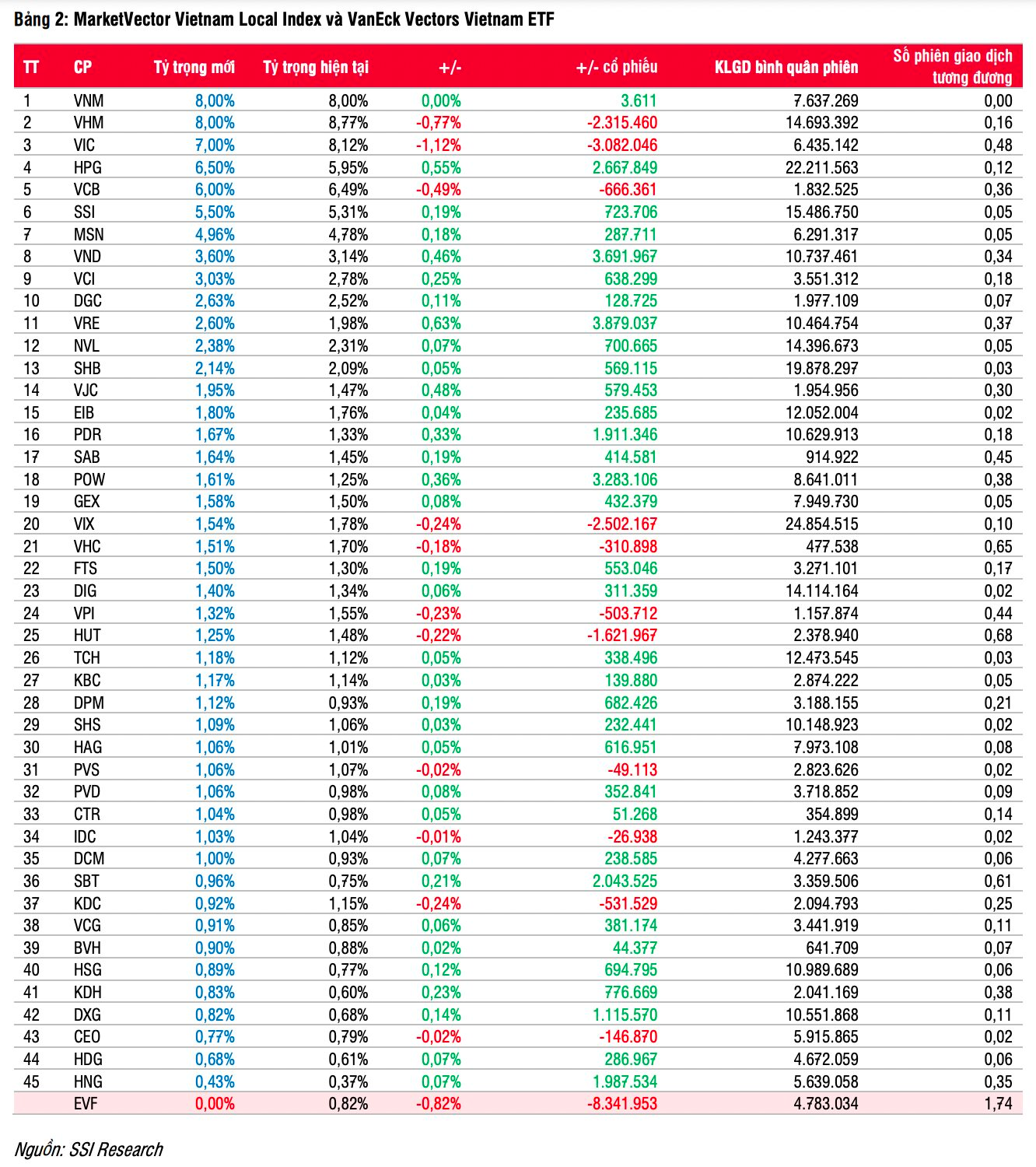

Vietnam’s stock market is about to witness an interesting development with the upcoming rebalancing of foreign ETFs. On September 6th, FTSE Russell will announce the constituent stocks of the FTSE Vietnam All-share and FTSE Vietnam Index.

