In Saigontel’s reviewed consolidated financial statements for the first half of 2024, HoSE-listed Saigon Telecommunications Technology JSC (Saigontel, code SGT) recorded net revenue of nearly VND361 billion, a 25% decrease compared to the same period last year. Gross profit, after deducting cost of goods sold, stood at VND79 billion, a 22% year-on-year decline.

Among the expenses, it is notable that finance costs increased by VND5 billion to nearly VND45 billion post-review, a 16% increase compared to the previous year. Saigontel attributed this rise to additional provisions for investment in accordance with regulations, resulting in a 12.6% increase in finance costs compared to the self-prepared report.

On the other hand, share of profits from associates decreased from VND3.64 billion to VND3.46 billion after the review. Similarly, the share of losses from other activities also reduced from VND12.18 billion to VND11.62 billion.

As a result of these changes, Saigontel’s post-review net profit decreased from VND18.6 billion to VND13.4 billion, a 40% drop compared to the first six months of 2023.

For the full year 2024, Saigontel maintains its ambitious plan with a revenue target of VND4,000 billion, representing a 205.5% increase compared to the previous year, and a projected pre-tax profit of VND450 billion, a significant 490.5% jump from the actual performance in 2023.

Thus, with a pre-tax profit of VND21.84 billion in the first half of 2024, Saigontel has accomplished 4.9% of its full-year 2024 plan.

Saigontel misses profit target by 28% post-review

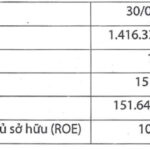

As of the end of the second quarter of 2024, Saigontel’s total assets amounted to VND7,182.5 billion, a slight decrease from VND7,191 billion reported in the self-prepared financial statements. Short-term receivables decreased from VND1,529 billion to VND1,473 billion after the review.

In addition to the decline in business performance, Saigontel also experienced a negative operating cash flow of VND229.8 billion in the first half of 2024, compared to a positive cash flow of VND265.3 billion in the same period last year.

Moreover, during this period, the investment cash flow was negative at VND46.85 billion, while the financial cash flow was positive at VND256.6 billion, mainly due to increased borrowings to compensate for the operating cash flow deficit.

Regarding the capital structure, it is worth noting that there were changes in financial borrowings after the review. Specifically, short-term borrowings increased from VND1,603 billion to VND1,607 billion, while long-term borrowings decreased from VND2,021 billion to VND2,017 billion.

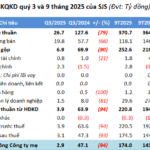

“DIC Corp Reports 55% Drop in First-Half Year Profit After Audit”

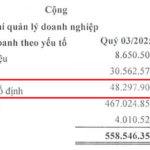

DIC Corp. is proud to announce that we have achieved 27.6% of our annual revenue target and approximately 2% of our annual profit goal. While we have a long way to go, this is a testament to the hard work and dedication of our team. With our innovative strategies and unwavering commitment, we are confident in our ability to surpass these milestones and achieve even greater success in the coming months. Stay tuned as we continue to strive for excellence and make our mark in the industry.

Sure, I can assist you with that.

## From the Start of 2024, Becamex (BCM) Successfully Raises 1.8 Trillion VND in Bond Issuance

Becamex (BCM) has successfully issued its fourth bond series, BCMH2427003, raising 500 billion VND with a 3-year maturity. This latest issuance brings the company’s total bond proceeds to an impressive 1.8 trillion VND, showcasing their strong financial standing and the market’s confidence in their offerings.