The market saw very little movement in the last week of August, just before the long holiday break. While liquidity declined significantly and scores did not rise much, with stocks maintaining high differentiation, experts did not consider this a worrying signal.

The market’s stagnation last week was expected as the VN-Index approached the old peak of 1300 points and a long holiday loomed. Investors temporarily limited transactions and selling pressure was not high. The index closed August at 1284 points, meaning only about 20 points more are needed for a breakthrough peak. Experts are leaning towards a positive scenario after the holiday, and the market is likely to reach a new high.

However, there are also a few opinions anticipating a weaker scenario, meaning the VN-Index will peak but fail to attract good capital flow, liquidity will not increase strongly, and it will fall into a “fake peak” or bull-trap scenario above the 1300-point threshold. Even in the weakest scenario, experts still expect the VN-Index to reach the 1320-1330 point range in the short term.

Regarding leading stocks, the Banking, Securities, and Real Estate sectors are still considered the best performers with many supportive stories in the short and medium term.

Nguyen Hoang – VnEconomy

The market continued to trade sideways with a very narrow range in the last sessions before the long holiday, and liquidity also weakened sharply. The ability to maintain differentiation remains, making the view that the market will explode beyond 1300 points after trading resumes next week dominant. What are your thoughts on this?

In the scenario where the index surpasses the June peak (around 1305 points), there is also a resistance region to note around 1330-1350. This could be where the index takes a “retest” turn.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

Initially, I thought the VN-Index would adjust to fill the gap increase, converging with the MA 50 and MA 100 regions. However, at this stage, the index has had seven sessions of tight price accumulation, along with gradually decreasing liquidity at the end of the accumulation phase, and the US stock market surpassing the peak, which will create a sense of excitement. Therefore, I assess the likelihood of a post-holiday explosion beyond 1300 points for the VN-Index as very high.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

After a sharp increase from the bottom area of around 1185 points, the VN-Index has slowed down, moving sideways with less vibrant trading activities. The resistance zone of around 1280 – 1300 points shows a significant latent supply, where many distribution sessions with high liquidity appeared, so the index will tend to fluctuate and adjust.

However, the bright spot is that the declining sessions did not trigger a decisive selling state, the breadth of red codes was not large, and there was still buying power supporting the lower price regions, helping the index avoid deep declines. With the momentum currently tilting towards the buying side, I believe the VN-Index still has many opportunities to conquer the 1300-point threshold.

Le Duc Khanh – Analysis Director, VPS Securities

I still lean towards the scenario that the market will break through after the holiday. However, a surge in 1 – 2 sessions to the 1290 – 1300-point region or beyond could lead to a “breathless” phenomenon in the following sessions. Overall, the upward trend remains dominant.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

For more than a week recently, after entering the supply region of 1280-1300 points, the market has slowed down, creating a tug-of-war with low volatility and decreasing volume. Midcap stocks positively adjusted with weak selling pressure, while large-cap stocks still gained points to maintain the score. This development is leaning towards the possibility of an explosion beyond 1300 points after the holiday. However, I noticed that the tug-of-war here is not commensurate with the strong previous upward momentum, so we need to closely observe the buying power (reflected through volume). If it surpasses but is not accompanied by high volume, we need to pay attention to the possibility of a fake breakthrough and subsequent adjustment.

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

The market traded sideways with a very narrow range last week before the holiday, and liquidity also weakened sharply compared to before. The trading movements last week could reflect investors’ growing anxiety, with unclear orientations making supply and demand relatively balanced with average transaction values.

However, I think this is quite normal after the market has experienced two strong rising weeks. This could be a resting period before conquering the 1,300 level of the VN-Index. If we look at the overall picture, we should note that the upward trend next week is likely to continue, but in the context that we are still in a long-term upward trend starting from the beginning of November 2023, the differentiation between stocks will be more intense in the coming time, as the driving force for the market is no longer as strong as in the early years.

I believe that the bottom-fishing demand last week was not strong enough to show investors’ enthusiasm or optimism about the future, so being more selective with stocks and balancing the cash-stock portfolio will help investors be in a safer position in the coming trading weeks.

Nguyen Hoang – VnEconomy

In a beautiful scenario, if the VN-Index breaks through the peak successfully, how high do you project it can go?

Le Duc Khanh – Analysis Director, VPS Securities

In an upward trend from now until the end of September and the fourth quarter of 2024, a rise to the 1350 – 1400-point region and even better is still possible. In the short term, a surge within September could be from 1300 – 1350 points. If we only talk about next week, the 1300 – 1320-point threshold can be expected.

After successfully conquering the short-term peak of around 1300 points, the VN-Index will have the opportunity to maintain its upward momentum to the 1330-point threshold before facing significant fluctuation pressure again.

Nghiem Sy Tien

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

In the scenario where the index surpasses the June peak (around 1305 points), there is also a resistance region to note around 1330-1350. This could be where the index takes a “retest” turn. If the “retest” is positive with weak selling pressure, we can expect the upward momentum to continue towards higher resistance regions. However, if it is accompanied by strong selling pressure, there could be a deeper decline.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

If the VN-Index breaks through the peak successfully, I have two scenarios:

i) If the VN-Index breaks out with strong liquidity and rising prices, sustained buying power, and a “test” of the old peak of around 1300 with a non-strong declining candle and low liquidity, then the destination of this upward movement is towards the region of around 1372 points.

ii) If the VN-Index breaks out with weak liquidity and thin buying power, along with a quick and strong adjustment back to the region below 1300, then the probability of this breakout being a “bulltrap” is high, and I assess that this “break” will stop at around 1320 points.