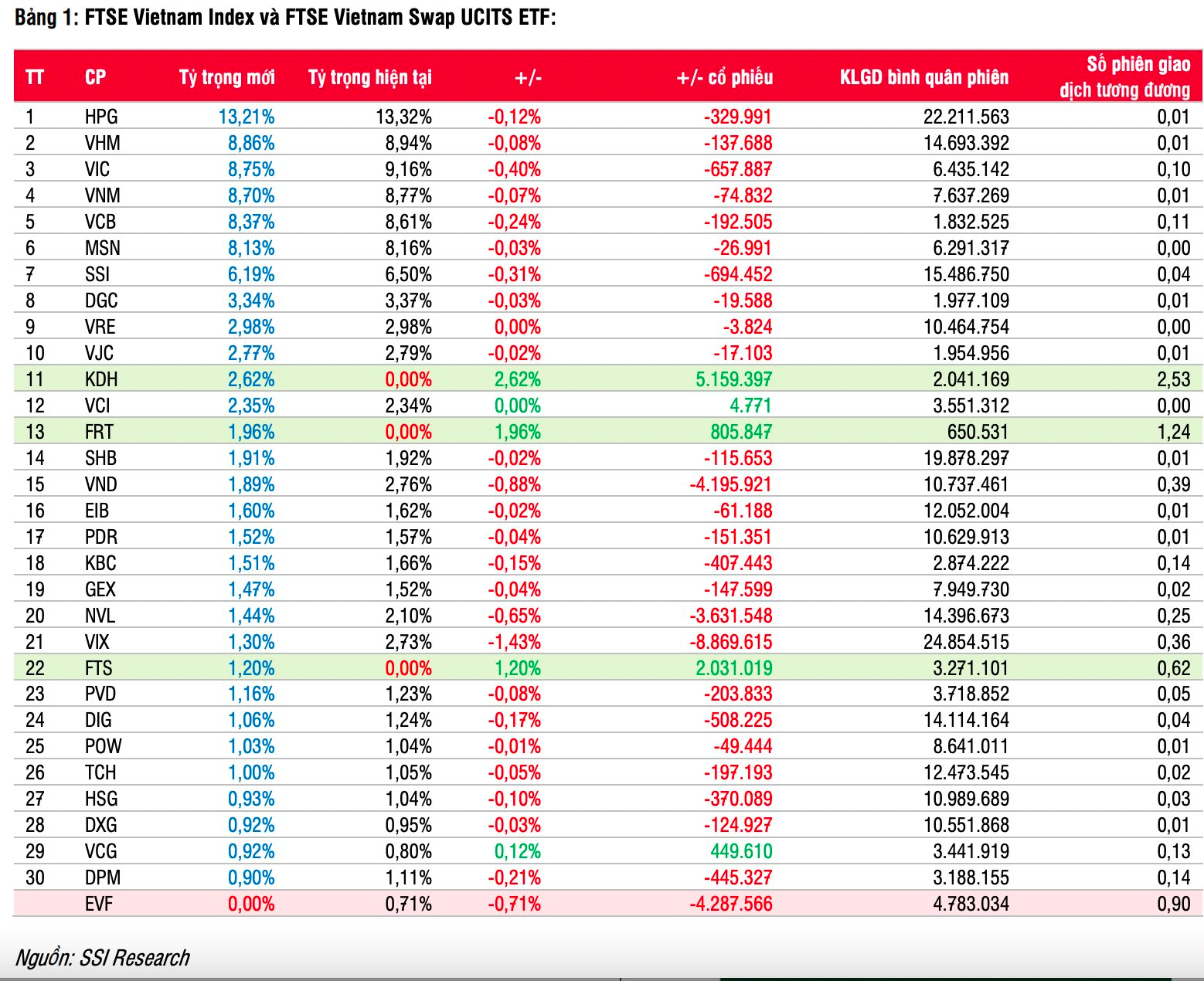

A week later, in the early hours of September 13th, MarketVector will also disclose the stocks under the MarketVector Vietnam Local Index.

By September 20th, these ETFs will have completed the rebalancing of their portfolios. Currently, the total assets of the FTSE ETF, referencing the FTSE Vietnam Index, stand at approximately VND 7.4 trillion, while the V.N.M ETF, tracking the MarketVector Vietnam Local Index, boasts a scale of VND 12.5 trillion. SSI Securities Corporation has recently released projections about the ETFs’ portfolio rebalancing.

Regarding the FTSE Vietnam Index, SSI Research predicts that three stocks, KDH, FRT, and FTS, are likely to be added to the index. Specifically, among the FTSE criteria of market capitalization, liquidity, free float, and foreign room availability, KDH has met the final criterion as the foreign room availability increased to 11.9%. Additionally, FRT and FTS have satisfied the liquidity criterion in this review compared to the previous one.

On the other hand, EVF stock may be removed from the index as it fails to meet the requirements for the free-float ratio and free-float market capitalization.

Given this scenario, SSI Research estimates that the FTSE Vietnam Swap UCITS ETF will purchase approximately 5.1 million KDH shares, 805,000 FRT shares, and 2 million FTS shares to include them in its portfolio.

Conversely, the fund is expected to sell about 4.29 million EVF shares, while VIX and VND are the two stocks that will likely experience a significant reduction in weight, with potential sell-offs of 8.9 million and 4.2 million shares, respectively.

Turning to the MarketVector Vietnam Local Index, SSI Research does not anticipate any new additions to the index. Conversely, EVF is unlikely to be removed from the index despite not meeting the free-float market capitalization condition.

Assuming these changes, the index’s portfolio will comprise 45 stocks. SSI estimates that the VanEck Vectors Vietnam ETF will sell approximately 8.3 EVF shares.

Following a similar pattern, some stocks are expected to be offloaded, including VIX (-2.5 million shares), VIC (-3 million shares), VHM (-2.3 million shares), and HUTT (-1.6 million shares).

Conversely, the fund may purchase additional shares of VRE (3.9 million), VND (3.7 million), and POW (3.3 million), among others.