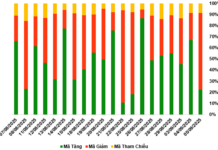

The Vietnamese stock market witnessed a slight dip during the week of August 26-30, with the VN-Index closing at 1,283.87 points, a decrease of 1.45 points (-0.11%) from the previous week. This followed a positive week of trading, with the market opening on Monday in the green as it approached the 1,290-point mark.

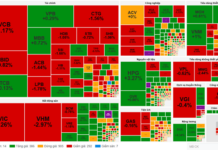

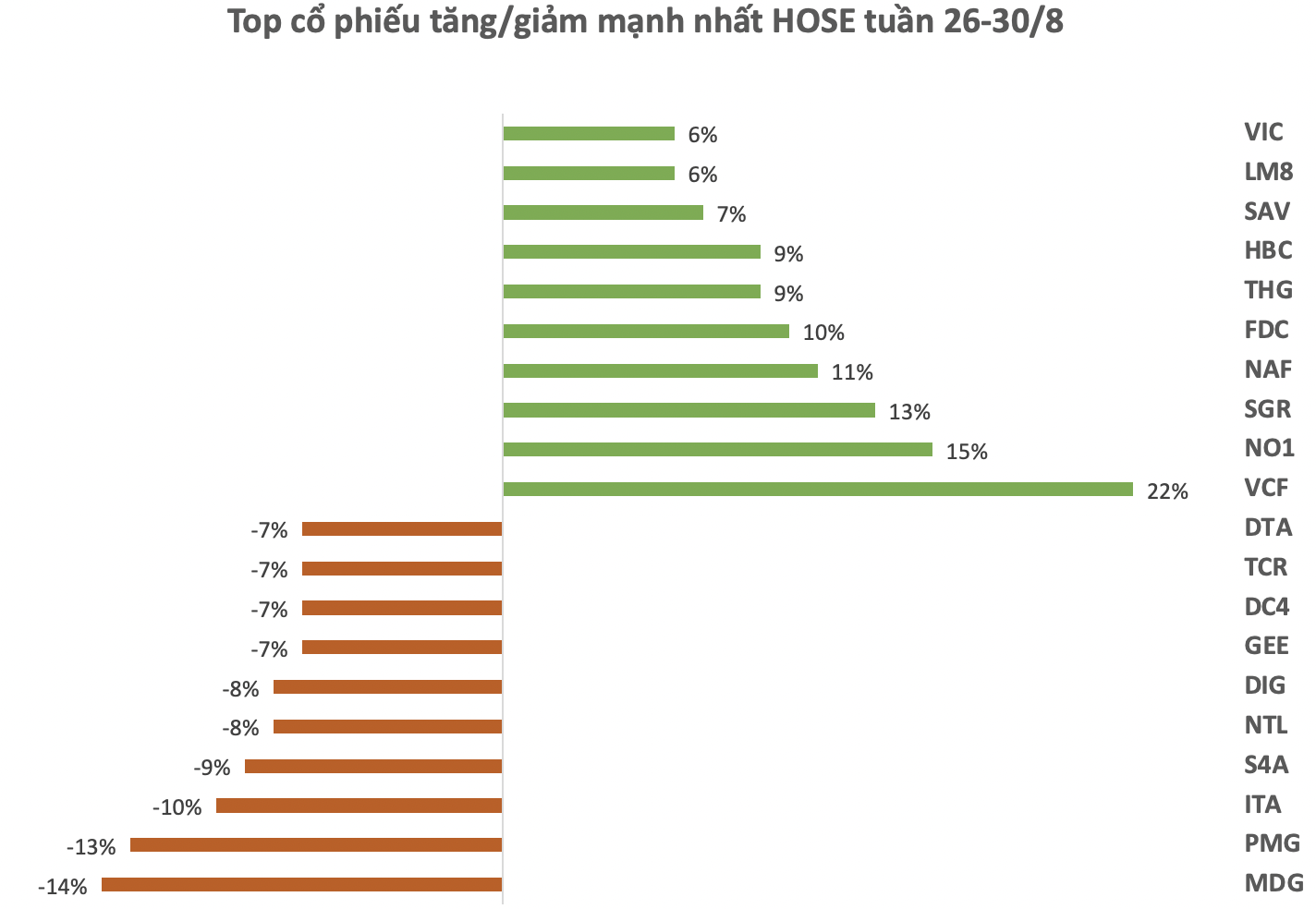

HOSE: VCF topped the list of gainers, surging 22% over four consecutive sessions, including three ceiling-hitting sessions. Currently trading at VND267,000 per share, VCF boasts the most expensive share price on the HOSE, far surpassing its peers. Its market capitalization has also improved significantly, nearing VND7 trillion.

VCF’s rally was triggered by the company’s announcement of a 250% cash dividend for 2023, equivalent to VND25,000 per share. The record date is set for September 9, with payments expected on September 20.