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

In the optimistic scenario where the VN-Index breaks through the peak successfully, we need to consider many factors to assess the market’s growth potential. In Rong Viet Securities’ August strategy report, we stated, “Estimated EPS (cumulative 12 months) for the whole market has grown by 10% YoY as of the end of the second quarter. For the whole of 2024, we estimate that the market’s EPS growth can reach 14 -18% YoY, driven by the Banking and Real Estate sectors, while other sectors continue the stable growth trend.”

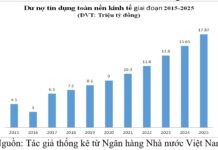

The Banking group is expected to maintain its positive trend thanks to the expansion needs of the economy, supporting credit growth in 2024, which could reach 14%-15% YoY. It is projected that the scale of bad debts will slightly decrease by the end of the year due to the economic recovery, thereby reducing the pressure from new bad debts and accelerating the handling of existing bad debts.

In the real estate sector, large enterprises such as Vinhomes (VHM), Khang Dien (KDH), and Nam Long (NLG) are actively delivering products that have been launched, while many enterprises are promoting the implementation of new projects due to high housing demand. Low-interest rates are expected to continue, creating favorable conditions for real estate businesses in capital mobilization and business development.

In addition, the government’s strong support policies, including the Law on Real Estate Business (amended), the Law on Housing (amended), and the Law on Land (amended), which took effect from August 1, 2024, are also making important contributions to the recovery and sustainable development of the real estate market.

With these factors, I believe that the Banking and Real Estate sectors will continue to recover and develop, although the final result will depend on the specific factors of each particular stock.

Le Duc Khanh – Analysis Director, VPS Securities

The leading group is likely to be large-cap stocks, the VN30 group, and notably the Banking and Securities groups. Capital flow has not increased much while the general market has slightly increased, indicating that key stocks still dominate and attract the attention of investors.

Nguyen Hoang – VnEconomy

The phenomenon of large-cap stocks such as VIC, VHM, and the Banking group taking turns to increase prices kept the VN-Index fluctuating positively last week. However, no stock was really strong and sustainable, only increasing alternately for 1-2 sessions. Mid-cap and small-cap stocks also differentiated significantly, and short-term profits were very thin. Which group of stocks do you expect to lead the market in the breakout scenario?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

In the breakout scenario, I believe that the Banking group is most likely to lead the market and create a spillover effect on other stock groups. In fact, the increase among Banking stocks has been quite differentiated recently, and there is still room for this group to break through further thanks to the expected favorable profit prospects. In addition, the Securities sector is notable due to the expected upgrade after the Ministry of Finance and SSC strive to remove obstacles related to “pre-funding.”

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

Although the signal of excited buying power has slowed down after the previous sharp increase, capital flow still shows rotational movement in pillar stocks. This is a positive signal reflecting the market’s confidence in the upcoming upward trend. At the same time, this capital flow will play a role in maintaining the rhythm and supporting the index when entering a short-term fluctuation phase. In the context of a lack of information, fundamental large-cap stocks are expected to lead the index to conquer the old peak.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

Looking from the beginning of this recovery phase, we can see that the leading groups are the Securities and Real Estate sectors, supported by the Banking group when the other two groups adjust or accumulate. I still assess that the Securities and Real Estate groups will be the main driving force for the market’s breakout scenario, along with some large-cap stocks to enhance the strength of this “break.”

I believe that the bottom-fishing demand last week was not strong enough to show investors’ enthusiasm or optimism about the future, so being more selective with stocks and balancing the cash-stock portfolio will help investors be in a safer position in the coming trading weeks.

Nguyen Thi Thao Nhu

Nguyen Thi Thao Nhu – Senior Director of Individual Customers, Rong Viet Securities

According to our strategy report, the business results of listed companies in the first half of the year recorded a recovery and growth trend in most sectors. Especially, from the second quarter, the growth in scale, improved asset turnover, and profit margins were evident. Estimated EPS (cumulative 12 months) for the whole market has increased by 10% YoY as of the end of the second quarter. For the whole of 2024, EPS for the whole market is expected to grow by 14% – 18% YoY, driven mainly by the Banking and Real Estate sectors, while other sectors continue the stable growth trend.

The Banking group is expected to maintain its positive trend thanks to the expansion needs of the economy, supporting credit growth in 2024, which could reach 14%-15% YoY. It is projected that the scale of bad debts will slightly decrease by the end of the year due to the economic recovery, thereby reducing the pressure from new bad debts and accelerating the handling of existing bad debts.

In the real estate sector, large enterprises such as Vinhomes (VHM), Khang Dien (KDH), and Nam Long (NLG) are actively delivering products that have been launched, while many enterprises are promoting the implementation of new projects due to high housing demand. Low-interest rates are expected to continue, creating favorable conditions for real estate businesses in capital mobilization and business development.

In addition, the government’s strong support policies, including the Law on Real Estate Business (amended), the Law on Housing (amended), and the Law on Land (amended), which took effect from August 1, 2024, are also making important contributions to the recovery and sustainable development of the real estate market.

With these factors, I believe that the Banking and Real Estate sectors will continue to recover and develop, although the final result will depend on the specific factors of each particular