Masan Consumer Holdings Reports Impressive Financial Results for the First Half of 2024

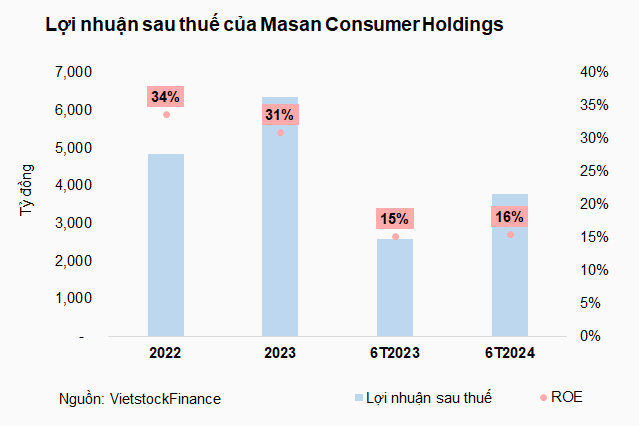

Masan Consumer Holdings announced impressive financial results for the first half of 2024, with a 46% increase in profit after tax compared to the same period last year, according to the periodic financial statement sent to the Hanoi Stock Exchange (HNX). The company’s profit after tax reached nearly VND 3,782 billion, resulting in a return on equity (ROE) of 16%, surpassing the previous year’s figure of 15%.

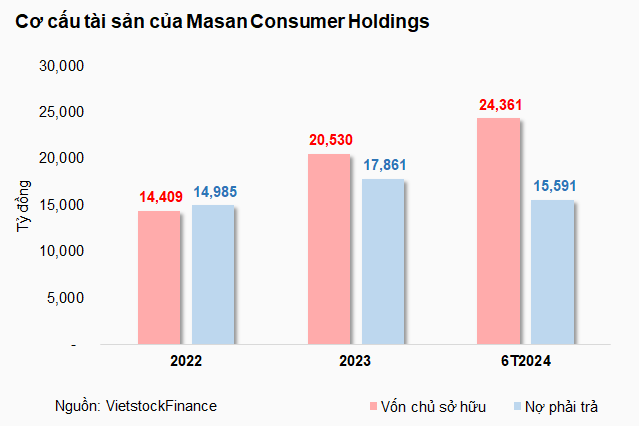

As of June 30, 2024, the company’s total liabilities stood at nearly VND 15,591 billion, a 13% decrease compared to the beginning of the year. The debt-to-equity ratio was 0.64. Notably, the bond debt amounted to over VND 2,192 billion, a 7% increase, but the bond debt-to-equity ratio declined from 0.1 in the previous year to 0.09.

Further investigation reveals that Masan Consumer Holdings has only one bond issue, MCHBONDS2014, which was listed on December 5, 2014, with a 10-year maturity date of December 5, 2024. The Vietnam Industrial and Commercial Bank Securities Company (VCBS) serves as the bond registrar for this issue.

With this bond offering, Masan Consumer Holdings successfully raised VND 2,100 billion. The bonds carry a fixed interest rate of 8% per annum, payable semi-annually, while the principal is repayable in a lump sum at maturity. Notably, these bonds are guaranteed by the Credit Guarantee and Investment Facility (CGIF), a trust fund of the Asian Development Bank (ADB). This transaction marks CGIF’s first deal in Vietnam.

