Baoviet Insurance Group reports pre-tax profit of VND 1,276 billion and net profit of VND 1,059 billion, up 9.4% over the same period in 2023

According to the reviewed consolidated financial statements for the first six months of 2024, Baoviet Insurance Group reported total revenue of VND 28,030 billion, equivalent to USD 1.1 billion. Pre-tax profit and net profit reached VND 1,276 billion and VND 1,059 billion, up 9.6% and 9.4%, respectively, compared to the same period in 2023. As of June 30, 2024, total assets amounted to VND 234,844 billion, up 6.2% from December 31, 2023.

The Parent Company’s total revenue reached VND 810 billion, with net profit of VND 580 billion, up 4.8% and 5.5%, respectively, compared to the same period in 2023, closely following the 2024 plan approved by the Annual General Meeting of Shareholders. As of June 30, 2024, the Parent Company’s total assets stood at VND 18,396 billion, with equity of VND 18,252 billion, up 2.9% and 3.3%, respectively, from December 31, 2023.

With its strong financial position and leading capital and asset scale in the insurance industry, Baoviet Insurance Group always fulfills its commitments to shareholders and enhances value for investors. According to the profit distribution plan, in 2024, the Group will allocate over VND 745 billion for cash dividend payments, equivalent to a dividend rate of 10.037% per par value share.

The life insurance business line reported total revenue of VND 21,558 billion, with a notable net profit of VND 630 billion, up 19.9% over the same period

In the first half of 2024, the insurance market witnessed positive signs of recovery, and Baoviet Life Insurance proactively seized this opportunity by enhancing the quality of its dedicated and professional services, always putting customers’ interests first. Baoviet Life Insurance launched several customer care programs, including gift redemption programs for loyal customers, scholarship grants for customers’ children who had received insurance benefit payments, “Enhancing Protection – Living a Healthy and Joyful Life,” and “Protecting the Whole Family for a Carefree Journey.”

Baoviet Life Insurance also affirmed its brand reputation as a leading Vietnamese insurer, earning the title of “Top 10 Reputable Life Insurance Companies” for eight consecutive years. They were also recognized as one of the Top 10 Innovative, Creative, and Efficient Enterprises in 2024 in the insurance industry. Additionally, they were awarded the “Best Life Insurance Company in Vietnam 2024” and acknowledged for bringing satisfaction and happiness to their customers.

The non-life insurance business line reported total revenue of VND 5,709 billion, a growth of 2.8%

In the first six months of 2024, Baoviet Non-life Insurance’s total revenue reached VND 5,709 billion, an increase of 2.8%, with a post-tax profit of VND 178 billion, up 18.4% over the same period in 2023.

To show appreciation to its customers, Baoviet Non-life Insurance launched attractive promotional programs. From now until December 31, 2024, Baoviet Non-life Insurance, in collaboration with Elite Fitness, offers valuable gifts to its members. All Baoviet Non-life Insurance customers who purchase insurance during this period will also receive attractive benefits, including free weekend workouts at Elite Fitness clubs, a 30% discount on membership cards, and a 20% discount on personal trainer packages.

Recently, Baoviet Non-life Insurance was honored with the “60 Years of Excellence Awards Insurance Vietnam 2024” by Global Banking & Finance Review. This award recognizes the company’s outstanding contributions over its 60 years of development and its commitment to serving multiple generations of customers and businesses.

The financial investment sector achieves positive results

Baoviet Securities Company (BVSC) reported total revenue of VND 532 billion and net profit of VND 116 billion in the first half of the year (actual figures), up 55.2% and 59.6%, respectively, compared to the same period in 2023. BVSC maintains its position as a leading securities company in the market and collaborates with numerous universities and training centers nationwide to nurture young talent and develop a high-quality workforce for the future market.

In the first six months of 2024, along with the recovery of the securities market, the operating performance of the open-ended funds showed positive growth. All three open-ended funds of Baoviet Fund Management Company (BVF) outperformed the reference index. BVF affirmed its position as one of the leading fund management companies in the industry by achieving growth in terms of managed asset scale, business results, and investment performance.

Giving back to the community: Baoviet Insurance Group organizes its annual blood donation drive

Baoviet Insurance Group’s blood donation program has contributed 3,000 units of blood

|

As part of its 60-year journey, Baoviet Insurance Group actively engages in community-building and regularly organizes meaningful activities to create a better and happier life for all. “Baoviet – For Your Belief” is the name of the Group’s annual blood donation drive, initiated in 2013. With a tradition of compassion and community-oriented missions, the blood donation drive has always been enthusiastically supported by Baoviet’s staff and consultants. Over the past decade, the program has collected more than 3,000 units of blood, contributing to the national blood bank. Baoviet Insurance Group aims to support the community and share the difficulties faced by the healthcare sector, instilling hope and optimism in patients in need of blood transfusions.

As Baoviet Insurance Group approaches its 60th anniversary (January 15, 1965 – January 15, 2025), it focuses its resources on optimizing its network advantages, diversity in business fields, and professionalism of each member unit within the Group. The Group aims to shape the future by allocating resources of over VND 100 billion to social security activities since 2020, focusing on key areas such as education, healthcare infrastructure improvement, housing support for the underprivileged, disaster relief, and support for COVID-19 prevention and control efforts.

SERVICES

“CapitaLand Development Launches ‘Steps of Love’ Campaign in Hanoi”

On August 27, 2024, CapitaLand Development (CLD) proudly launched its second annual “Steps of Love” campaign in Hanoi, in collaboration with the CapitaLand Hope Foundation (CHF) and Blue Dragon Children’s Organization. This initiative aims to unite the community in supporting underprivileged children and youth in Vietnam.

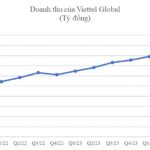

Viettel Global Announces H1 Profit Before Tax of VND 4,740 Billion, Leading Market Share in 7 International Markets

Viettel Global (VGI), a leading international investment corporation, has released its audited consolidated financial statements for the first six months of 2024, reflecting a slight improvement compared to its previously self-prepared reports.