According to a disclosure sent to the Hanoi Stock Exchange (HNX), Crystal Bay’s total assets as of June 30, 2024, amounted to nearly VND 6.4 trillion, remaining stable compared to a year earlier. Meanwhile, its total liabilities decreased by over 4% to nearly VND 4 trillion. Bond debt stood at VND 1,960 billion, down nearly 12%.

Compared to the beginning of 2024, the company’s total assets decreased slightly by 1%, while total liabilities remained unchanged.

|

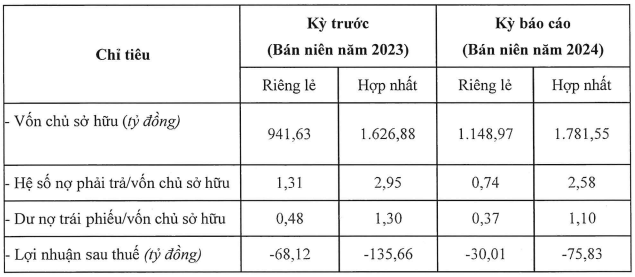

Crustal Bay’s business results for the first six months

Source: HNX

|

Crystal Bay currently has one bond issue outstanding with the code CBGCB2124001, valued at VND 420.5 billion. This bond was issued on November 5, 2021, with a value of VND 450 billion, a three-year term, and a maturity date of November 5, 2024. The bond is secured by 78.2 million shares issued by Crystal Bay, owned by shareholders, along with the rights and interests arising from these shares.

Headquartered in Khanh Hoa, Crystal Bay operates in three main sectors: international and domestic tourism, hotel and resort operations, and tourism real estate. With a charter capital of VND 1,150 billion, the company was founded by Mr. Nguyen Duc Chi, who also serves as the Chairman of the Board of Directors. Crystal Bay has invested in numerous tourism and resort projects, including SunBay Park Hotel & Resort Phan Rang, Sailing Bay Ninh Chu, and Crystal Marina Bay in Khanh Hoa province…

“I’d Still Buy Land If I Had the Money”

“I’m sitting on multiple real estate assets, but I’m struggling to sell them. It’s a challenging position to be in, and I know I’m not alone. The market is flooded with similar properties, and buyers have the upper hand. It’s a tricky situation, and I’m considering my options carefully.”