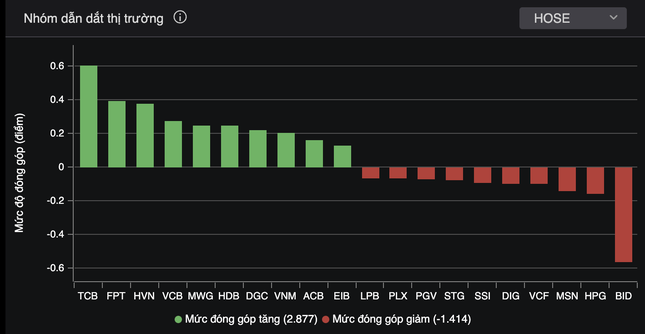

The market was dominated by a tug-of-war between bulls and bears today (August 30th). While the Vietnamese stock market escaped the “green on the outside, red on the inside” situation, the VN-Index lacked driving force. VN30 group heavyweights such as TCB, FPT, HVN, VCB, and MWG tried to maintain the market’s momentum, while BID, HPG, and MSN exerted downward pressure.

Large and influential sectors lacked consensus. Despite a dominant green performance in the banking group, the pressure from BID alone erased the positive contribution of leading stocks like TCB and VCB.

Large sectors lacked consensus.

Real estate stocks were not immune to the market’s polarization. Leading stocks in terms of liquidity, such as DIG, NVL, VRE, CEO, and GEX, all witnessed adjustments. DIG, the stock of DIC Corp, has been on a downward trend for the past five consecutive sessions, facing intense selling pressure after the market received the Government Inspectorate’s conclusion on the equitization process and state capital divestment at DIC Corp.

Over the past week, DIG’s market price has dropped by more than 7%. Today, this stock continued to lead the market in terms of liquidity, with a trading value of more than VND 744 billion, a significant gap compared to the following stocks, VIX and VHM.

Overall, as the holiday break approaches, a cautious sentiment prevails in the market. This is a typical occurrence during holiday periods. The stock market closed for the weekend on August 30th and will resume trading on September 4th after the 2-day National Day holiday on September 2nd. On September 4th, the market will resume its normal trading hours.

With this holiday schedule, securities transactions with a T+2 settlement cycle conducted on August 29th and 30th will be settled on September 4th and 5th, respectively. Transactions with a T+1 settlement cycle conducted today will be settled on September 4th.

The Hanoi Stock Exchange (HNX) has recently added four stocks to the list of those ineligible for margin trading due to negative audited semi-annual profits.

The four newly margin-ineligible stocks are QTC of Quang Nam Transport Construction and Investment Joint Stock Company, PTD of Phuc Thinh Construction and Trading Joint Stock Company, VTC of VTC Telecommunications Joint Stock Company, and CAN of Ha Long Canned Food Joint Stock Company. They were included in the list due to negative post-tax profits in the semi-annual audited financial statements.

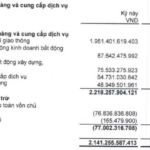

Ho Chi Minh Stock Exchange (HoSE) has also added three stocks to the list of ineligible margin trading stocks: EVE of Everpia Joint Stock Company, STK of Century Fiber Joint Stock Company, and TLH of Tien Len Steel Corporation. This is due to the negative post-tax profits of the parent company in the semi-annual consolidated financial statements for 2024, as audited.

At the end of the trading session, the VN-Index rose 2.4 points (0.19%) to 1,283.87 points. The HNX-Index decreased by 0.32 points (0.13%) to 237.56 points. The UPCoM-Index increased by 0.32 points (0.34%) to 94.17 points. Liquidity continued to decline, with the HoSE matching value falling to VND 12,116 billion. Foreign investors net bought a slight VND 44 billion, focusing on FPT and MWG.

Elevating Vietnamese Stocks: Awaiting the Close of the 8th of October Session in the U.S.

The prestigious international stock market index provider, FTSE Russell, has announced that Vietnam is poised for an upgrade to emerging market status. The highly anticipated decision will be revealed after the close of the US stock market on October 8th.