Company related to Chairman CC1 becomes a major shareholder

With the purchase of a large amount of shares of Construction Corporation No. 1 – JSC (UPCoM: CC1) at the beginning of this year and holding 4.46%, CC1-Holdings continued to successfully purchase more than 2 million shares on August 28, out of a total of 2.2 million registered shares, thereby increasing its ownership to 5.03%, equivalent to more than 18 million shares, officially becoming a major shareholder of CC1.

The reason given by CC1-Holdings for not purchasing the remaining shares was that the expected agreement was not reached.

Referring to the agreed price on August 28, more than 2 million shares were traded, equal to the number of shares purchased by CC1-Holdings, with a value of nearly VND 29 billion.

Chairman of SSI‘s son sells shares, related organization buys

Mr. Nguyen Duy Linh, son of Mr. Nguyen Duy Hung, Chairman of Securities SSI Nguyen Duy Hung, sold 47 million SSI shares in the period of August 19-23. These shares account for 3.1% of the Company’s capital. After the transaction, Mr. Linh no longer holds SSI shares.

In contrast, an organization related to Chairman Nguyen Duy Hung, NDH Investment Company, purchased 32 million SSI shares from August 21-23. After the transaction, NDH Investment increased its ownership in SSI to more than 126.2 million shares, equivalent to holding 8.354% of the capital.

SSI shares recorded large matching volumes in the sessions of August 19, 21, and 23, totaling the volume registered for trading by Mr. Linh and NDH Investment. Therefore, it is highly likely that this was a transaction between Mr. Linh and NDH Investment.

Mr. Hung is the owner and Chairman of NDH Investment. In addition, another son of Mr. Hung, Mr. Nguyen Duy Khanh, is the General Director of the company. Mr. Hung currently holds more than 11.6 million SSI shares (0.773% of capital), and Mr. Khanh holds nearly 3.5 million shares (0.232% of capital). In total, this group holds 141.4 million SSI shares, equivalent to 9.359% of the capital.

During the period when Mr. Linh sold his shares, the closing price of SSI shares averaged around VND 33,000/share. Mr. Linh’s transaction was estimated to be worth nearly VND 1,550 billion. For NDH Investment, the value was estimated at about VND 1,065 billion.

IDJ intends to purchase 6 million API shares

The Board of Directors of Investment Joint Stock Company IDJ Vietnam (HNX: IDJ) has just approved the decision to invest in 6 million shares of Asia-Pacific Investment Joint Stock Company (HNX: API) at market price, by matching or agreeing on the exchange.

The expected implementation time is in the third quarter of 2024. If successful, IDJ will become a major shareholder of API with an ownership ratio of 7.14%.

At the close of the session on August 30, the market price of API shares fell back to VND 8,800/share. However, compared to the beginning of May, the share price has still increased by 110%. Based on this price, it is estimated that IDJ needs to spend nearly VND 53 billion to complete the deal.

A General Director is about to spend nearly VND 80 billion to buy a large amount of HBS shares

Mr. Nguyen Phan Trung Kien, General Director of Hoa Binh Securities Joint Stock Company (HNX: HBS), registered to buy by agreement and matching 8 million HBS shares to increase his ownership rate from August 28 to September 25, 2024.

If successful, Mr. Kien will increase his ownership in HBS to 24.24% of the capital, from holding no shares previously.

Based on the closing price of HBS on August 30, which was VND 9,700/share, the estimated amount of money needed for this transaction is nearly VND 78 billion.

Mr. Dang Thanh Tam wants to ‘hand over’ more than 11% of KBC capital to a related enterprise

On August 30, Mr. Dang Thanh Tam, Chairman of the Board of Directors of Kinh Bac City Development Holding Corporation – JSC (HOSE: KBC), announced that he would transfer ownership of nearly 87 million KBC shares to DTT Investment and Development Joint Stock Company in the form of capital contribution through share transfer.

The transaction will be made through the Vietnam Securities Depository and Settlement Corporation, with the expected timing between September 9 and October 8, 2024.

After the transaction, Mr. Tam’s direct ownership in KBC will decrease from 18.06% to 6.79%, equivalent to more than 52 million shares.

Not long before this, Mr. Tam sold 25 million shares (16.89%) of Saigon Telecommunication Technology Joint Stock Company (HOSE: SGT) to DTT from May 8 to May 31, 2024. The deal was estimated to be worth nearly VND 366.3 billion, averaging VND 14,125/share.

