Vietnamese manufacturers continued to register expansions in output and new orders midway through the third quarter. Although growth in each of these indices eased from the near-record highs seen in July, the rates of increase remained strong and led to the sharpest rise in purchasing activity in over two years. However, a less positive sign was that employment fell for the first time in three months. Meanwhile, both input costs and output charges continued to increase in August, but reports of competitive pressures suggested that rates of inflation and price rises had softened significantly over the month.

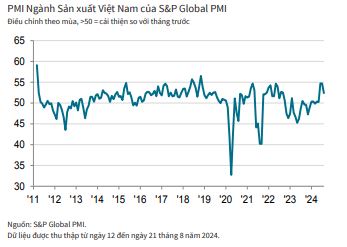

The S&P Global Vietnam Manufacturing Purchasing Managers’ Index (PMI) posted at 52.4 in August, down from 54.7 in July but still indicative of a strong improvement in business conditions midway through the third quarter.

Operating conditions have now improved in each of the past five months. The health of the manufacturing sector has been highlighted by continued strong increases in output and new orders, with respective growth rates remaining rapid despite easing from the especially sharp rises seen in June and July.

Improved customer demand led to higher new orders, and companies responded by raising production accordingly. In some cases, the relative stability of prices helped firms secure new work, while there were also mentions of improved international demand. New export orders increased for the fifth month running.

The relatively stable price environment was also evident in the input cost and output charge data. While both series continued to increase, the rates of inflation softened markedly from July and were among the weakest in the current four-month sequence of rising expenses. Some manufacturers reported higher raw material prices, but the rate of increase softened amid competitive pressures. Meanwhile, lower oil prices led to reduced transportation costs in some instances.

Strong new order intakes and easing cost pressures encouraged goods producers to step up their purchasing activity in August. Moreover, the rate of increase quickened for the fourth month in a row and was the sharpest since May 2022.

The inputs bought were often utilized directly in production, leading to a further reduction in pre-production inventories. Stocks of finished items also decreased, as completed products were shipped to clients to fulfill sales orders.

In contrast to the trend for purchasing, employment fell for the first time in three months amid reports of employee departures and the non-replacement of temporary staff. The reduction in workforce numbers at a time of rising new order volumes led to a further increase in backlogs of work during August.

Outstanding business rose for the third month running, and the rate of increase was unchanged from July. Suppliers’ delivery times shortened for the third month running, although the degree of improvement was only marginal as several firms reported delays with international shipments.

Manufacturers remained optimistic that output would increase over the next 12 months, expecting customer demand to continue to improve and new orders to rise. However, business confidence eased for the second month running, and the degree of positivity was the lowest since January.

Commenting on the latest survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, said: “As expected, Vietnam’s manufacturing sector saw output and new orders increase at slower rates than the especially rapid rises seen in June and July. Such growth rates are always difficult to sustain, and the fact that growth remained sharp means there are few reasons to be concerned on this front. One issue that firms are facing is falling employment, and this is making it harder to complete projects, as backlogs also rise. We would hope to see employment start to rise again in the coming months.

On a more positive note, inflation softened markedly in August, with both input costs and output charges rising at much weaker rates. Indeed, this was cited as a factor helping new order intakes remain on an upward trajectory. Overall, the second half of the year is off to a good start for the sector, with plenty to play for in the months ahead.”

Double Delight as Exchange Rates Cool Off

The Vietnamese currency market has witnessed a positive trend recently, with the VND/USD exchange rate cooling off. The USD has dropped below the 25,000 VND mark. On August 29, 2024, the State Bank of Vietnam (SBV) set the daily reference exchange rate at 24,221 VND per USD, an increase of 9 VND from the previous session, but a decrease of 29 VND from the previous week. The SBV’s trading arm maintained the buying rate for USD at 23,400 VND while increasing the selling rate to 25,382 VND per USD.

The Tumultuous Tale of the 200 and 500 Dong Banknotes

Despite legal requirements for service providers and merchants to accept small denomination coins of 200 and 500 dong, in reality, very few places are willing to accept these coins. This discrepancy between legal tender and practical acceptance presents a challenge for consumers and businesses alike.

Is the Gold Market Settling After a Turbulent Week?

After a string of impressive performances throughout the summer, with a 2% increase in July, analysts and traders tempered their optimism for gold in early September.