In the real estate sector, VIC also had a breakthrough week, climbing 6% over the past five sessions. This pushed its market capitalization up by nearly VND10 trillion to almost VND169 trillion.

On the other hand, MDG, PMG, ITA, and S4A faced profit-taking pressure, all declining by over 8% this week.

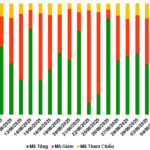

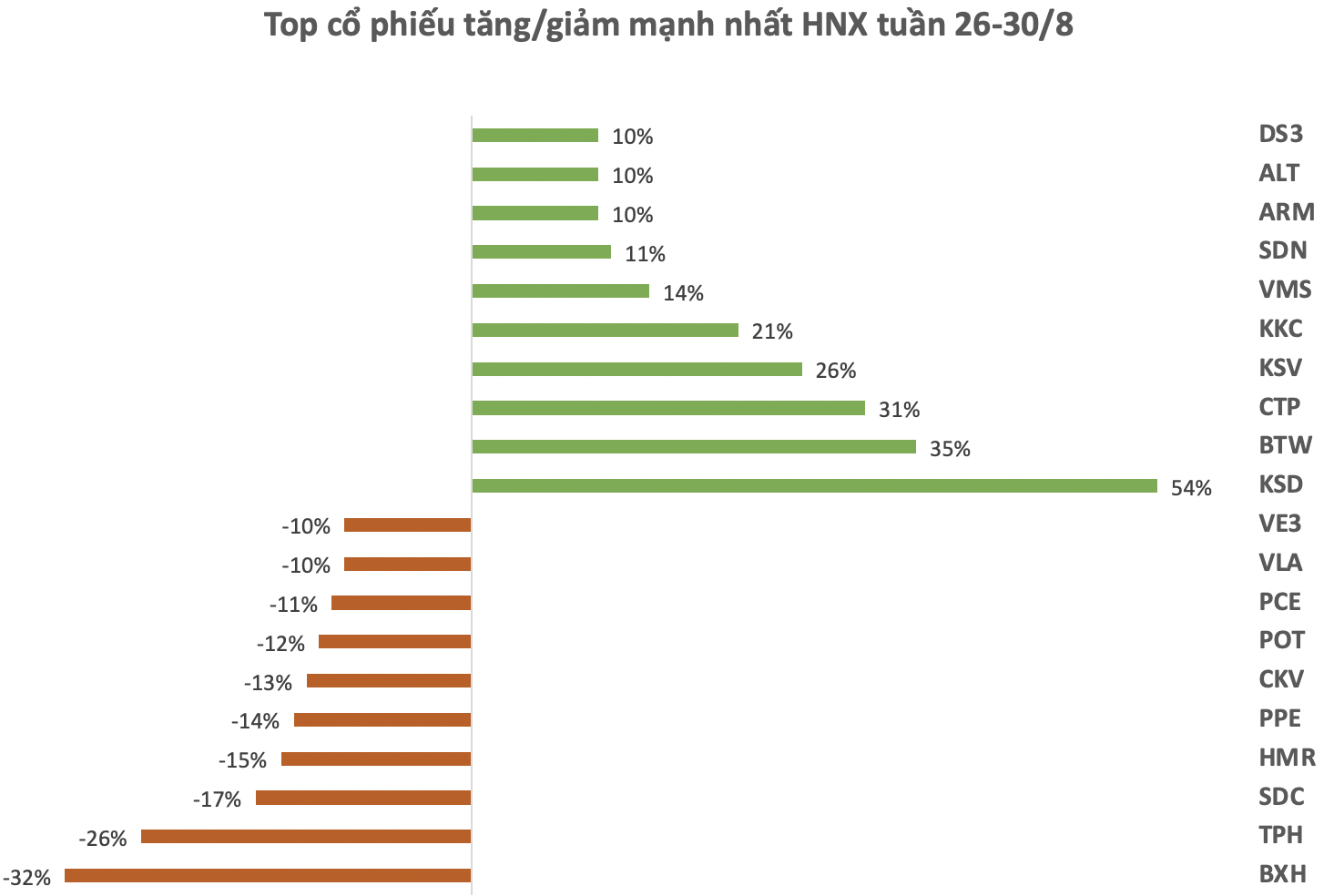

HNX: The majority of gainers on the HNX were small-cap, low-liquidity stocks such as KSD, BTW, KSV, and KKC. KSD stood out with seven consecutive gaining sessions, although trading volume remained low and volatile, ranging from a few thousand shares to a high of 57,000 shares in a single session.

On the downside, BXH, TPH, and SDC faced profit-taking pressure, declining by over 17-32% during the week.

