Vietnam’s trade has come a long way from a struggling nation with a persistent trade deficit to now boasting a vibrant economy with impressive export turnover and surpluses.

From Import-Dependent to Export Powerhouse

Vietnam endured challenging early years of economic reforms in the 1980s, facing significant import demands, even for staple foods like rice. However, the Sixth National Congress of the Communist Party of Vietnam in 1986 charted a new course, identifying exports as one of the three key economic fronts, alongside food and consumer goods production. The Party’s mid-term conference in 1991 further solidified this strategy, emphasizing a focus on exports while working to replace imports with domestically produced goods.

This consistent strategic orientation has guided Vietnam’s export journey from 1986 until today, yielding remarkable results. Bold and prudent policies fueled Vietnam’s export growth in the initial stages, with double-digit annual increases from 1991 to 2010, peaking at over 15% in certain years. From 2011 to 2022, the average annual growth in the total value of Vietnam’s exports reached 12.6%.

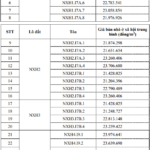

In 1991, Vietnam’s total export turnover stood at a modest $2.087 billion, while imports reached $2.338 billion. Fast forward to 2015, and Vietnam’s exports had soared to $162.016 billion, with imports at $165.775 billion—a staggering 77.63-fold increase in exports over that period.

By 2022, Vietnam’s export turnover had grown 2.29 times that of 2015 and a remarkable 177.9 times higher than in 1991.

These impressive figures showcase Vietnam’s remarkable export growth over the years, even during the challenging COVID-19 pandemic (2019–2021). From 1992 to 2022, Vietnam’s average annual export growth rate was an impressive 17.96%. This consistent performance has solidified Vietnam’s position as one of the world’s fastest-growing exporters for over three decades.

Vietnam’s textile industry has been a key manufacturing and export sector for many years.

Additionally, from 2016 to 2022, Vietnam’s economy achieved seven consecutive years of trade surpluses. This trend continued into 2023, a notable achievement for a developing country with significant import needs and limited competitiveness in processed goods in the international market.

Vietnamese goods are now present in nearly 200 countries and territories worldwide, including major and demanding markets such as the US, Japan, and the EU.

Over the last three decades, Vietnam’s export strategy has undergone a fundamental shift, moving away from a reliance on raw materials and semi-processed goods to a focus on processed and manufactured products. This evolution has not only contributed significantly to GDP growth and improved the trade balance but also enhanced the quality of economic growth, created jobs, expanded economic integration, and elevated Vietnam’s standing on the global stage.

Aiming for Record Heights

The COVID-19 pandemic caused a dip in trade growth in 2022, but this was understandable given the global health crisis. However, by early 2024, Vietnam’s trade was poised to rebound and reach new heights.

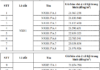

According to the General Department of Vietnam Customs, the country’s total import and export turnover in the first seven months of 2024 exceeded $440 billion, a 17.2% increase, equivalent to over $63 billion per month, compared to the same period in 2023. Considering the annual trend of higher trade volumes in the latter part of the year, the full-year import and export turnover for 2024 could reach $780–790 billion and even approach the $800 billion mark—a record high.

In an interview with the Cong Thuong Newspaper, Dr. Le Quoc Phuong, former Deputy Director of the Center for Industry and Trade Information under the Ministry of Industry and Trade, emphasized that the goal is not just about achieving export turnover for 2024 but also maintaining long-term momentum. Despite being a poor country with limited competitive products, Vietnam has risen to become one of the top 20 economies in terms of trade volume. Many Vietnamese products, such as rice, pepper, and textiles, are among the world’s top exports, cementing the country’s status as an export powerhouse. Dr. Phuong stressed the importance of meeting the stringent standards of international markets without delay.

Vietnam’s trade performance has been a bright spot for the economy.

With the signing of various FTAs, tariff barriers have been lowered, but non-tariff barriers, such as technical standards and food safety regulations, have become more prominent. Market requirements, such as the EU’s anti-IUU fishing regulations, the EU’s anti-deforestation measures, and food safety standards in Japan and South Korea, have intensified competition for Vietnamese goods. This trend is expected to become even more stringent, forcing businesses to adapt or risk falling behind.

To mitigate risks, businesses should also diversify their markets, exploring niche markets like the Middle East, Africa, and South America, in addition to traditional markets. This strategy helps reduce dependence on a single market and provides a buffer against potential disruptions.

In 2025, the Ministry of Industry and Trade aims to increase export turnover by approximately 6% and maintain a trade surplus of around $15 billion. Additionally, the Ministry will expedite negotiations for the Comprehensive Economic Partnership Agreement (CEPA) between Vietnam and the United Arab Emirates (UAE) and leverage a range of promotion activities, both online and offline, to capitalize on opportunities presented by implemented FTAs.

Industrial Production in Thanh Hoa Booms

In August, businesses in Thanh Hoa province continued their efforts to sustain production activities, actively overcoming challenges related to raw materials and input costs. They focused on seeking and expanding new markets, which resulted in a significant boost to industrial production in the region.

“Vietnam’s Triple Threat: Outpacing Singapore’s Growth in 2023”

The World Bank predicts that Vietnam’s economy will grow by 6.1% in 2024, showcasing the country’s resilience and potential. With a vibrant business environment and a growing domestic market, Vietnam is an attractive prospect for investors and entrepreneurs alike. The country’s economic growth is expected to be driven by a combination of factors, including a robust export sector, increasing domestic consumption, and strategic government initiatives. This positive outlook underscores Vietnam’s position as an emerging market and a key player in the Southeast Asian region.