Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 588 million shares, equivalent to a value of more than 13.7 trillion VND. The HNX-Index reached over 48.6 million shares, equivalent to a value of more than 960 billion VND.

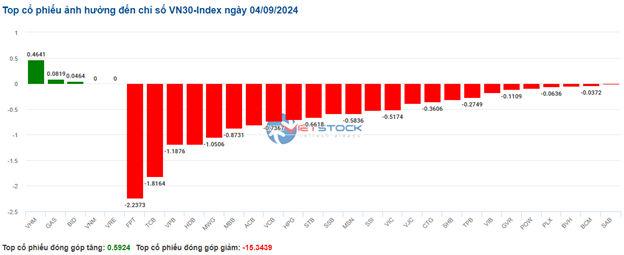

The VN-Index opened the afternoon session with buying power returning, helping the index recover, but sellers still dominated until the end of the session, causing the VN-Index to stay in the red. In terms of impact, VCB, VPB, FPT, and GVR were the most negative stocks, taking away more than 3 points from the index. On the other hand, VHM, GAS, CTG, and VRE were the most positive stocks, contributing over 2 points to the VN-Index.

| Top 10 stocks with the strongest impact on the VN-Index on 04/09/2024 |

The HNX-Index also followed a similar trajectory, with the index negatively impacted by SHS (-2.44%), MBS (-1.79%), NTP (-2.3%), and KSV (-1.59%)…

|

Source: VietstockFinance

|

The energy sector saw the biggest decline in the market, falling by -2.17%, mainly due to BSR (-2.51%), PVD (-2.73%), PVS (-0.96%), and PVC (-3.01%). This was followed by the telecommunications and information technology sectors, which fell by 1.88% and 1.24%, respectively. On the other hand, the healthcare sector saw the strongest recovery in the market, rising by 1.4%, mainly driven by TNH (+3.12%), IMP (+6.95%), DVN (+3.13%), and DHT (+0.29%).

In terms of foreign trading, they net sold over 822 billion VND on the HOSE exchange, focusing on DGC (139.93 billion), HPG (107.76 billion), FPT (106.05 billion), and VPB (94.01 billion). On the HNX exchange, foreigners net sold more than 28 billion VND, focusing on MBS (19.03 billion), SHS (16.58 billion), LAS (4.35 billion), and TNG (3.73 billion).

| Foreign Trading Buy – Net Sell Dynamics |

Afternoon Session: No Support for the Index Yet

Selling pressure was strong and quickly spread, dragging the indices into the red on the first trading day after the holiday. At the midday break, the VN-Index fell by 1.01%, settling at 1,270.96 points, while the HNX-Index dropped by 0.96% to 235.29 points. The market breadth tilted heavily towards sellers, with 492 declining stocks versus 167 advancing stocks.

The trading volume of the VN-Index reached nearly 299 million units in the morning session, equivalent to a value of over 7 trillion VND. The HNX-Index recorded a trading volume of over 26 million units, with a value of nearly 520 billion VND.

Large-cap stocks put significant pressure on the market, with the VN30-Index falling by more than 17 points, or 1.3%, to 1,314.19 points. Many stocks declined sharply, falling by more than 2%, including GVR, SSB, HDB, PLX, FPT, and TPB. The top 10 stocks with the most negative impact on the VN-Index were all from this group, taking away more than 7 points from the index. On the other hand, VHM, GAS, BID, and VNM were the few bright spots, managing to stay in positive territory, but their contribution was not significant.

Source: VietstockFinance

|

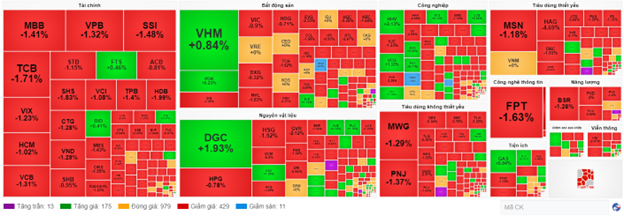

Almost all sectors were in the red, with telecommunications and energy plunging the most, falling by over 2%. This was mainly driven by large-cap stocks in these sectors, such as VGI (-2.51%), FOX (-1.61%), VNZ (-1.1%), CTR (-1.09%); BSR (-2.09%), PVS (-1.47%), PVD (-2.91%), etc.

