Global steel prices continue their recovery after dipping to an eight-year low. Specifically, steel bar futures prices rose above the 3,100 CNY/ton mark. The upward trend in global steel prices has somewhat eased the pressure on domestic steel manufacturers, including Hoa Phat (HPG).

In its latest report, Rong Viet Securities (VDSC) expects the domestic steel market to maintain its recovery momentum and support businesses’ sales volume in the second half of 2024. This is especially true as construction activities pick up, the real estate market recovers more clearly, and the peak construction season in Q4 arrives.

Regarding the export market (mainly for HRC products), despite the large European market initiating anti-dumping investigations into HRC products originating from Vietnam, VDSC believes HPG will proactively shift orders to serve the needs of domestic coated sheet companies. As a result, HPG’s sales volume in the second half of 2024 is expected to reach 4.5 million tons (+7% year-on-year), largely contributed by 2.4 million tons of construction steel (+13% year-on-year) and 1.5 million tons of HRC (equivalent to the same period in 2023).

Additionally, although the average selling price is projected to decrease by 10% compared to the first half due to China’s influence, the price of main raw materials will see a corresponding drop. This allows HPG to maintain its GPM margin at 13%, equivalent to the first six months of 2024. VDSC forecasts HPG’s revenue and gross profit in the last six months of 2024 to reach VND 67,800 billion and VND 8,800 billion, respectively, corresponding to an 8% and 10% year-on-year increase.

In terms of profitability, the analysis team expects net profit in the second half to reach VND 5,800 billion (+16% year-on-year).

For the full year 2024, VDSC projects HPG’s net profit to reach VND 12,000 billion (+77% year-on-year). The corresponding EPS is 1,775 VND.

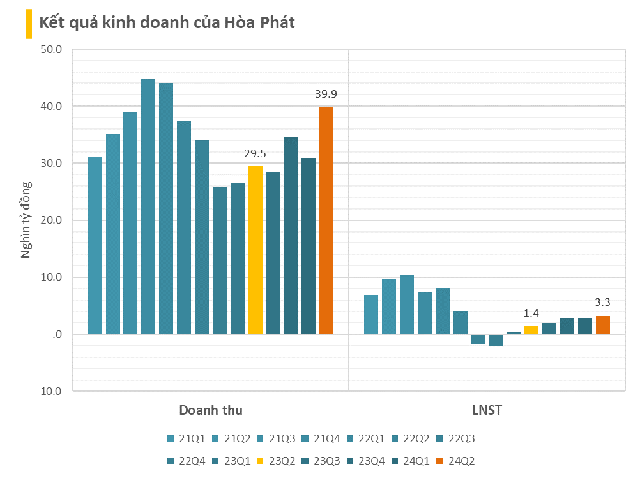

Previously, in Q2/2024, HPG recorded revenue of VND 39,600 billion (+34% year-on-year), with a consumption volume of 2.3 million tons (+28% YoY), including 1.27 million tons of construction steel (+62% YoY) and 723,000 tons of HRC (-5% YoY).

The consumption volume of construction steel continued to improve due to demand from public investment projects and real estate projects (especially in the North). However, the consumption volume of hot-rolled steel coils (HRC) slightly decreased compared to the previous quarter due to the European market’s import quota for HRC from each country in the “other countries” group (including Vietnam), making exports to this market more challenging in Q2.

In the first half of 2024, the company recorded revenue of VND 70,400 billion, up 25% compared to the same period last year, equivalent to completing 50% of the full-year plan.

“Steel Punch” with an investment of 85,000 billion VND may record revenue from Q1/2025

Regarding the Dung Quat 2 steel plant, Mr. Mai Van Ha, Director of Hoa Phat Dung Quat Steel, said that the project has currently completed 80% of the progress of phase 1 and 50% of phase 2. It is expected that phase 1 will complete the installation of equipment for the hot-rolled steel coil production line in mid-September 2024, after which the company will proceed with cold testing and equipment calibration. According to the current progress, phase 1 is expected to produce the first test batch of hot-rolled products by the end of 2024.

VDSC assesses that the project’s construction progress is in line with expectations, and DQ02 may start generating commercial products and recognizing revenue in Q1/2025.

VDSC anticipates that the plant will operate with a relatively high efficiency in 2025 (80% for phase 1, equivalent to 2.2 million tons). Accordingly, HPG’s HRC output in 2025 is projected to reach 5 million tons (+67% year-on-year), meeting ~40% of Vietnam’s HRC demand.

It is known that the Hoa Phat Dung Quat Gang Steel Integrated Production Complex has a scale of 280 ha, with a total investment of VND 85,000 billion. The design capacity is 5.6 million tons of high-quality hot-rolled steel coils (HRC) per year. According to the plan, phase 1 of the project will be operational in Q1/2025, and phase 2 will be completed and operational in Q4/2025. To ensure the project’s progress as planned, hundreds of contractors are working day and night on the construction and equipment installation on the site.

By design, the blast furnace volume of the Dung Quat 2 project is 2,500m3, double that of Dung Quat 1, resulting in lower energy consumption. The project was initiated in Q1/2022. Once completed in Q1/2025, Hoa Phat’s crude steel production capacity is expected to exceed 14.5 million tons per year, including 8.6 million tons of HRC.

The Billionaire’s Iron Fist: Tran Dinh Long’s $3.6 Billion Steel Punch

The Hoa Phat Dung Quat 2 Integrated Steel Complex is a behemoth of an operation, spanning 280 hectares of land and boasting a staggering investment of 85,000 billion VND. With a design capacity of 5.6 million tons of high-quality hot-rolled steel coils annually, this complex is a testament to the scale and ambition of Hoa Phat’s operations.

The Battle for Domestic Steel: A Timely Defense

The steel industry is crying out for support. Experts agree that now, more than ever, it needs a boost from policy mechanisms to enhance its product competitiveness and safeguard against imports.