Illustration

Agribank Savings Interest Rates for Individual Customers

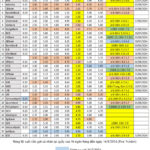

According to the latest survey in early September 2024, deposit interest rates for individual customers at the Vietnam Bank for Agriculture and Rural Development (Agribank) currently range from 1.7% to 4.8% per annum.

Specifically, the 1-month and 2-month terms have an interest rate of 1.7% per annum, while the 3-month to 5-month terms are at 2.0% per annum. Deposits with a term of 6 to 11 months will earn an interest rate of 3.0% per annum.

For terms ranging from 12 to 18 months, customers will receive an interest rate of 4.7% per annum. Meanwhile, the highest interest rate of 4.8% per annum is offered for the 24-month term.

Non-term deposits or those using payment accounts will earn a low-interest rate of 0.2% per annum.

Agribank Deposit Interest Rates for Individual Customers in September 2024

|

Term |

VND |

|

Non-term |

0.2% |

|

1-month |

1.7% |

|

2-month |

1.7% |

|

3-month |

2.0% |

|

4-month |

2.0% |

|

5-month |

2.0% |

|

6-month |

3.0% |

|

7-month |

3.0% |

|

8-month |

3.0% |

|

9-month |

3.0% |

|

10-month |

3.0% |

|

11-month |

3.0% |

|

12-month |

4.7% |

|

13-month |

4.7% |

|

15-month |

4.7% |

|

18-month |

4.7% |

|

24-month |

4.8% |

|

Payment Account |

0.2% |

Source: Agribank

Agribank Deposit Interest Rates for Corporate Customers

For corporate customers, Agribank’s deposit interest rate framework is currently between 1.6% and 4.2% per annum.

Specifically, the 1-month and 2-month terms are offered at an interest rate of 1.6% per annum, while the 3-month to 5-month terms are at 1.9% per annum. Deposits with a term of 6 to 11 months will earn an interest rate of 2.9% per annum.

The longest terms, ranging from 12 to 24 months, are offered the highest interest rate of 4.2% per annum.

For non-term deposits and payment accounts of corporate customers, Agribank applies an interest rate of 0.2% per annum.

Agribank Interest Rates for Corporate Customers in September 2024

|

Term |

VND |

|

Non-term |

0.2% |

|

1-month |

1.6% |

|

2-month |

1.6% |

|

3-month |

1.9% |

|

4-month |

1.9% |

|

5-month |

1.9% |

|

6-month |

2.9% |

|

7-month |

2.9% |

|

8-month |

2.9% |

|

9-month |

2.9% |

|

10-month |

2.9% |

|

11-month |

2.9% |

|

12-month |

4.2% |

|

13-month |

4.2% |

|

15-month |

4.2% |

|

18-month |

4.2% |

|

24-month |

4.2% |

|

Payment Account |

0.2% |

Source: Agribank

The Stock Market “King” Returns to the Race?

The domestic stock market rallied with a positive boost from banking stocks, but there was a significant differentiation between individual stocks.

The New ACB Interest Rates for August 2024: Maximize Your Savings with the Highest Online Deposit Interest Rates for 12 Months; Average Lending Rates for New Loans Stand at 6.87%/year.

Introducing ACB’s exclusive online savings account, offering an industry-leading interest rate for personal depositors. With a minimum commitment of 12 months, you can enjoy a competitive 6.87% annual interest rate on your savings. This exceptional rate applies to new loans, providing a smart financial strategy for those seeking lucrative returns.

The Latest Savings Account Interest Rates for August 2024

Recent statistics from the Ho Chi Minh City branch of the Vietnam Bank Association revealed that, over a 3-week period (from July 29 to August 16), 15 out of 36 banks had increased their savings deposit interest rates, while 4 banks lowered theirs.