| A series of 6 consecutive declines in TLG stock |

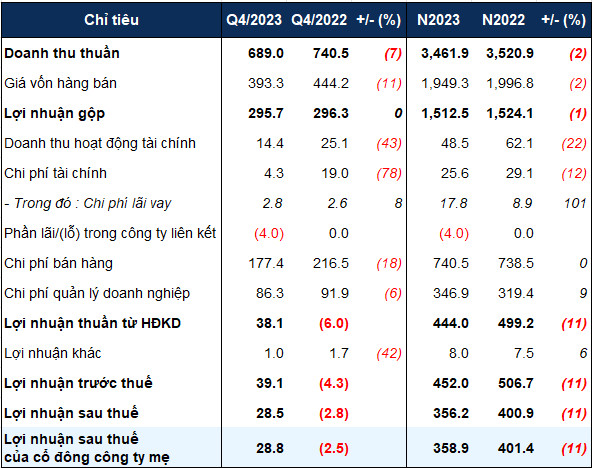

In Q4 2023, TLG’s net revenue reached VND 689 billion, a 7% decrease compared to the same period last year. Due to a faster decrease in cost of goods sold, gross profit remains at VND 296 billion; gross profit margin improved from 40% to 43%.

In this period, financial revenue dropped 43% to VND 14 billion, but financial expenses decreased by 78% to VND 4 billion. Similarly, selling and administrative expenses also decreased. Thanks to that, Thiên Long achieved a net profit of VND 29 billion, a significant improvement compared to the VND 3 billion loss in the same period.

However, excluding the Q4 2022 loss due to extraordinary marketing expenses, Q4 2023 is the lowest profit quarter for TLG in the past 9 quarters, since Q4 2021.

|

Q4 and Full-Year 2023 Business Results of Thiên Long

(Unit: Billion VND)

Source: TLG, compiled by the author

|

For the whole year 2023, TLG’s net revenue reached VND 3,462 billion and net profit was VND 359 billion, a decrease of 2% and 11% respectively compared to the previous year, achieving 87% of the revenue plan and 90% of the profit target.

The company announced that the overall purchasing power in 2023 decreased significantly compared to the previous year, both in domestic and international markets. However, the company implemented sales programs to maintain revenue and market share. In addition, the company also invested in brand development and research of new products, which increased costs and impacted profitability.

By the end of 2023, Thiên Long’s total assets reached VND 2,808 billion, a decrease of VND 61 billion compared to the beginning of the year. The company holds VND 690 billion in cash and bank deposits, a decrease of 10%; inventory reached VND 855 billion, a decrease of 8%.

In terms of balance sheet, the payable debt is VND 714 billion, a decrease of nearly VND 200 billion compared to the beginning of the year, mainly due to the payment of nearly VND 117 billion in dividend. Short-term borrowings, mainly from commercial banks, increased to VND 250 billion, with the largest loan of nearly VND 101 billion from BIDV. Long-term loans at HSBC decreased by half to VND 33 billion.

From the end of August 2023 until now, TLG stock price has continuously decreased from VND 58,000/share to VND 47,000/share, corresponding to a 23% decrease.

|

TLG Stock Price in the Past 1 Year |