According to Articles 1 and 2 of Decree 103/2024/ND-CP, households and individuals, when permitted by competent state agencies to change the land use purpose to residential land, shall pay land use fees as follows:

The land use fees for the type of land after the change are as follows:

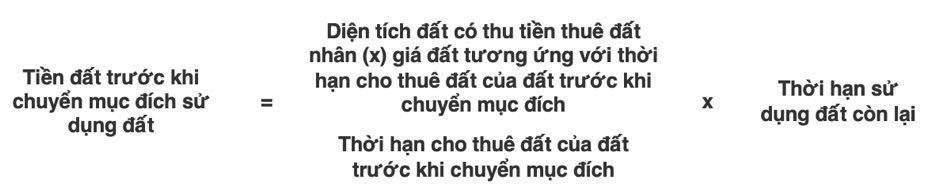

Land use fees and land rent before the change of land use purpose (hereinafter referred to as “pre-change land money”) shall be calculated as follows:

For land that was agricultural land before the change of purpose, which was allocated by the State to households and individuals without land use fee collection, or agricultural land legally transferred by households and individuals, which was allocated by the State to another household or individual without land use fee collection, the pre-change land money shall be calculated by multiplying the land area by the corresponding agricultural land price in the Land Price Table.

For land that was agricultural land leased by the State with land rent paid once for the entire lease term, the pre-change land money shall be calculated as follows:

Where the land price corresponding to the lease term of the pre-change land is the land price in the Land Price Table for calculating the land rent paid once for the entire lease term.

The remaining land use term shall be determined by subtracting (-) the time of land use before the change of purpose from the land allocation or lease term (=).

If the remaining land use term calculated according to this point is not a full year, it shall be calculated in months. Any period of less than a month shall be calculated as one month if it is 15 days or more, and no land use fee shall be charged for any period of less than 15 days.

For land that was agricultural land leased by the State on an annual land rent payment basis, the pre-change land money shall be equal to zero (= 0).

In case the land use fee for the type of land after the change of land use purpose is smaller than or equal to the pre-change land money, the land use fee at the time of change of land use purpose shall be equal to zero (=0).

The City of Ho Chi Minh will Adjust the Collection Rates in the New Land Price Table

The newly proposed land price schedule has increased prices by as much as 5 to 51 times compared to the previous schedule. However, the authorities will collaborate and report to the People’s Committee of Ho Chi Minh City, proposing that the government review and adjust the tax rates and collection amounts as necessary to ensure equitable financial obligations regarding land matters.

The Tax Department Wins Lawsuit Against Enterprise

The Ho Chi Minh City High People’s Court ruled in favor of the Can Tho Tax Department’s appeal, dismissing the lawsuit filed by Joint Stock Company 720. The Tax Department is now proceeding with the necessary steps to reclaim the outstanding land rent amounting to over VND 25 billion from Joint Stock Company 720.