Board member intends to sell 5% of PC1 capital

Mr. Phan Ngoc Hieu, a member of the Board of Directors of PC1 Corporation (HOSE: PC1), announced his plan to sell all 15.6 million PC1 shares, or 5% of the Company’s capital, for portfolio restructuring purposes. The expected transaction period is from August 30 to September 27, 2024.

If the capital withdrawal is successful, Mr. Hieu will no longer be a shareholder of PC1 just four months after being elected to the Board of Directors.

Based on the closing price of PC1 on August 30, which was VND 28,250/share, it is estimated that Mr. Hieu could earn nearly VND 440 billion after no longer being a major shareholder of PC1.

The “female general” behind the Katinat and Phe La cafe chains registered to sell more than 13 million VCI shares

Ms. Truong Nguyen Thien Kim, owner of the Saigon Katinat Kafe and Phe La cafe chains, has just registered to sell 13.2 million shares of Vietcap Securities Joint Stock Company (HOSE: VCI) from September 4 to October 3, 2024, to meet personal needs.

Ms. Kim is the wife of Mr. To Hai, a member of the Board of Directors and General Director of VCI. If the transaction is successful, the number of VCI shares held by Ms. Kim will decrease from more than 22.8 million shares (5.17%) to 9.6 million shares (2.18%). Meanwhile, Mr. To Hai currently holds 22.44% of the capital.

In the stock market, VCI shares have been on an upward trend since the beginning of August, with the market price increasing from the VND 40,000/share region to the VND 48,000/share region, an increase of 20% in almost a month. Based on the current price, Ms. Kim could earn a minimum of VND 634 billion if the transaction is completed.

