Notably, other extraordinary profits stood at VND 4,578.6 billion, compared to a loss of over VND 222 billion in the same period last year. As a result, net profit reached VND 5,401 billion (a decrease of VND 74 billion compared to the self-prepared report), while the company posted a loss of VND 1,386 billion in the same period last year.

With the profit in the first half of the year, Vietnam Airlines’ accumulated loss decreased to VND 35,907.6 billion, and negative equity stood at VND 11,633 billion.

According to HVN’s explanation, the consolidated business results for the first six months of 2024 showed a significant increase compared to the same period last year, mainly due to profitable operations of the parent company and its subsidiaries. The company also recorded a significant increase in other income due to debt forgiveness for its subsidiary, Pacific Airlines, as per the agreement for aircraft return.

Vietnam Airlines attributes the improved performance to the recovery of the transportation market and the company’s proactive implementation of a series of solutions, including flexible management of transportation supply, maximum cost reduction, and negotiation of service price reductions. These measures significantly enhanced production and business operations, especially in the first quarter of 2024, which is the peak season for the aviation industry. However, due to seasonality, April and May are the lowest months for the domestic aviation market, resulting in less effective production and business results compared to the first quarter.

As of the end of the second quarter, Vietnam Airlines’ total assets amounted to VND 57,732 billion, a slight decrease compared to VND 57,791 billion in the self-prepared report.

Total liabilities stood at VND 69,364.4 billion, slightly higher than the self-prepared report’s figure of VND 69,324 billion. The company’s financial borrowings were over VND 23,355 billion, a reduction of approximately VND 3,500 billion compared to the beginning of the year.

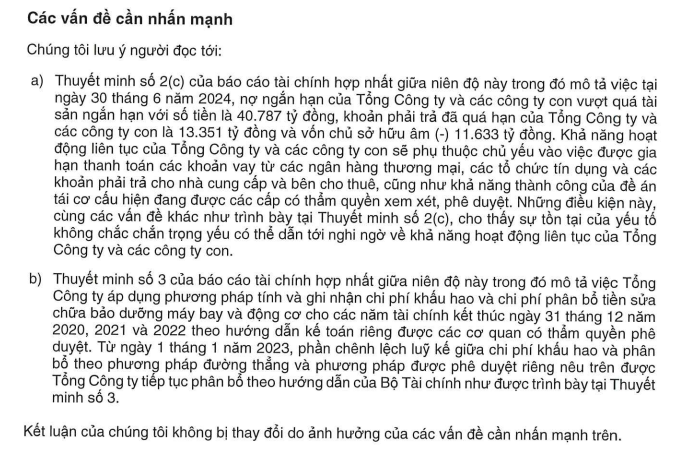

In the audited semi-annual financial statements for 2024, KPMG, the auditing firm, highlighted that as of June 30, 2024, the company and its subsidiaries’ short-term debts exceeded short-term assets by VND 40,787 billion, with overdue payables of VND 13,351 billion and negative equity of VND 11,633 billion.

Source: HVN

The company’s ability to continue as a going concern depends mainly on obtaining extensions for debt repayments from commercial banks and credit institutions and for payables to suppliers and lessors. It also relies on the success of the restructuring plan currently under review and approval by the competent authorities. These matters indicate the existence of a material uncertainty that may cast significant doubt on the company’s ability to continue as a going concern.

In the notes on the going concern assumption, Vietnam Airlines stated that its Board of Directors and executive management regularly assess the impacts and implement coping strategies to address financial difficulties to maintain the company’s going concern status.

Regarding operational management, the company has adjusted its aircraft fleet plan, flight schedules, and routes to align with market demand, peak seasons, and post-COVID-19 travel and tourism needs to optimize operating costs and maintain its market share in domestic passenger transportation.

In terms of working capital, the company has been negotiating with commercial banks to obtain additional credit limits to support its production and business activities. As of June 30, 2024, the total credit limit signed with commercial banks was VND 29,800 billion. Additionally, the company has access to a refinancing loan of VND 4,000 billion from banks according to Circular No. 04/2021/TT-NHNN dated April 5, 2021.

During this period, banks agreed to continue providing credit limits for short-term loans that the company had repaid on time and met the conditions and regulations. Vietnam Airlines is confident in maintaining the current credit limits in the following year and ensuring the repayment of maturing loan principals.

For long-term borrowings and finance leases, the company has successfully negotiated with some creditors to restructure the repayment schedule for maturing loans. Many partners have agreed to reduce prices (for aircraft leasing and maintenance) or defer or extend payment schedules (for aircraft leasing, air traffic control services, and flight-related services).

Regarding the restructuring plan, Vietnam Airlines has completed its development and reported it to the relevant authorities. The plan is currently under review by the competent authorities, who are working to address difficulties and approve the proposals. The plan includes a comprehensive set of solutions to address the company’s current financial situation:

Improving the results of aviation transportation operations by implementing synchronized solutions to enhance adaptability, expedite recovery, and efficiently utilize production capacity.

Restructuring assets and divesting capital from subsidiaries and associated companies to increase income and cash flow.

Preparing the necessary conditions for implementing the plan to issue shares to increase owner’s equity after obtaining approval from the competent authorities.