In a recent filing with the regulatory body, Mr. Dang Thanh Tam, Chairman of the Board of Management of Kinh Bac City Development Holding Corporation (code: KBC), registered to transfer the ownership of 86.55 million KBC shares, equivalent to 11.27% of the company’s charter capital. The transaction is expected to take place between September 9 and October 8, with the share transfer taking place through the Vietnam Securities Depository and Clearing Corporation.

Mr. Tam currently owns 138.67 million KBC shares, representing 18.06% of the charter capital. Following this transaction, his ownership in the company will decrease to 52.12 million shares, or 6.79%.

Meanwhile, DTT Investment and Development Joint Stock Company does not currently hold any KBC shares. After the transaction, the company will become a new major shareholder of Kinh Bac, with an ownership ratio of 11.27%. This company was newly established in January this year with a charter capital of VND 490 billion. Mr. Dang Thanh Tam holds a 90.4% ownership interest and is also the director and legal representative of the company.

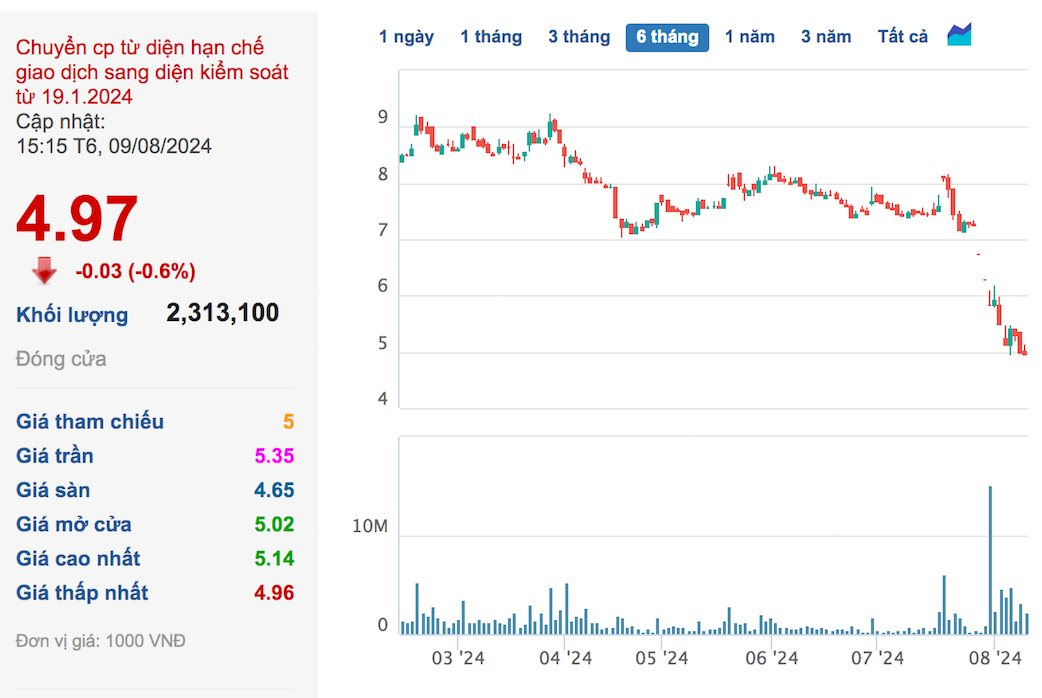

The daughters of the Chairman of the Board of Phat Dat registered to sell 1.7 million PDR shares.

Phat Dat Real Estate Development Joint Stock Company (code: PDR) announced that, from September 6 to October 4, Ms. Nguyen Thi Minh Thu, daughter of Mr. Nguyen Van Dat, Chairman of the Board, registered to sell 1.09 million PDR shares to meet personal financial needs.

The transaction will be executed by matching or agreement, expected to reduce Ms. Thu’s ownership in PDR to nearly 6 million shares, equivalent to 0.68% of the company’s charter capital.

During the same period and for the same purpose, Mr. Nguyen Tan Danh, Vice Chairman of the Board of Phat Dat and son of Chairman Nguyen Van Dat, registered to sell 617,754 PDR shares, expected to reduce his ownership to 3.4 million shares, equivalent to 0.39% ownership.

It is noteworthy that the number of shares registered for sale is equal to the number of shares that the daughters of the Chairman of PDR bought three months ago (from June 3 to June 5) at a price of around VND 26,000 per share.

At the close of the trading session on August 30, PDR stood at VND 21,550 per share, meaning that Ms. Thu and Mr. Danh could collect nearly VND 37 billion. Based on the current price, the transaction may incur a loss of about 17%.

Right after the holiday, from September 4 to October 3, Thai Binh Investment Company, an entity related to Mr. Nguyen Duc Thuan, a member of the Board of Directors of Nam Long Investment Joint Stock Company (code: NLG), registered to sell 3.5 million NLG shares to restructure its investment portfolio.

If the transaction is successful, the company will reduce its ownership in NLG from 21.14 million shares, or 5.49%, to 17.64 million shares, or 4.58%.

Previously, from July 24 to August 22, the organization also registered to sell 3.8 million NLG shares, but only 435,500 shares were sold due to the stock price not meeting expectations.

Alongside the planned and completed transactions, there have also been cases where leaders and major shareholders registered to sell but were unable to do so. Mr. Nguyen Quang Bao, Hanoi Branch Director and Deputy General Director of Vietcap Securities Joint Stock Company (code: VCI), recently reported selling only 1.5 million VCI shares out of the registered 2.8 million shares, equivalent to 54%. The transaction was executed from July 30 to August 28.

Based on the average purchase price of VND 45,260 per share, it is estimated that Mr. Bao could have earned more than VND 68.5 billion from this deal.

Following the transaction, the Vice General Director of Vietcap reduced his ownership in the company from 0.72% to 0.38%, corresponding to a decrease from 3.2 million shares to 1.68 million shares. When asked about the reason for not completing the transaction, Mr. Bao cited unfavorable market conditions.

Why Does Dang Thanh Tam Want to Sell Over 86 Million KBC Shares?

“Recently, Kinh Bac City Development Holding Corporation, chaired by Mr. Dang Thanh Tam, successfully issued KBCH2426001 bonds, raising VND 1,000 billion to restructure its debts. This move showcases the company’s financial strategy and commitment to sustainable growth, ensuring its long-term success and solidifying its position as a leading real estate developer in Vietnam.”