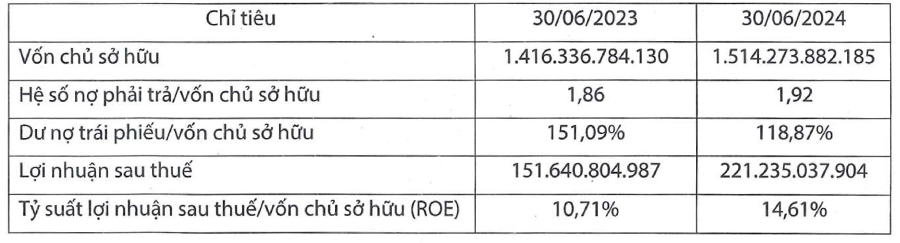

The company’s post-tax profit for the first half of the year exceeded VND 221 billion, a 46% increase compared to the same period last year.

Equity increased slightly by 6% to over VND 1,500 billion. The debt-to-equity ratio rose from 1.86 to 1.92, indicating total debt of approximately VND 2,900 billion. The bond debt-to-equity ratio decreased from 1.51 to 1.19, implying outstanding bond debt of about VND 1,800 billion, a 25% reduction compared to the previous year.

|

Trung Nam Solar Power’s financial indicators for the first half of 2024

Source: HNX

|

Currently, the company has 12 bond issues outstanding, including the codes TBSCH1926002, TBSCH1928012, TBSCH1926005, TBSCH1928006, TBSCH1928007, TBSCH1928008, TBSCH1928009, TBSCH1928010, TBSCH1926003, TBSCH1926004, TBSCH1928011, and TSP119001. The total value of the bond issues is VND 2,100 billion, with maturities ranging from 2026 to 2028.

As of the end of 2023, the company’s outstanding bond debt was nearly VND 1,900 billion. In the first half of 2024, the company fulfilled its interest payment obligations on time for the bond issues and repurchased a portion of the principal of 3 bond issues, TBSCH1926003, TBSCH1926004, and TBSCH1926005, totaling VND 69.5 billion on February 2, 2024.

Recently, the company also adjusted the interest rate for this bond issue. Specifically, prior to the bondholders’ meeting resolution on August 15, the interest rate clause applied was the CIB reference rate (for large customers) for a 60-month term from MB plus a margin of 2.43% from August 1, 2024, or when the company was downgraded between February 15 and July 31, 2024.

Following the change, the interest rate for the bond issue from August 1 to December 31, 2024, will be fixed at 9.25% per annum. Thereafter, from January 1, 2025, the interest rate applied will be the CIB reference rate for a term of over 60 months from MB plus a margin of 2.43%, and there will be no mention of debt rescheduling.

In July 2024, the bondholders of Trung Nam Solar Power also approved several matters related to the transfer of secured assets for this bond issue.

Firstly, it was agreed that Trung Nam Renewable Energy Joint Stock Company (a subsidiary of Trungnam Group and also the guarantor of the bond issue) would be allowed to transfer all 19.9 million shares of Trung Nam Solar Power. The recipients of the shares were Asia Renewable Energy Development Investment Company Limited (18 million shares) and Mr. Nguyen Thanh Binh (1.9 million shares).

Secondly, Mr. Vu Nhat Thanh and Ms. Dao Thi Minh Hue, who are also guarantors of the bond issue, were permitted to transfer their respective holdings of 10,000 and 90,000 shares of Trung Nam Solar Power to Mr. Nguyen Dang Khoa.

Consequently, Asia Renewable Energy, Mr. Binh, and Mr. Khoa became guarantors of the bond issue, using 18 million, 1.9 million, and 100,000 shares of Trung Nam Solar Power as collateral, respectively. All three will sign a mortgage contract with the managing organization.

“Dragon Village Announces Net Profit of Over VND 68.8 Billion for the First Half of 2024; Debt Stands at 6.7 Times Equity”

In the first half of 2024, Dragon Village reported a net profit of over VND 68.8 billion, almost 3.9 times higher than the same period last year. This impressive growth showcases the village’s thriving economy and promising future prospects.