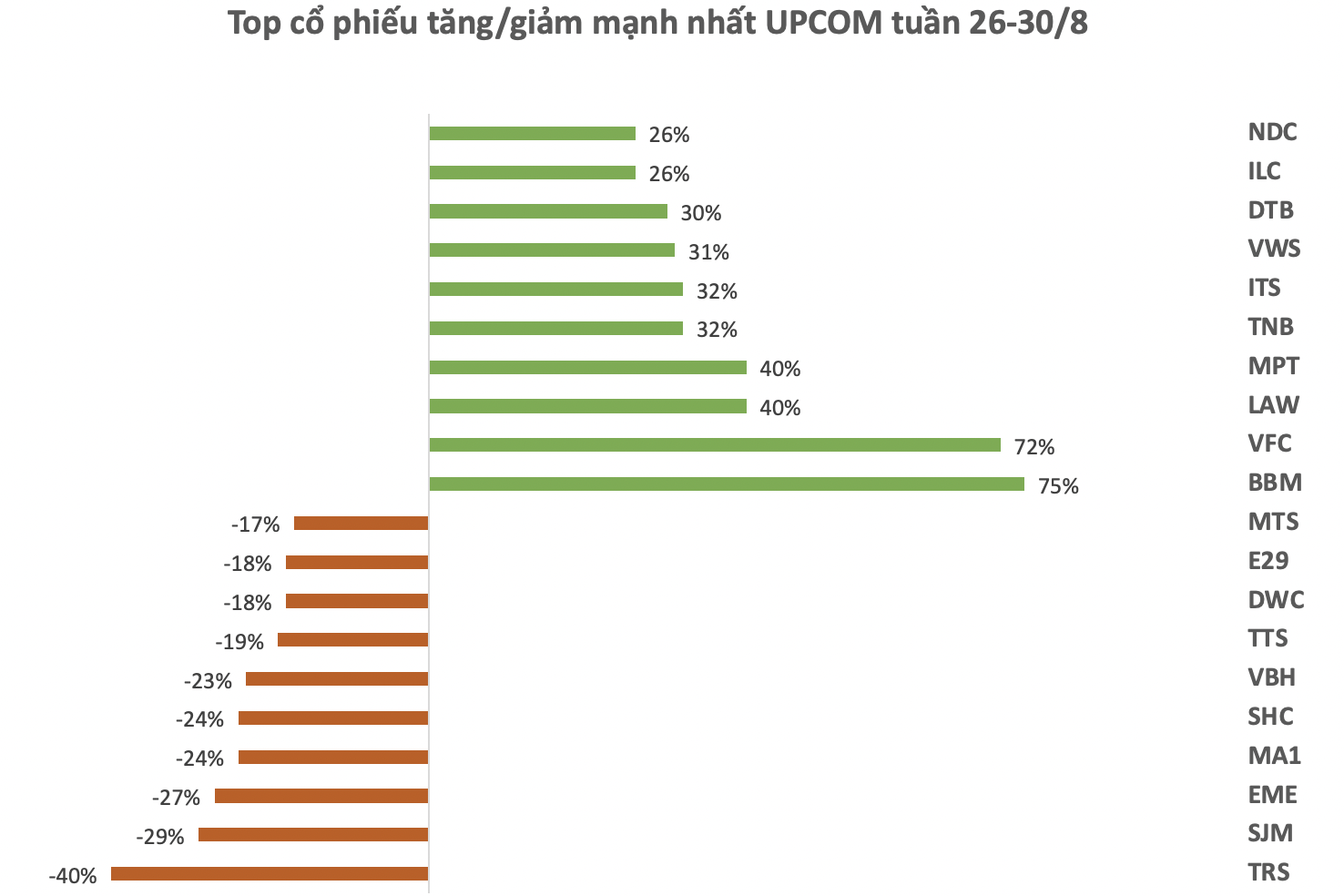

UPCOM: BBM, the stock of Hanoi Beer – Nam Dinh Joint Stock Company, led the gainers on UPCOM, surging to the ceiling price for three consecutive sessions. For the week, BBM climbed nearly 75% to VND11,700 per share. However, trading volume remained low, with only a few hundred to a few thousand shares traded per session.

Hanoi Beer – Nam Dinh Joint Stock Company, formerly known as Ba Lan Bakery, was established in 1969 and operated under the management of the Nam Ha Food Department, specializing in beer and bakery products.

Following BBM was VFC, which surged 72% to VND115,000 per share. However, trading volume remained subdued, with only a few thousand shares traded per session.

In contrast, several stocks on UPCOM recorded declines of 17%-40% during the week. Notably, TRS of Transport and Maritime Services Joint Stock Company plummeted nearly 40% to VND19,500 per share, with a meager trading volume of a few hundred shares.

The Unusual Story: Tan Tao Approaches 30 Audit Firms but Gets Rejected – What’s the Reason?

“According to Tan Tao, the entire auditing firm is afraid of working with them due to the potential suspension by the Securities Commission. This is a bold statement, and one that certainly captures attention. However, it is important to delve deeper and understand the intricacies of such a claim. The implication here is that the company’s operations are so complex and unique that they strike fear into the hearts of even the most seasoned auditors. This intriguing proposition piques the interest of potential investors and stakeholders, prompting them to want to learn more about this enigmatic company and the nature of its business.”