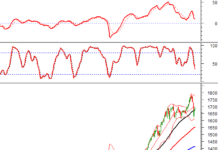

Last week, the VN-Index witnessed only slight fluctuations around the reference point, ending the week 0.1% lower at 1,283 points. VIC (+6.4%), VHM (+4.4%), and TCB (+4.2%) were the main supportive factors in the market. In contrast, BID (-3.2%), VCB (-0.8%), and HPG (-2.1%) applied downward pressure on the index.

Foreign investors sold a net amount of VND 824.8 billion on the three exchanges. Trading liquidity decreased by 12% to VND 15,646 billion/session.

Foreigners reduced selling intensity in August. Data: Vietstock.

In summary, the VN-Index experienced a volatile August, plunging at the beginning of the month to its latest bottom of around 1,180 points. Subsequently, the index formed a bottom and ascended in a V-shape to the 1,280-1,290 range. Buying force recovered as the market witnessed a surge in the 1,240-1,250 region, but it weakened as the index approached the previous peak of 1,300 points.

Most sessions exhibited low liquidity during the rapid market ascent, indicating that investors remained cautious and fearful. In such a low-liquidity uptrend, most sectors took turns to rise again mildly. The oil and gas, chemical, technology, telecommunications, and rubber sectors all witnessed slight increases of 1-2%.

The real estate sector played a leading role from the market bottom, with a 5.1% increase in August. Heavily beaten-down stocks like DXG, PDR, and VHM quickly rebounded. However, news of inspections of DIG at the end of the month halted the short-term uptrend of this sector.

As the holiday concludes, there are high hopes for a vibrant market. VNDirect Securities’ analysts believe that recent domestic and international macroeconomic developments are reinforcing a positive scenario for the stock market in the final quarter of the year.

Specifically, recent US macroeconomic data has “dismissed” the market’s concerns about a “recession” in the world’s largest economy. The possibility of a “soft landing” for the US economy, coupled with the Federal Reserve’s willingness to cut interest rates, is positive for the global financial market.

Domestically, exchange rate pressure has eased, and the State Bank’s policy easing moves have gradually had a positive impact on investor sentiment in the stock market. With significant risks subsiding, VNDirect experts suggest that investors will shift their focus to promising growth stories and be willing to accept higher risks for higher expected profits. This will drive money flow into the stock market.

With the “holiday mood” fading away, VNDirect forecasts that money flow will soon return and push the main index towards the strong resistance zone of 1,290-1,310 points. The market behavior in this zone will determine whether the accumulation phase is complete and a short-term uptrend has begun.

Therefore, investors can continue to hold stocks and await market confirmation at the 1,290-1,310 resistance zone. The focus sectors for the coming week include banking, securities, real estate, and automobile distribution.

Nhat Viet Securities (VFS) forecasts two market scenarios for September. In the first scenario, selling pressure weakens, and positive news boosts the market after the long holiday. A strong bullish candle with high liquidity breaking through the 1,290-1,300 resistance confirms this upward trend.

“Real Estate Credit Continues to Grow Positively”

“As 2024 commenced, the market witnessed a rebound, coupled with declining interest rates. This prompted banks to actively extend real estate loans, particularly for projects with sound legal foundations. “