to VND18.1 trillion, while foreign investors net sold VND684 billion, offloading FPT and HPG while accumulating VHM and VNM.

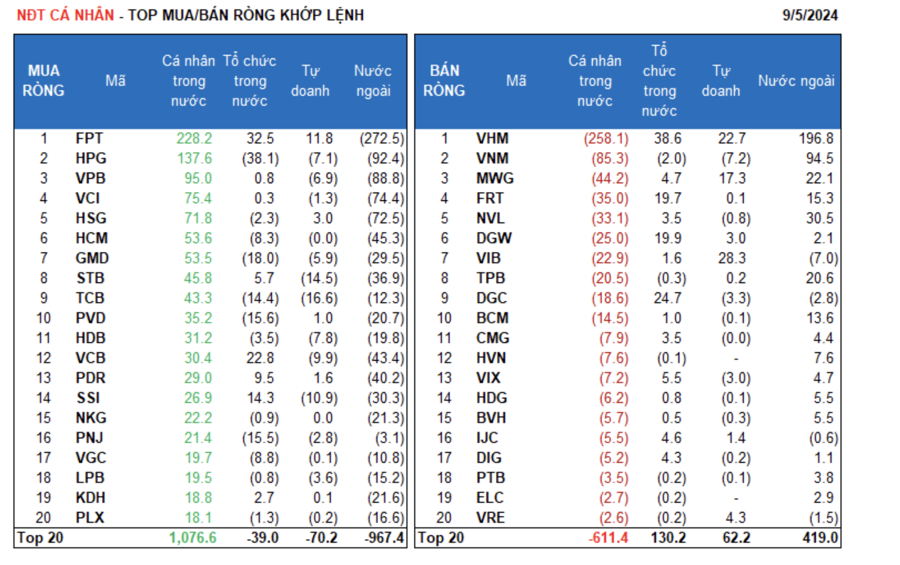

Foreign investors net sold VND670.7 billion, and in terms of matched orders, their net selling value stood at VND681.2 billion. Their net buying focused on Real Estate, Food & Beverage, and a few other sectors. The top stocks they bought were VHM, VNM, FUEVFVND, NVL, MWG, TPB, FRT, BCM, HVN, and BVH.

On the selling side, their focus was on the Banking sector, offloading FPT, HPG, VPB, VCI, HSG, VCB, PDR, STB, and SSI.

Individual investors net bought VND686.2 billion, and their net buying value in matched orders was VND655.7 billion. In terms of matched orders, they net bought 11 out of 18 sectors, mainly the Banking sector. Their top buys included FPT, HPG, VPB, VCI, HSG, HCM, GMD, STB, TCB, and PVD.

On the selling side, they net sold 7 out of 18 sectors, primarily Real Estate and Retail. Their top sells were VHM, VNM, MWG, FRT, NVL, DGW, TPB, DGC, and BCM.

Proprietary trading accounts net sold VND115.6 billion, and their net selling value in matched orders was VND96.8 billion.

In terms of matched orders, proprietary trading accounts net bought 6 out of 18 sectors, with Real Estate and Retail being the largest. Their top buys were VIB, VHM, MWG, FUESSVFL, FPT, MSN, VRE, DGW, HSG, and NT2. On the selling side, their focus was on Financial Services stocks, offloading FUEVFVND, TCB, STB, SSI, VCB, HDB, REE, POW, VNM, and HPG.

Domestic institutional investors net bought VND115.6 billion, and their net buying value in matched orders was VND122.2 billion. Focusing on matched orders, domestic institutions net sold 10 out of 18 sectors, with Basic Materials being the largest. Their top sells included HPG, GMD, PVD, PNJ, TCB, FUESSVFL, VGC, HCM, CTR, and REE.

On the buying side, they focused on the Real Estate sector, accumulating VHM, FPT, DGC, VCB, CTG, DGW, FRT, SSI, DXG, and VHC.

Matched orders today reached VND1,970.2 billion, down 3.3% from the previous session, contributing 10.8% to the total trading value. Notably, foreign investors executed a large matched order transaction in MBB, purchasing over 54.9 million shares worth more than VND1,300 billion.

Additionally, there were matched order transactions between domestic individuals in TCB, MWG, KOS, HVN, and KDC.

The money flow allocation increased in Real Estate, Securities, Information Technology, Steel, Food & Beverage, Retail, Power, and Aviation sectors while decreasing in Banking, Chemicals, Construction, Agro-Forestry-Fishery, and Oil & Gas Services sectors. Specifically, in terms of matched orders, the money flow allocation increased in the large-cap VN30 sector but decreased in the mid-cap VNMID and small-cap VNSML sectors.

The New Real Estate Boom: Are Ho Chi Minh City Residents Ready to Spend Their Savings and Take Out Loans for Property?

The property market is booming, and potential buyers know that hesitation will only result in missed opportunities. With an increasing number of people willing to take out loans to secure their dream homes, the competition is fierce. The pressure to act fast is on, as buyers recognize that property prices and availability show no signs of decreasing.

The Legacy Treasure in the Heart of Haiphong

“Owning a valuable piece of real estate with long-term growth potential has always been a top priority for families looking to pass on a legacy to future generations.”