The financial sector, which accounts for a large proportion of the market’s capitalization, also exerted considerable pressure on the indices, falling by 1.23%. Many stocks declined by over 1%, including VCB, CTG, TCB, VPB, MBB, ACB, STB, and HDB, among others.

In contrast, the healthcare sector was the only bright spot in the market, rising by 0.84%. This was led by stocks such as IMP (+6.61%), DTP (+3.88%), DMC (+5.25%), and MKP (+6.67%). However, several stocks in this group were still in negative territory, including DHG (-0.46%), TNH (-1.04%), DBD (-0.73%), and OPC (-1.26%), to name a few.

Foreigners net sold nearly 564 billion VND on the HOSE exchange in the morning session, focusing their sales on DGC (over 102 billion) and HPG (nearly 77 billion). On the HNX exchange, foreigners net sold nearly 22 billion VND, mainly offloading SHS shares.

10:30 am: Financial Group Under Heavy Selling Pressure, VN-Index in the Red

Strong selling pressure emerged at the start of the session, pushing the main indices below the reference levels. While buying interest resurfaced, sellers remained slightly dominant. As of 10:30 am, the VN-Index lost more than 10 points, trading around 1,273 points, while the HNX-Index fell by 1.73 points, trading around 235 points.

Most stocks in the VN30 basket faced intense selling pressure. Specifically, FPT, TCB, VPB, and HDB took away 2.23 points, 1.82 points, 1.19 points, and 1.18 points from the overall index, respectively. Conversely, VHM, GAS, and BID were the only three stocks that managed to stay in positive territory, but their gains were modest.

Source: VietstockFinance

|

The information technology sector recorded a sharp decline in the market. In particular, selling pressure was concentrated in two stocks: FPT, which fell by 1.63%, and CMG, which dropped by 1.57%.

Although the financial sector’s decline was not significant, it had the most negative impact on the indices due to its high weight in the market, accounting for over 34% of the total market capitalization. The sector witnessed a broad-based sell-off, with most stocks in the red, including MBB, VPB, SSI, TCB, and many others. Only a handful of stocks, such as FTS, BID, CSI, and VNR, managed to stay in positive territory, but their gains were minor.

On the other hand, the healthcare sector stood out as the only group in the green, extending its gains from the previous three sessions. However, the sector remained somewhat polarized, with nearly 30 stocks trading at the reference price. Specifically, stocks like IMP (+4.67%), DCL (+0.39%), DHT (+0.58%), and AMV (+3.33%) were in the green. In contrast, DHG (-0.56%), OPC (-3.35%), TNH (-1.04%), and DVM (-1.96%) were among the stocks facing selling pressure.

Compared to the opening, sellers became more dominant. There were 429 declining stocks (including 11 at the lower limit) and 175 advancing stocks (including 13 at the upper limit).

Source: VietstockFinance

|

Opening: VN30 Basket Weighs on VN-Index

The market opened on a negative note, with most sectors shrouded in red. In particular, the VN30 basket had the most significant negative impact, with most of its constituent stocks falling.

A slew of VN30 stocks witnessed sharp declines, including GVR, BCM, MWG, VRE, TCB, SSI, MSN, FPT, MBB, VPB, and CTG, among others.

The energy sector followed a similar trend, with most stocks in the red from the start of the session. Notable decliners included BSR (-1.67%), PVD (-1.64%), PVS (-0.98%), PVC (-1.5%), PVB (-1.71%), and POS (-4.55%), to name a few.

The telecommunications services sector also painted a gloomy picture, dragged down by large-cap stocks such as VGI (-2.51%), CTR (-1.25%), VNZ (-1.1%), and FOX (-0.86%). Additionally, a few small-cap stocks with negative impacts on the sector included FOC (-1.51%), YEG (-0.55%), and ELC (-1.46%), among others.

What Stocks to Pick After the 2-9 Holiday?

The recent market volatility and corrections present a prime opportunity for savvy investors to snap up potential stocks for the year-end rally, according to securities firms. This post-holiday dip is a chance to get in on the ground floor and position yourself for success as the market bounces back.