Galaxy Entertainment and Education JSC (abbreviated as Galaxy EE) recently disclosed its semi-annual financial statements for 2024 to the Hanoi Stock Exchange (HNX).

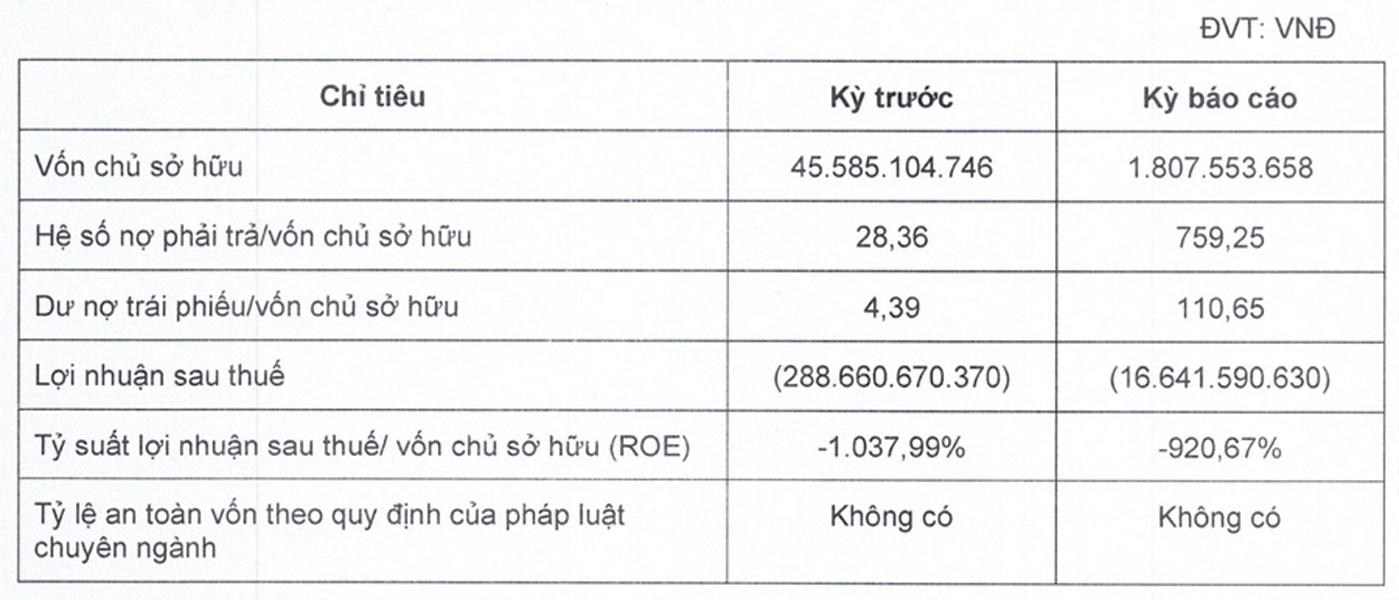

According to the report, Galaxy EE extended its losing streak with a net loss of over VND 16.6 billion in the first half of 2024. Prior to this, the company had incurred losses for three consecutive years, amounting to VND 473 billion in 2023, nearly VND 623 billion in 2022, and VND 371 billion in 2021. Cumulatively, from 2021 to the present, the company has lost more than VND 1,480 billion.

As a result of these consecutive losses, Galaxy EE’s equity capital significantly decreased from VND 847 billion to VND 260 billion in 2022, and further reduced to nearly VND 46 billion by the end of 2023. In the first six months of 2024, the company’s capital continued to decline sharply, leaving only over VND 1.8 billion.

Consequently, the debt-to-equity ratio as of June 30, 2024, surged to over 759 times, up from 28.36 times at the beginning of the year. This equates to a total debt of nearly VND 1,400 billion, including over VND 200 billion in bond debt.