|

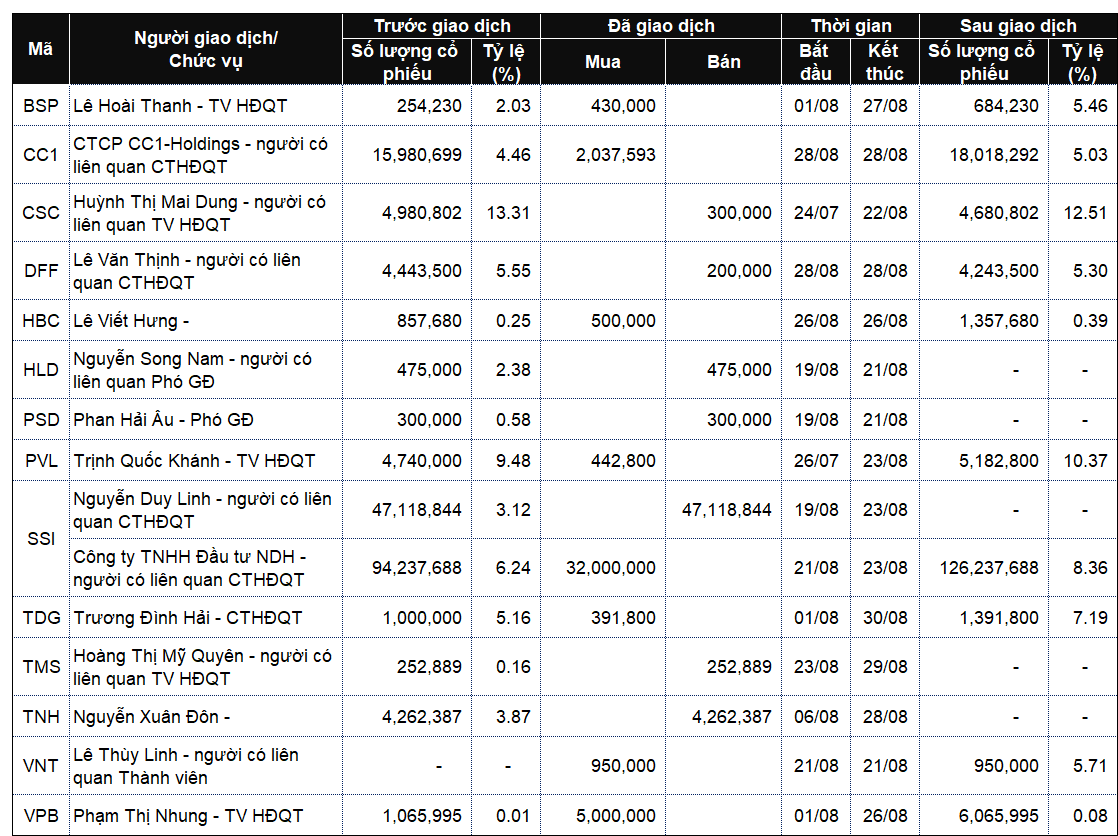

List of company leaders and relatives trading from August 26-30, 2024

Source: VietstockFinance

|

|

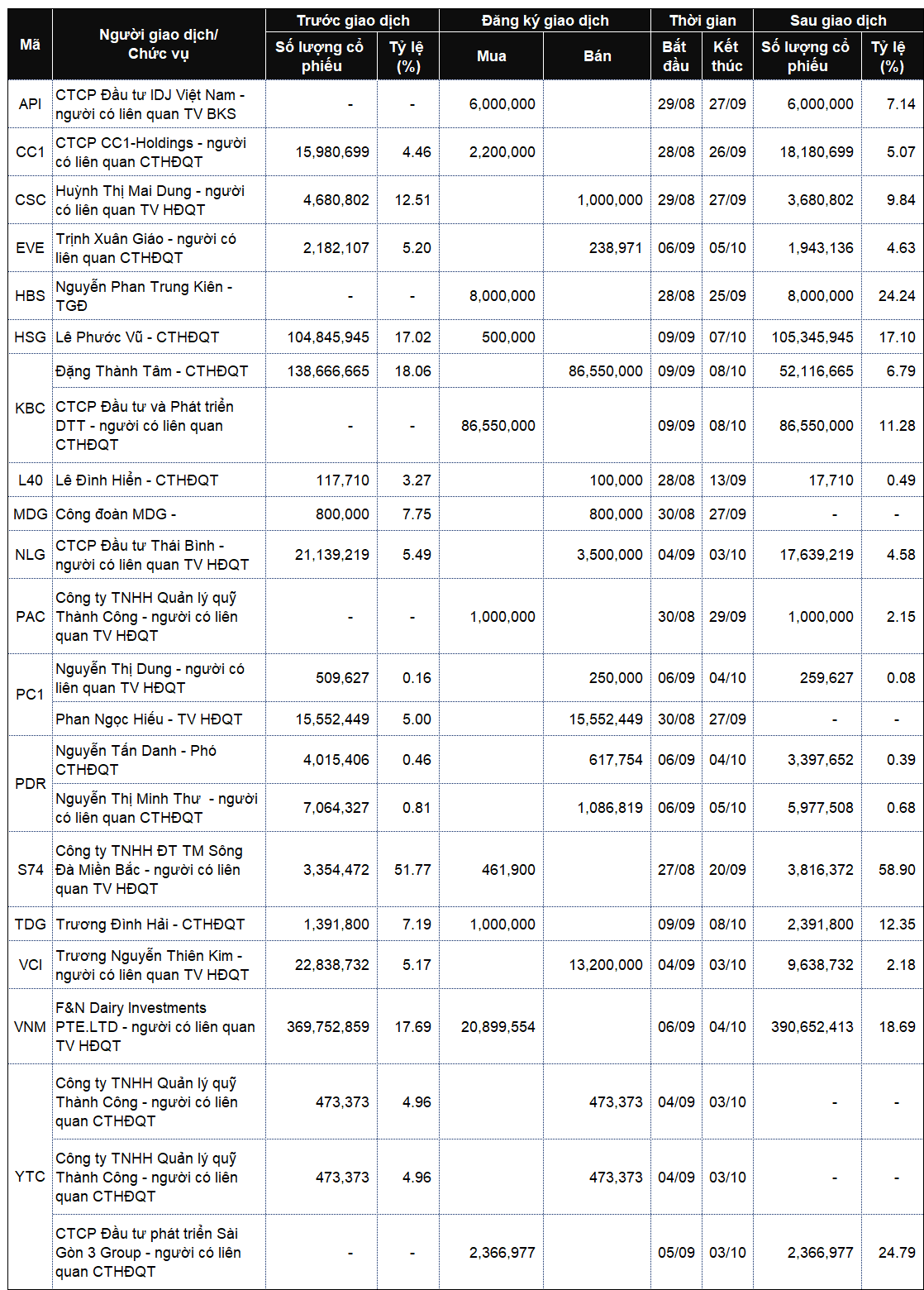

List of company leaders and relatives registering to trade from August 26-30, 2024

Source: VietstockFinance

|

The Heiress and Senior Executive of Phat Dat Want to Sell Millions of PDR Shares

PDR stock is currently down 14% since the beginning of 2024. A concerning decline, but a potential opportunity for savvy investors to enter a promising market. With a strategic approach, this stock could offer a unique entry point and a chance to diversify. A well-timed investment could see a significant rebound, offering a profitable future for those willing to take a calculated risk.