LPBank’s Counter Savings Interest Rates for Individual Customers in September 2024

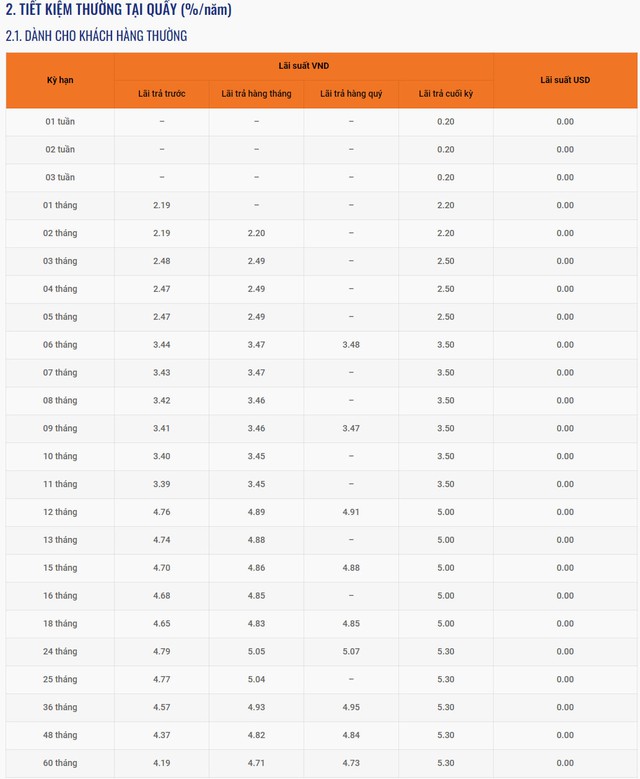

A survey at the beginning of September found that the State Commercial Joint Stock Bank of Vietnam (LPBank) offered an annual interest rate of 0.2% – 5.3% for individual term deposits at the counter with interest paid at maturity.

Specifically, short-term deposits with tenors of less than 1 month are subject to an interest rate of 0.2% per annum; tenors of 1 and 2 months earn an interest rate of 2.2% per annum; tenors of 3 – 5 months are at 2.5% per annum; tenors of 6 – 11 months are at 3.5% per annum; and tenors of 12 – 18 months have a deposit interest rate of 5% per annum.

The highest interest rate for regular individual customers depositing at the counter is 5.3% per annum, applicable to tenors of 24 – 60 months.

In addition to the interest payment at maturity option, LPBank also offers flexible interest payment options for customers to choose from, including: interest payment in advance, monthly interest payment, and quarterly interest payment.

Especially, for new or renewed deposits with a tenor of 13 months and a minimum amount of VND 300 billion, customers will be offered a preferential interest rate of 6.5% per annum.

LPBank’s Counter Deposit Interest Rate Table for Regular Individual Customers in September 2024

Source: LPBank

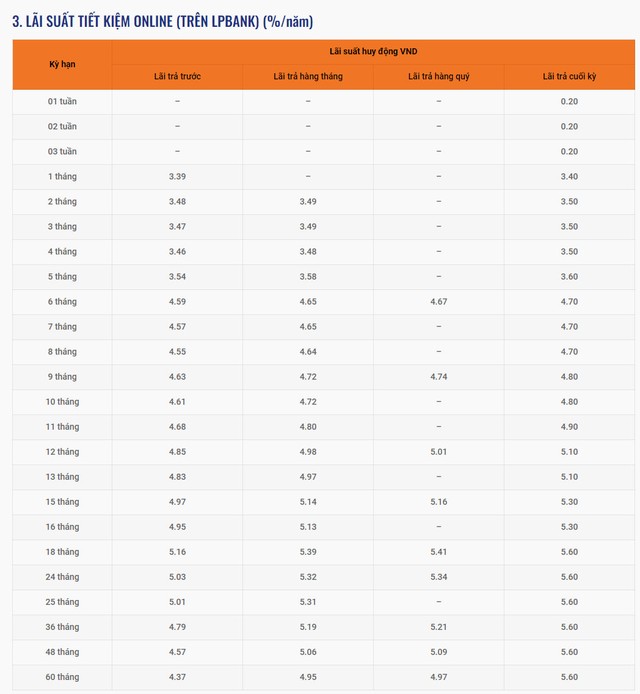

LPBank’s Online Savings Interest Rates for Individual Customers in September 2024

For individual customers’ online deposits, LPBank offers an interest rate range of 0.2% – 5.6% per annum, which is 0.3% – 0.8% per annum higher than counter deposits for many tenors.