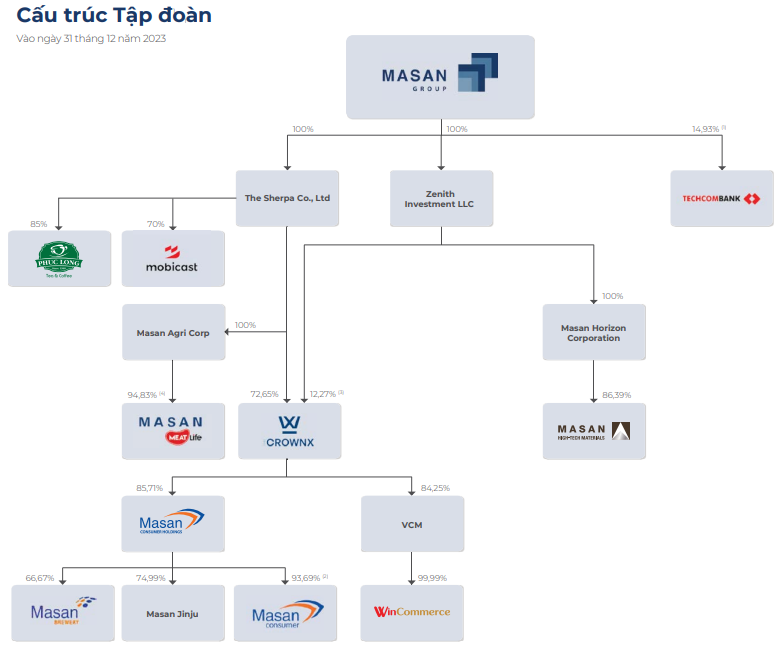

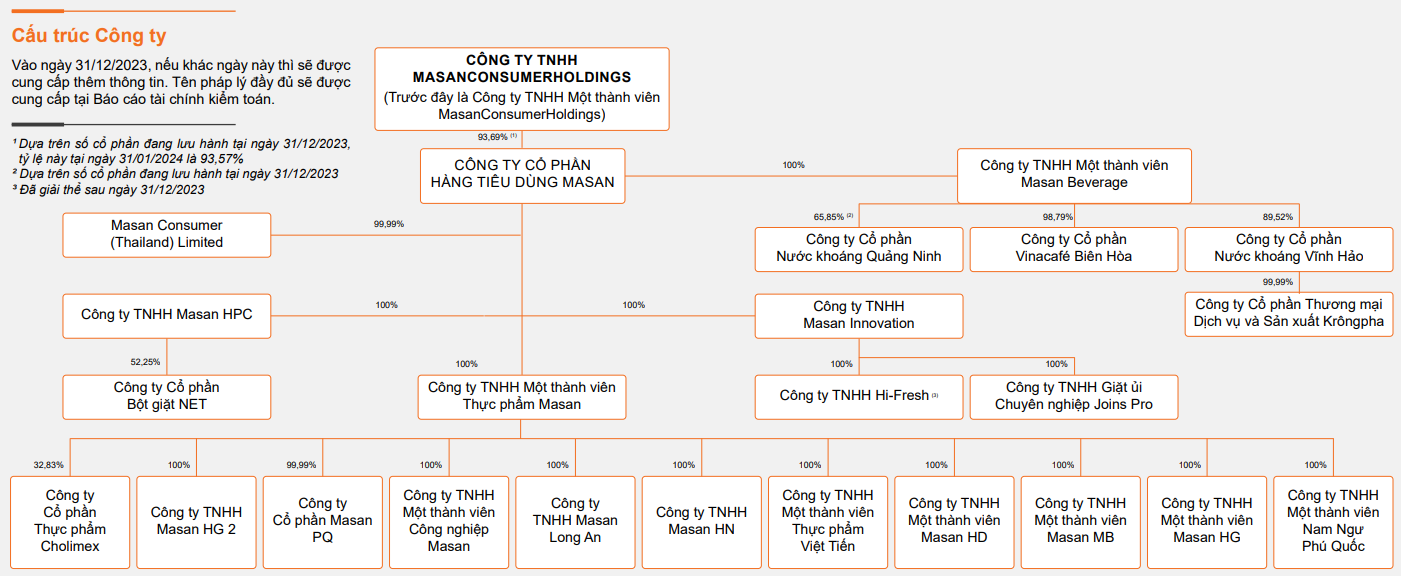

Masan Consumer Holdings, formerly known as Hoa Bang Lang Consulting Limited Company, was established in August 2009 as a wholly-owned subsidiary of the Masan Group. The company serves as a platform for the group to invest in the food, beverage, and related industries. In December 2013, the company changed its name to Masan Consumer Holdings Limited Company.

Currently, Masan Consumer Holdings is recognized as an indirectly owned subsidiary of the Masan Group (MSN), primarily engaged in investment fund management. Its key portfolio companies include Masan Consumer (MCH) and Masan Brewery.

Source: 2023 Annual Report of MSN

|

Source: 2023 Annual Report of MCH

|

Through its subsidiaries, Masan Consumer Holdings offers a diverse range of food and beverage products, including soy sauce, fish sauce, seasoning sauce, chili sauce, broth mix, instant noodles, ready-to-eat meals, instant coffee, breakfast cereals, bottled beverages, and beer.

The company’s key brands include CHIN-SU, Nam Ngư, Tam Thái Tử, Omachi, Kokomi, Tiến Vua, Vinacafé, Wake-up Coffee, Wake-up 247, Compact, EnerZ, Bupnon Tea365, Vĩnh Hảo, Quang Hanh, Vivant, Faith, Red Ruby, Lush, and Sư Tử Trắng. Additionally, with the successful public offering for Net Detergent JSC in February 2020, Masan Consumer Holdings expanded its portfolio into the personal and home care segment, including laundry detergents (Joins, Super Net), liquid detergents (Chante’), dishwashing liquids (Sopa, Homey), and bath soaps (La’Petal).

Huy Khải

Home Credit Reports Doubled Profit, Surpassing $20 Million in the First Half of the Year

Home Credit’s stellar performance continues into 2024, with the company’s first-half results outperforming the full-year profits of 2023.