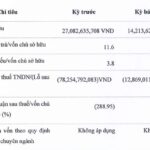

North Star Holdings JSC announced its business results for the first six months of 2024 with a loss of nearly VND 783 million, compared to a loss of over VND 1 billion in the same period last year.

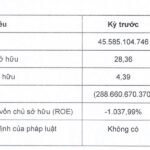

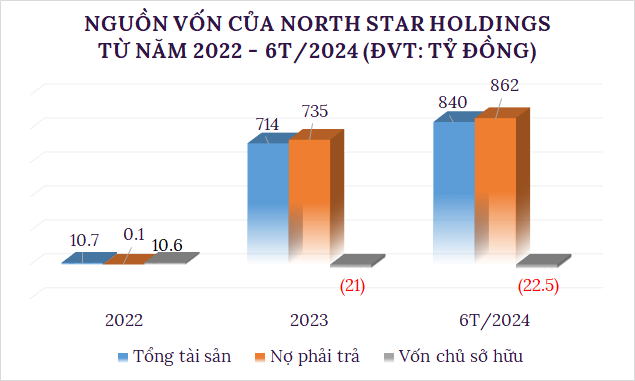

With continuous failure to generate profits, as of June 30, North Star Holdings’ equity was negative VND 22.5 billion. Its debt increased to over VND 862 billion, a 29% rise compared to the same period in 2023; of which, bond debt stood at approximately VND 333 billion, a 50% reduction.

In the first half of this year, North Star Holdings spent over VND 36 billion on bond interest payments for the NSTCH2324001 bond.

The NSTCH2324001 bond was issued on April 14, 2023, with a value of VND 671 billion, a 16-month term, maturing on August 14, 2024, and an interest rate of 14% per annum. To date, the Company has fully redeemed this bond after 26 partial buybacks.

Source: Compiled by the author

|

North Star Holdings was established on October 17, 2006, and is headquartered at 237 Linh Nam, Vinh Hung Ward, Hoang Mai District, Hanoi. Its initial chartered capital was nearly VND 10 billion, with founding shareholders including Ms. Nguyen Thi Hoa (30%), Ms. Luong Bich Huong (30%), and Mr. Le Thanh Tung (40%).

Currently, Mr. Le Xuan Luc serves as the Company’s CEO, and its chartered capital is VND 48 billion. The headquarters has been relocated to the CX3 office building in the Ao Sao urban area, Thinh Liet Ward, Hoang Mai District, Hanoi.

Surprising Facts About North Star Holdings – The Company’s Recent Failed Bond Issuance

The Heiress and Senior Executive of Phat Dat Want to Sell Millions of PDR Shares

PDR stock is currently down 14% since the beginning of 2024. A concerning decline, but a potential opportunity for savvy investors to enter a promising market. With a strategic approach, this stock could offer a unique entry point and a chance to diversify. A well-timed investment could see a significant rebound, offering a profitable future for those willing to take a calculated risk.