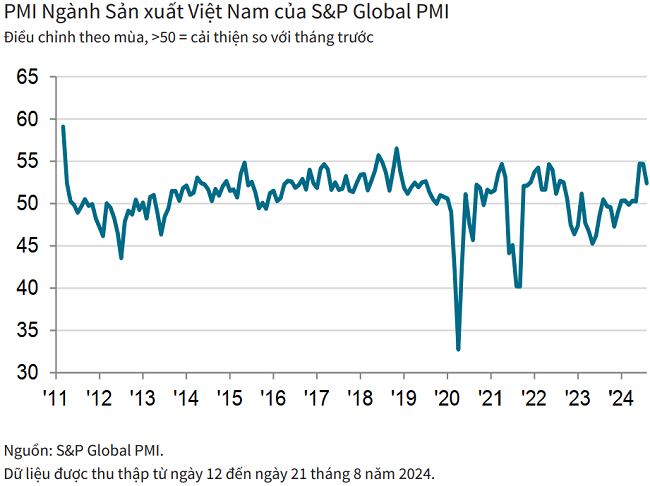

On September 4, S&P Global published the Purchasing Managers’ Index (PMI) report for Vietnam’s manufacturing sector, highlighting three key points: significant growth in output and new orders, easing inflationary pressures, and a slight dip in employment.

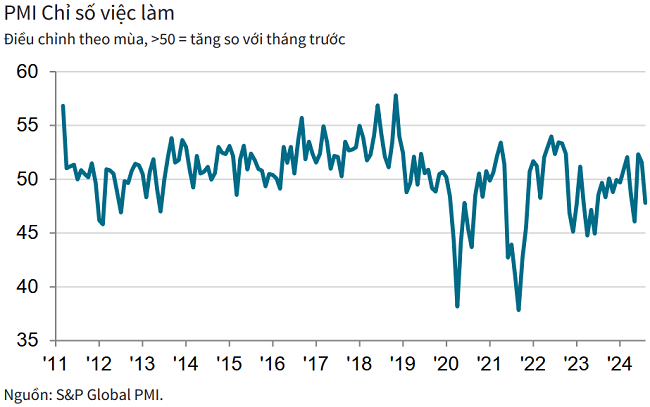

According to S&P Global’s report, Vietnamese manufacturers experienced a mid-Q3 boost in output and new orders, maintaining a strong growth trajectory despite a slower pace compared to July’s near-record levels. However, employment witnessed its first decline in three months, creating a slight blemish in the otherwise positive picture.

August saw a continuation of rising input costs and output charges, yet the rate of increase slowed considerably compared to previous months, indicating a welcome easing of inflationary pressures.

The S&P Global Vietnam Manufacturing PMI stood at 52.4 in August, down from 54.7 in July, but still indicative of robust business growth midway through Q3. Operating conditions have been consistently improving over the past five months.

The health of the manufacturing sector remains strong, with output and new orders continuing to rise at a rapid pace, albeit slightly slower than the exceptional rates seen in June and July. This sustained growth reflects the resilience and dynamism of Vietnam’s manufacturing industry.

“The increase in new orders was attributed to improved customer demand, with companies raising their output accordingly. In some cases, relatively stable pricing helped secure new business, and there were also mentions of enhanced international demand. New export orders increased for the fifth month in a row,” the report emphasized.

The relative stability in pricing was also evident in the input cost and output charge data. While both continued to rise, the rate of increase slowed significantly compared to July, indicating a potential easing of cost pressures on businesses.

Some manufacturers reported higher raw material prices, but the overall pace of cost increases slowed amid competitive pressures. Additionally, lower oil prices contributed to reduced transportation costs in some instances.

The robust increase in new orders and milder cost pressures encouraged manufacturers to step up their purchasing activity in August. The rate of growth accelerated for the fourth consecutive month, reaching its highest since May 2022.

Input buying often directly translates to production, and as a result, stocks of purchases continued to deplete. Finished goods inventories also decreased as products were shipped to customers to fulfill rising order demands.

In contrast to the expansion in purchasing activity, employment contracted for the first time in three months, with reports of employee departures and the non-renewal of temporary contracts.

This reduction in the workforce, coupled with rising new orders, led to a further increase in outstanding business in August, marking the third consecutive month of growth in this regard. The rate of increase remained unchanged from July, indicating a sustained challenge in managing workloads.

Suppliers’ delivery times shortened for the third month in a row, albeit marginally, as some international delivery delays persisted.

Manufacturers remained optimistic about future output, anticipating improved customer demand and expecting new orders to rise. However, business confidence eased for the second month in a row, registering the softest sentiment since January.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, noted that while Vietnam’s manufacturing sector witnessed a slowdown in output and new order growth compared to the exceptional levels of June and July, the sustained expansion highlights the industry’s resilience.

“One issue that companies are facing is a reduction in employment, which is making it more difficult to complete projects and leading to a rise in outstanding work. Hopefully, employment will pick up again in the coming months,” he added.

On a positive note, inflationary pressures appear to be easing, with input costs and output charges rising at a much softer pace in August. This could bode well for the sector’s performance in the coming months, providing some relief to businesses and consumers alike.

The Ultimate Guide to Motorcycle Insurance Claims: Your Step-by-Step to a Smooth Payout

The Ministry of Finance reports that in the first half of this year, the amount paid out for compulsory motor third-party liability insurance for motorbikes and scooters reached nearly VND 42 billion, accounting for almost 10% of the total premium revenue.

Unlocking the Potential: Exploring Opportunities to Enhance Vietnam-Japan Cross-Border Payments

The State Bank of Vietnam’s (SBV) working delegation, led by Deputy Governor Pham Tien Dung, conducted a comprehensive survey and market potential assessment in Tokyo, Japan. The aim was to identify opportunities to enhance efficient bilateral cross-border payment cooperation between Vietnam and Japan.