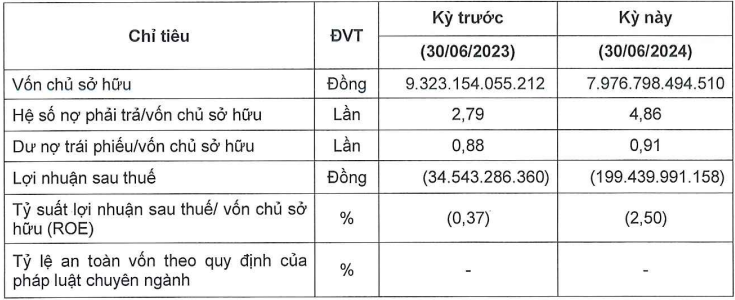

As of June 30, 2024, Hung Thinh Quy Nhon’s total assets exceeded VND 46.7 trillion, a more than 32% increase compared to the same period last year. Despite a 49% rise in payables, nearing VND 38.8 trillion, bond debt decreased by nearly 12%, to just under VND 7.3 trillion.

|

Hung Thinh Quy Nhon’s Business Results for the First Half of 2024

Source: HNX

|

Hung Thinh Quy Nhon currently has four bond issues outstanding, totaling VND 6,500 billion, with interest rates ranging from 9.5% to 11% per annum. All bonds were issued by Hung Thinh Quy Nhon in 2021, with varying maturity dates. Two issues, totaling VND 2,500 billion, will mature in late June 2025, while the remaining two, valued at VND 4,000 billion, will mature in the first half of 2026.

Last July, Hung Thinh Quy Nhon repurchased VND 500 billion of the HTQNB2124001 bond issue and VND 500 billion of the HQNCH2124002 bond issue ahead of schedule.

The HTQNB2124001 bond was issued on February 3, 2021, with a 42-month term and a planned maturity date of August 3, 2024. It carries an interest rate of 10.5% per annum.

The HQNCH2124002 bond, on the other hand, was issued on April 2, 2021, with a term of 1,219 days and a maturity date of August 3, 2024. It offers a 10.5% interest rate for the first four interest periods, 11% for the next four periods, and 11.5% for the final four periods. The bonds are secured by the use rights and assets attached to the land of the Hai Giang Merry Land project, as well as movable assets, receivables arising in the future from or related to the canal area of the project, and other legal security measures owned by Hung Thinh Quy Nhon and/or third parties, with a payment guarantee from Hung Thinh Land.

Hung Thinh Quy Nhon is currently developing a complex project comprising offices, hotels, and apartments, including a high-rise residential and commercial area, at 1 Nguyen Tat Thanh Street, Ly Thuong Kiet Ward, Quy Nhon City, Binh Dinh Province (commercially known as Grand Center Quy Nhon).

The Rise of a Real Estate Giant: Unveiling the Mystery Behind the Soaring Success and the Enigmatic 100,000 Billion Dong Portfolio.

The real estate company boasts an impressive profit of over 4,400 billion VND in the first half of the year, ending a long streak of consecutive years of losses.