Specifically, short-term deposits with tenors of less than 1 month have a common interest rate of 0.2% per annum; tenor of 1 month earns an interest rate of 3.4% per annum; tenors of 2 – 4 months are at 3.5% per annum; tenor of 5 months is at 3.6% per annum; tenors of 6 – 8 months are at 4.7% per annum; tenors of 9 – 10 months are at 4.8% per annum; 11 months is at 4.9% per annum; 12 – 13 months is at 5.1% per annum; and 15 – 16 months is at 5.3% per annum.

The highest interest rate for individual customers’ online deposits is 5.6% per annum, applicable to tenors of 18 – 60 months.

In addition to interest payment at maturity, LPBank also offers other interest payment options for online deposits, such as: interest payment in advance, monthly interest payment, and quarterly interest payment.

LPBank’s Online Deposit Interest Rate Table for Individual Customers in September 2024

Source: LPBank

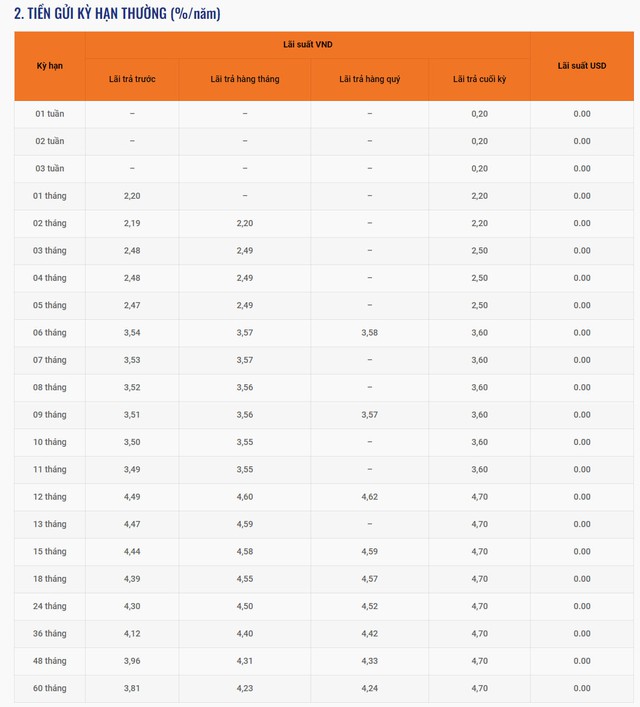

LPBank’s Savings Interest Rates for Business Customers in September 2024

In early September, the interest rate for business customer deposits at LPBank ranged from 0.2% to 4.7% per annum for interest payment at maturity.

Accordingly, deposits with tenors of 1 week, 2 weeks, and 3 weeks are subject to an interest rate of 0.2% per annum; tenors of 1 – 2 months earn an interest rate of 2.2% per annum; tenors of 3 – 5 months are at 2.5% per annum; and tenors of 6 – 11 months are at 3.6% per annum.

Currently, the highest interest rate offered to business customers at LPBank is 4.7% per annum, applicable to tenors of 12-60 months.

In addition to interest payment at maturity, LPBank also offers alternative interest payment options for business customers, including: interest payment in advance, monthly interest payment, and quarterly interest payment.

LPBank’s Counter Deposit Interest Rate Table for Regular Business Customers in September 2024

Source: LPBank

Enhancing NIM: Tackling the Ongoing Challenge

Speaking to the Bank Times journalist, Dr. Le Duy Binh, Executive Director of Economica Vietnam asserted that restoring the net interest margin (NIM) to a higher level is a challenging task for the banking system. The immediate solution lies in focusing on optimizing operating costs, enhancing governance capabilities, accelerating digital transformation, and increasing the CASA ratio to improve NIM.

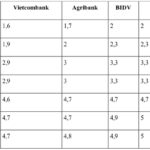

“The Big Four Banks: September’s Best Deposit Rates”

The interest rates offered by Agribank, BIDV, VietinBank, and Vietcombank currently hover around the 1.6-4.8% annual mark. Among the Big 4 banks, Vietcombank consistently offers the lowest interest rates to its customers.