|

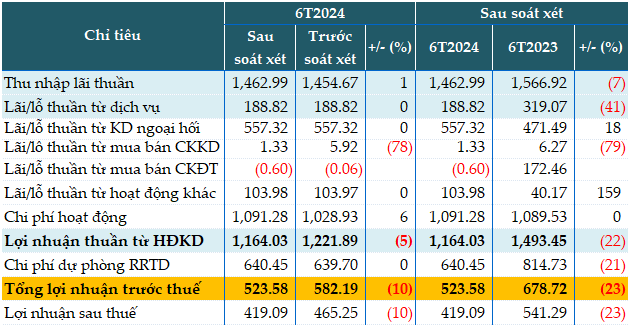

Reviewed Consolidated BCTC for 6M 2024 of ABB. Unit: Billion VND

Source: VietstockFinance

|

According to the reviewed report, ABB’s net interest income increased by over 8 billion VND (+1%) compared to the previous self-prepared report, reaching nearly 1,463 billion VND.

Profit from securities trading activities decreased to 1.3 billion VND, a reduction of 4.5 billion VND (-78%) compared to the self-prepared report.

Operating expenses after the review increased by 63 billion VND (+6%) compared to the self-prepared report, recording 1,091 billion VND, similar to the same period last year.

As a result, the reviewed profit-before-tax for the first half decreased by 10% compared to the self-prepared report, reaching nearly 524 billion VND, a 23% drop compared to the same period last year.

Regarding the full-year plan of 1,000 billion VND in profit before tax, ABB achieved 52% after two quarters.

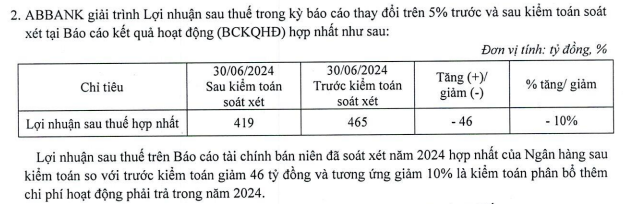

The reviewed profit-after-tax for the first half also decreased to 419 billion VND, a 10% drop compared to the previous self-prepared report.

Source: ABBank

|

As of 30/06/2024, the Bank’s total assets decreased by 6% from the beginning of the year to 152,175 billion VND, while the self-prepared report showed 152,145 billion VND.

Loans to customers and customer deposits remained unchanged from the self-prepared report, recording 91,037 billion VND and 85,515 billion VND, respectively, a decrease of 7% and 15% compared to the beginning of the year.

“Revenue Down, Management Costs Up: Saigonres Swings to Loss Post-Review”

Saigonres witnessed a significant shift in its financial standing, moving from a reported profit of 2.3 billion VND to a staggering loss of 23.3 billion VND after a thorough review. This drastic change can be attributed to reduced revenue and soaring business management expenses, highlighting the challenges faced by the company.

“Vingroup’s Acquisition of VinWonders Nha Trang Proves Profitable with Nearly 2,000 Billion VND in Earnings: Every 2 VND in Revenue Generates Over 1 VND in Profit”

“In February 2024, Vingroup announced its acquisition of a 99% stake in VinWonders Nha Trang from its partners. The total cost of the transaction amounted to 10.319 trillion VND. This move showcases Vingroup’s strategic expansion and their commitment to developing captivating attractions within Vietnam.”

Travel to Multiple Destinations and Win Big This 2-9 Holiday

During the 4-day holiday period from September 2nd, Khanh Hoa province recorded an estimated 175,200 tourist arrivals, a 14.6% increase compared to the same period last year. The province’s tourism director, Ms. Nguyen Thi Le Thanh, shared that approximately 403,000 visitors were recorded at various attractions, marking a 15% rise from the previous year.