In an interview with Tien Phong newspaper, Mr. Nguyen The Minh, Director of Retail Research at Yuanta Securities, shared his insights on the stock market’s prospects. He highlighted that the cooling down of exchange rates will be a crucial factor in supporting the market in the upcoming period. Previously, the rising exchange rates had impacted the market, particularly affecting foreign capital flows.

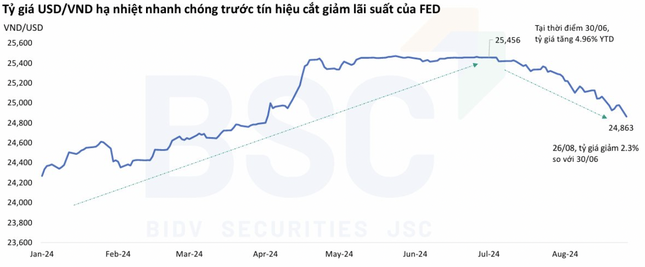

“During the months of March, June, and July, the exchange rate surged, and foreign investors net sold over VND 1,000 billion in each session. However, with the exchange rate now below 25,000 VND, the net selling of foreign investors has significantly decreased. The risk associated with exchange rates has diminished compared to the previous period when the VN-Index approached the 1,300-point mark,” Mr. Minh analyzed.

Exchange rate movements over time. Data: BSC.

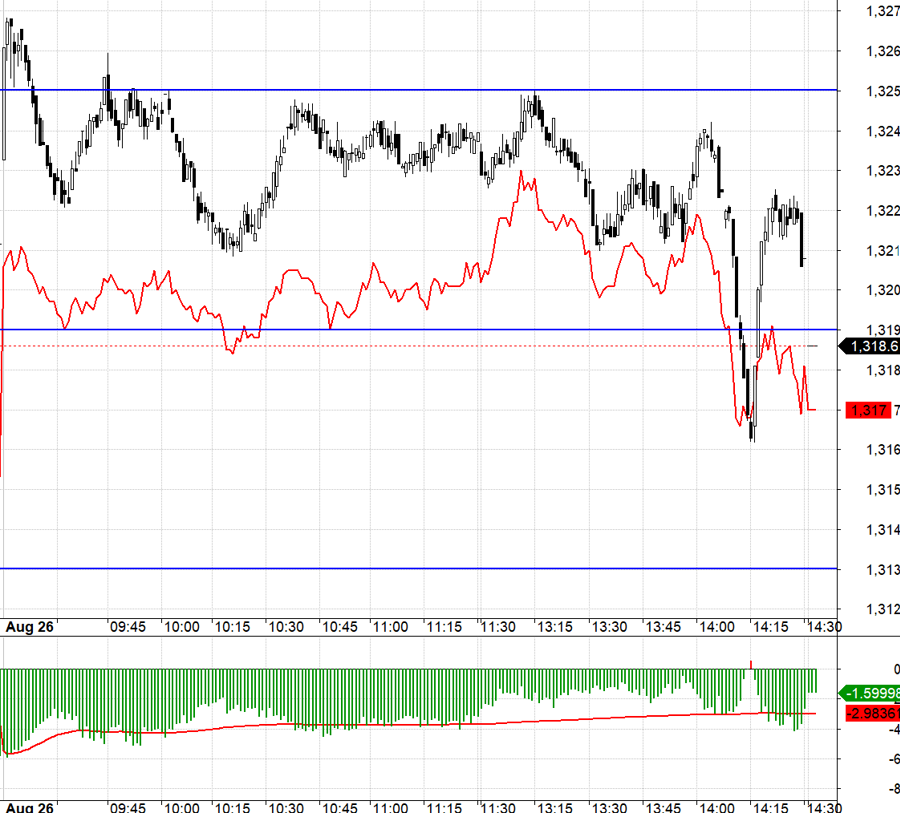

Mr. Minh recalled that the market had surpassed the 1,300-point threshold twice this year. After the holiday break, favorable conditions are in place for the VN-Index to reclaim its previous peak. Notably, the recovery of the real estate sector is a significant factor to consider.

“In March and June, the share prices of real estate companies declined, negatively impacting the overall market. However, at present, the representative index for the real estate sector has crossed the 100-day moving average, indicating a more positive mid-term trend. We expect it to not adversely affect the market as it did before,” he added.

The corrections in some stocks, such as DIG, are short-term and related to specific company issues rather than the industry as a whole. Additionally, three laws on real estate, which came into effect on August 1st, are anticipated to have a positive impact on the market and businesses,” the Yuanta expert explained.

Apart from real estate stocks, Mr. Minh believes that the market can also look forward to the banking and securities sectors. Their P/B ratios are currently below 2, making them attractive investments compared to the same period when the VN-Index approached the 1,300-point mark previously.

VNDirect’s analysts shared their views on exchange rates, stating that the pressure is expected to ease towards the end of the year. They attributed this to the anticipated interest rate cut by the US Federal Reserve (Fed) starting in September 2024, which would weaken the US dollar, along with positive trade surpluses, robust FDI inflows, and a strong recovery in tourism.

Indeed, over the past month, the USD/VND exchange rate has witnessed a significant decline, with the interbank rate falling below 25,000 VND/USD, a substantial drop from its previous peak of around 25,470 VND/USD.

VNDirect further predicted that the exchange rate would continue to be supported by multiple factors until the end of the year. These include the Fed’s initiation of an interest rate cut cycle, easing inflationary pressures domestically from the second half of Q3, sustained FDI inflows into Vietnam, a maintained trade surplus, and the influx of remittances during the upcoming Q4 holiday season.

BSC analysts concurred, stating that with the expected easing of exchange rate pressure due to the Fed’s interest rate cuts, many businesses’ profit growth in the second half of the year would be supported by lower borrowing costs, reduced foreign exchange losses, and decreased selling and management expenses, coupled with the low base from Q3 2023.

The Stock Market Ends the Week on a Down Note Despite Four Straight Sessions of Gains

Week 26 – 30/08: The VN-Index dipped 2 points to close the week at 1,283.4, despite four consecutive days of gains during the week.

Charging Seven Individuals for Stock Price Manipulation of CMS Securities

The Hanoi Police Investigative Agency has initiated legal proceedings and charged seven individuals with market manipulation of CMS stock, relating to Vietnam CMH Group Joint Stock Company. Over a five-month period, these individuals colluded and manipulated the stock through social media, profiting over 10 billion VND from their illicit activities.