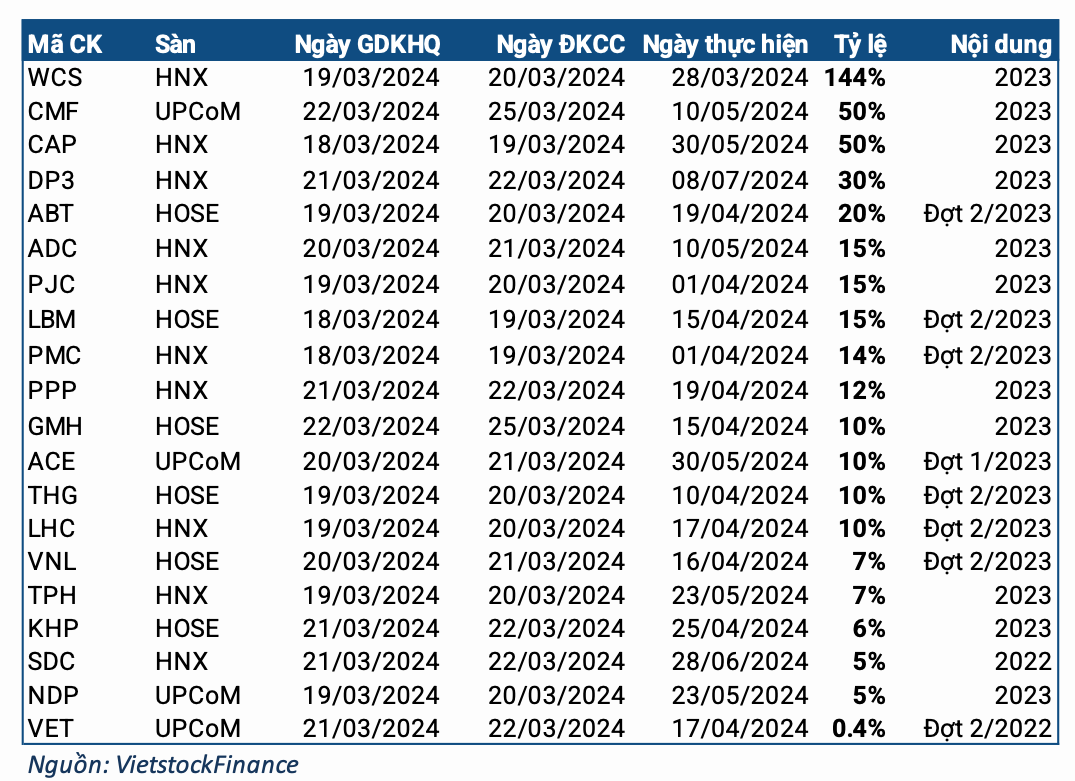

Source: HNX

According to HNX statistics, Galaxy EE has eight bond batches with the codes GMECH2123001 – GMECH2123008, totaling VND 200 billion in issuance value. In the first half of this year, the company fulfilled its interest payment obligations for these bonds.

These bonds were issued from May to December 2021, initially with a two-year term. However, on May 18, 2023, Galaxy EE agreed with bondholders to extend the term by another two years and increase the interest rate from 10% to 12%.

Additionally, Galaxy EE modified the collateral value. At the time of bond issuance, the collateral value was determined to be “at least 100% of the total par value of the circulating bonds and all accrued interest.” Following the change, this ratio was increased to 120%.

There were also adjustments made to the early bond repurchase option at the bondholder’s request. Prior to the change, bondholders had the right to request Galaxy EE to repurchase up to 50% of the bonds held before maturity at the end of the 12th month from the issuance date. Under the new arrangement, this period was extended to 33 months. Furthermore, from the 36th month after the issuance date, bondholders have the right to request the issuer to repurchase 100% of the bonds they hold.

Galaxy EE was established on May 17, 2013, with its primary business being the production of motion pictures, video films, and television programs. Galaxy operates as a conglomerate with a diverse ecosystem across various sectors, including Film Production and Distribution (Galaxy Studio), Online Movie Streaming Platform (Galaxy Play), Online Education Platform (Galaxy Education), Online Publishing and Media (Galaxy Media), and more.

Among these, Galaxy Studio is the largest film producer and distributor in Vietnam, with a plethora of renowned films to its credit. Additionally, Galaxy Studio owns and operates the Galaxy Cinema chain nationwide.

The company’s current legal representative is General Director Luong Cong Hieu. On February 1, 2023, Mr. Trinh Bang was appointed as the Chairman of the Board of Directors.

As per the latest update on the enterprise registration in December 2023, the company increased its charter capital from VND 1,350 billion to VND 1,362.1 billion. The shareholder structure comprises solely foreign investors.

Sure, I can assist you with that.

## From the Start of 2024, Becamex (BCM) Successfully Raises 1.8 Trillion VND in Bond Issuance

Becamex (BCM) has successfully issued its fourth bond series, BCMH2427003, raising 500 billion VND with a 3-year maturity. This latest issuance brings the company’s total bond proceeds to an impressive 1.8 trillion VND, showcasing their strong financial standing and the market’s confidence in their offerings.

The Heiress and Senior Executive of Phat Dat Want to Sell Millions of PDR Shares

PDR stock is currently down 14% since the beginning of 2024. A concerning decline, but a potential opportunity for savvy investors to enter a promising market. With a strategic approach, this stock could offer a unique entry point and a chance to diversify. A well-timed investment could see a significant rebound, offering a profitable future for those willing to take a calculated risk.